Canadian Condominium Construction Challenges

Canada’s condominium and apartment construction market is facing various challenges in 2024, as rising costs, slower demand, and financing difficulties put pressure on developers. While rental construction has risen, condominium starts have declined in most of the country’s largest markets.

Condominium development in the first half of 2024 is not keeping pace with the country’s growing population and urban expansion. Outside of Alberta, condominium projects have slowed as developers struggle to meet pre-construction sales targets and secure financing, according to the Canada Mortgage and Housing Corporation’s Fall Housing Supply Report.

Condo Starts in Canada’s Largest Cities

Despite a general increase in overall housing starts, condominium apartment starts have declined in most major Canadian cities. Total housing starts across the six largest CMAs increased by 4% in the first half of 2024 compared to the same period in 2023, although, when adjusted for population growth, these numbers are flatter.

Within these housing start numbers, there has been a slowdown in condominium starts. Particularly in Toronto and Vancouver, where investors have historically been more active, high financing costs and lower demand have made pre-construction condominiums less appealing. This has resulted in developers struggling to meet the minimum pre-construction sales thresholds necessary to secure financing, leading to delays and, in some cases, project cancellations.

The condominium segment has also seen a marked regional variation. In Calgary and Edmonton, condominium apartment starts increased, reflecting the suitable economic conditions and demand for these housing options in these areas.

Competition Between Condo and Purpose-Built Rental Construction

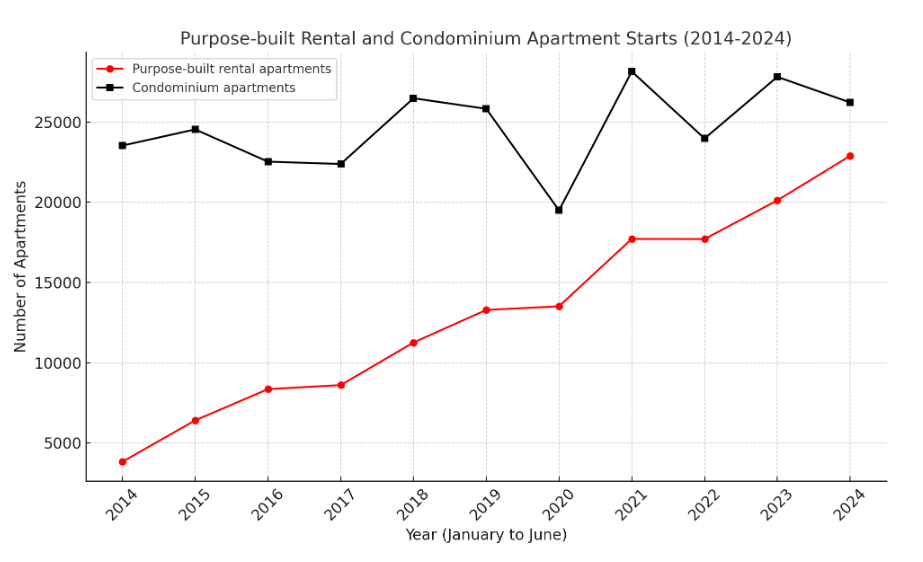

Purpose-built rental construction has provided competition for condo construction, as rentals starts surged to record levels. From January to June 2024, purpose-built rental apartment starts in the six CMAs rose to 22,891 units, continuing a trend of significant growth in rental supply. This represents a nearly 14% increase compared to 2023.

However, purpose-built rentals, particularly in Toronto and Vancouver, are also seeing increased competition from condominium apartments. With many condominium investors choosing to rent out their units due to softer resale markets, the inventory of available rental units has grown. This has had a stabilizing effect on rental prices.

The CMHC notes that, in some cases, newly built purpose-built rental units are priced comparably to rental condominiums, further blurring the line between these two segments of the rental market. The role of investors in the condominium market remains a factor. In cities like Toronto and Vancouver, where the secondary rental market relies heavily on investor-owned condominiums, higher interest rates have dampened investor enthusiasm.

Source: CHMC

Source: CHMC

Focus on Completions

Developers have been prioritizing clearing a backlog of projects under construction. Since the pandemic, construction timelines have been extended due to labour shortages, supply chain issues, and rising costs. By the end of 2023, the number of units under construction in the six CMAs had reached record highs.

In the first half of 2024, some of these constraints began to ease. The Building Construction Price Index (BCPI) for apartments, as reported by Statistics Canada, increased by 4% across markets, a significant reduction from the 8% growth seen in the previous year. Toronto, in particular, saw the sharpest deceleration, with the BCPI falling from 15% in 2023 to just 5% in 2024.

Factors for Condo Success

The CHMC indicates that those condominium projects that secured enough sales to proceed were smaller and less costly, on average.

Categories

Recent Posts

GET MORE INFORMATION