OPINION: Is Realtor.ca selling its soul?

In the rush to spin out the Canadian Real Estate Association (CREA)’s Realtor.ca as a taxable entity capable of generating revenues, I can’t help but wonder if we’re eliminating the very reason for its continued success. Why have Canadians made Realtor.ca the leading real estate advertising platform in the country? Spoiler alert, it’s not the technology. According to CREA, the three primary reasons Realtor.ca has held strong as the leading real estate platform for consumers across the country are: trust, transparency and a complete lack of bias in how information on the platform is presented. There is trust that Realtor.ca presents a complete picture, or as complete a picture as possible, of the real estate market across the country. There is a belief that the information provided is done so in a transparent manner with more information, such as sold data, coming online as consumers demand it — without the requirement to set up an account or to provide any user information. There is a belief that the information is unbiased and represents the source of truth for Canadian real estate markets. I believe that the nature of Realtor.ca — owned by CREA and part of a not-for-profit, advertising-free and account requirement-free entity — is the very thing that has created a bond of trust with Canadian consumers. Realtor.ca is not revenue-driven or revenue-motivated. I believe this is what makes it very different from every other platform out there, and ultimately what makes it important to Canadians. Revenue generation: Comes at a cost to the existing strong consumer relationship Changing the nature of Realtor.ca to mirror that of every other for-profit, revenue-driven platform out there could be a fatal mistake. It’s all well and good that members might save a few bucks if it can be spun out and made to generate its own revenue, but at what cost to the relationship Realtor.ca has built with the consumer over the last many years? The introduction of advertising, both direct and indirect for the purpose of generating ancillary referral revenue and selling user data, will fundamentally change the user experience that Canadians seek from Realtor.ca. Consumers will not only see but feel this change, and the touchstones of market differentiation that Realtor.ca currently owes for its success could dissipate. There are other issues with spinning out Realtor.ca. These will be debated, hopefully, at the upcoming CREA SGM, but they are largely mechanical and logistical in nature. My concern is more existential. Just to be clear — what’s created a bond of trust with our consumers, and the literal foundation of our success, is that Realtor.ca is not revenue-driven and that there’s no motivation to create revenue from the consumer. In spinning out Realtor.ca as a taxable entity, are we risking transforming our iconic site into just another platform driven by self-interest?

House Hacking: Using Your Home to Generate Income

House hacking can be a great way for Canadians to begin their journey into real estate investing. By renting out part of their primary residence, homeowners not only make their home more affordable but also gain valuable experience managing tenants and properties. This strategy offers aspiring investors a cost-effective way to enter real estate by generating income from their own home, eliminating the need for a separate investment property. For those who wish to expand gradually into a portfolio of investment properties, house hacking offers the opportunity to build equity while generating rental income to offset housing costs.At its core, house hacking is a method where a homeowner rents out part of their residence to generate income. This rental income helps reduce living expenses and can cover a portion of the mortgage, property taxes, and maintenance costs, making homeownership more affordable. The money generated through tenants helps homeowners build equity faster, giving them an opportunity to reinvest in other properties eventually.In cities where property values have significantly increased, house hacking has become a common solution to the affordability issue. As a growing number of Canadians face challenges when trying to afford the down payment and monthly costs associated with owning a home, house hacking presents a viable alternative. It’s especially beneficial in areas where rental demand is high, ensuring consistent rental income.Financing a House-Hacked PropertyFinancing a house-hacked property involves more than just securing a mortgage. Since house hacking requires larger properties offering distinct spaces with rental potential, a more expensive property is often required, creating additional considerations for potential homeowners. A mortgage broker can offer valuable advice on the best way to structure financing.Since the home is used as the primary residence, homeowners will have access to insured mortgage rates, with a maximum amortization period of 25 years, or 30 in certain cases, for CMHC-insured mortgages.If the property costs more than $1.5 million, you won’t qualify for a CMHC-insured mortgage which permits down payments as low as 5%. In this case, you’ll need a minimum 20% down payment. While opting for a longer amortization period of up to 35 years may lower your monthly mortgage payments, the interest rate will typically be higher than what you’d get with a CMHC-insured mortgage. For homes under $1.5 million, the process is more flexible. Homeowners can qualify for an insured mortgage with a down payment ranging from 5% to 10%, depending on the number of units in the property. How House Hacking WorksHouse hacking minimizes the financial burden of homeownership by generating rental income to offset the cost of owning a property. For example, if a homeowner buys a property for $500,000 with a 5% down payment of $25,000, that would leave a mortgage of $475,000. The monthly mortgage payment would be roughly $2,760. However, by renting out a basement unit for $1,500 per month, housing costs can be reduced.On a monthly basis, in addition to the mortgage payment, the homeowner will also have property taxes and insurance costs. Assuming tax payments of $400, and insurance costs of $140, this results in housing costs of $3,300. The $1,500 in rental income reduces the net monthly cost of owning the home to $1,800, making ownership more affordable and starting owners on the first rung of leveraging real estate for investment income.Of course, actual numbers and circumstances will vary, but the ability to rent out a portion of the home can provide significant income for homeowners. Benefits of House HackingHouse hacking generates a steady source of income. For many homeowners, this income helps cover the cost of their mortgage and other housing expenses, thus reducing the financial burden of owning a home. In addition to making monthly payments more manageable, house hacking enables homeowners to build equity faster. This additional income can accelerate mortgage payments, and in turn, lead to greater savings in interest over time.House hacking also allows homeowners to claim certain tax benefits. Expenses associated with managing rental units—such as repairs, maintenance, and even some utilities—can be tax deductible, which can lower overall costs. This strategy gives homeowners practical experience in property management, which can be a useful skill if they eventually want to expand their real estate holdings.Drawbacks and Considerations of House HackingHowever, there are potential downsides that homeowners should be aware of. Renting out part of your home inevitably impacts your privacy. Sharing space with tenants, even if they live in a separate unit, can mean limited personal freedom. In addition to this, house hacking comes with landlord responsibilities, including maintenance, tenant management, lease agreements, and ensuring compliance with provincial rental regulations. These tasks can be time-consuming and stressful for those unfamiliar with property management.Moreover, there are potential financial risks. Renovations may be required to make the rental unit suitable for tenants, and these upfront costs can be significant. Insurance premiums may rise when a home includes a rental unit, adding to ongoing costs. Utility bills may also increase, especially if the rental unit isn’t separately metered.Taxes are another consideration. Rental income is taxable, and homeowners will need to report this when filing. Additionally, the portion of the home rented out will not qualify for the principal residence capital gains exemption when the home is sold, meaning that capital gains tax could be owed on the rental portion of the property.What Properties Work Well for this Strategy?Areas intended for rental must comply with both municipal and provincial codes and regulations. Homeowners considering house hacking should ensure the property provides suitable, private living spaces for both themselves and tenants, while also meeting all applicable legal requirements.Some property types are better suited for the strategy. Homes with a legal basement suite work well, as homeowners can rent out a portion of the home without significantly altering their lifestyle. Many Canadian municipalities and provinces offer incentives to encourage the development of secondary suites, which are a great fit for house hacking. By using these programs, homeowners can reduce the upfront costs of creating rental units and maximize the potential of their property, making house hacking an even more attractive option.Garage apartments, carriage houses, guest houses, or in-law suites are other options that provide privacy for both homeowners and renters. Multi-family homes, such as duplexes, triplexes, and fourplexes, are ideal because they provide separate units that can easily be rented out, and multiplexes with fewer than four units can still qualify as owner-occupied properties. When looking for a potential home-hacking property, consult with a mortgage broker for the best financing options to help reduce your borrowing costs and improve affordability further.

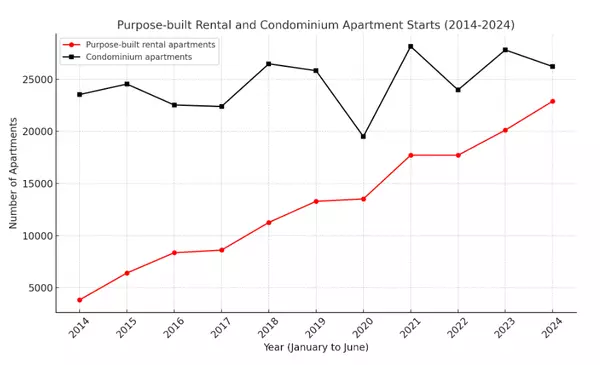

Addressing Canada’s student housing crisis with industry: The role of purpose-built solutions

Canada’s post-secondary education system is globally recognized, attracting students from around the world. However, a severe shortage of student housing threatens this success, posing a broader socioeconomic challenge that demands urgent action.The Canadian housing market faces a significant supply and demand imbalance, with over four million homes needed over the next six years to restore affordability.* Other policymakers, such as the Canadian Human Rights Commission, believe this number could be even higher. Rising government charges and insufficient construction capacity have exacerbated this crisis.Without positive government intervention and policy adjustments — such as the recently introduced HST exemptions on rental housing — amid the currently challenged financial environment, the lack of housing starts witnessed in the past two years will persist, particularly in university cities and towns where demand for all housing is exceptionally high. The magnitude of the student housing shortfall Canada is experiencing an unprecedented shortfall in student housing, with a deficit of over 400,000 beds nationwide.** This shortage is particularly acute in the country’s 20 largest university markets, which host approximately 1.5 million post-secondary students but offer only around 170,000 beds.*** The result? An overwhelming majority of students are forced to compete for already limited and expensive rental housing, exacerbating the housing crisis in local communities. In university towns like Guelph, Ontario, the housing shortage is particularly severe, reflecting a broader trend across many such communities. The strain on local rental markets, driven by insufficient student housing, has led to rising rents and forced many, including students, into substandard or overcrowded accommodations. Compounding this issue, the provincial tuition freeze mandate for domestic students has compelled universities to increase international student intake to cover rising costs, further straining the housing supply. The role of purpose-built student accommodations Purpose-built student accommodations (PBSAs) offer a viable solution to this crisis. Unlike traditional rental units, PBSAs are specifically designed to meet the unique needs of students, providing them with safe, affordable and community-oriented living spaces.Countries like the United Kingdom and the United States have successfully implemented PBSAs at scale, significantly alleviating housing pressures on students and local communities alike. Off-campus PBSA accounts for 60 per cent in the U.S., 58 per cent in the U.K. and 69 per cent in Australia, but only 29 per cent in Canada.**** The PBSA market in Canada remains underdeveloped.To close the gap, we must incentivize the development of PBSAs through policy changes, financial support and streamlined regulatory processes. The recent introduction of PBSA in the Government of Canada’s Affordable Housing Fund, which aims to provide low-interest loans for new affordable housing projects, is a step in the right direction, though details have yet to be released. Still, more needs to be done given PBSAs are essential to drive affordable housing and economic growth, by alleviating existing housing stock that can be made available to the general non-student population. Student housing in Ontario amid ongoing municipal approval challenges Bill 185 in Ontario is a significant development for expediting approvals in the student housing sector. This legislation has enabled Forum Asset Management to unlock approximately 1,100 units across projects in Guelph and Toronto, providing University of Guelph and York University students with high-quality, community-focused housing.However, despite the progress made by Bill 185, developers continue to face headwinds, from continually escalating development charges (which in Toronto, according to data from Scotiabank, have increased by 2,000 per cent over 20 years) to higher construction and financing costs. The way forward: Collaborative efforts and policy reform The Canadian student housing crisis cannot be solved by developers alone. It requires a combined effort from all stakeholders, including government agencies, educational institutions and the private sector. Key policy changes, such as the inclusion of PBSA in the definition of affordable housing (which would create development charge exemptions) and the adoption of policies similar to Bill 185 across other provinces, are essential to unlocking the potential of this sector. Additionally, property tax exemptions for student housing catering to specific university student bases, both on and off-campus, should be created. These exemptions could play a pivotal role in supporting universities’ broader educational and community missions, regardless of whether the housing is university-owned or operated by the private sector.By lowering the operational costs for student housing providers, such exemptions could directly translate into lower rents for students. This is particularly critical as students often face significant financial pressures, including the burden of repaying student loans upon graduation. Alleviating financial strain allows students to focus more on education and well-being, and less on the economic challenges associated with finding suitable housing.*****Moreover, universities must take a more active role in facilitating the development of PBSAs on or near their campuses. The QUAD at York University is an example of what can be achieved when public and private entities work together toward a common goal. Canada’s housing crisis is multifaceted and impacts all Canadians as well as international students. By adopting supportive policies, we can create more PBSA, which delivers a “two birds, one stone” approach by freeing up traditional housing while providing students with the safe, affordable housing they deserve.Successful projects such as ALMA @ Guelph and The QUAD at York University offer a blueprint for creating vibrant communities that benefit both students and the broader population. Crucially, these projects require experienced developers who understand the unique needs of students, as PBSAs are far more than just conventional apartment developments — they’re about building communities that foster social belonging, well-being and positive environments essential to the development of our future leaders. * Canada Mortgage and Housing Corporation, Housing shortages in Canada, Updating how much housing we need by 2030.** Forum estimate using data from Bonard, Student Housing Market Canada. November 2023, and Statistics Canada.*** Bonard, Student Housing Market Canada. November 2023.**** Canada Mortgage and Housing Corporation, Canada’s Housing Supply Shortages: Estimating what is needed to solve Canada’s housing affordability crisis by 2030.***** Simplydbs. Student Housing Index Survey. Student housing and youth mental health: Survey finds strong correlation. Enjoying this article?Get the latest REM articles in your inbox 3x week so you stay up to date on the latest in the Canadian real estate industry Success! Email Subscribe The post Addressing Canada’s student housing crisis with industry: The role of purpose-built solutions appeared first on REM.

Categories

Recent Posts