House Hacking: Using Your Home to Generate Income

House hacking can be a great way for Canadians to begin their journey into real estate investing. By renting out part of their primary residence, homeowners not only make their home more affordable but also gain valuable experience managing tenants and properties. This strategy offers aspiring investors a cost-effective way to enter real estate by generating income from their own home, eliminating the need for a separate investment property. For those who wish to expand gradually into a portfolio of investment properties, house hacking offers the opportunity to build equity while generating rental income to offset housing costs.

At its core, house hacking is a method where a homeowner rents out part of their residence to generate income. This rental income helps reduce living expenses and can cover a portion of the mortgage, property taxes, and maintenance costs, making homeownership more affordable. The money generated through tenants helps homeowners build equity faster, giving them an opportunity to reinvest in other properties eventually.

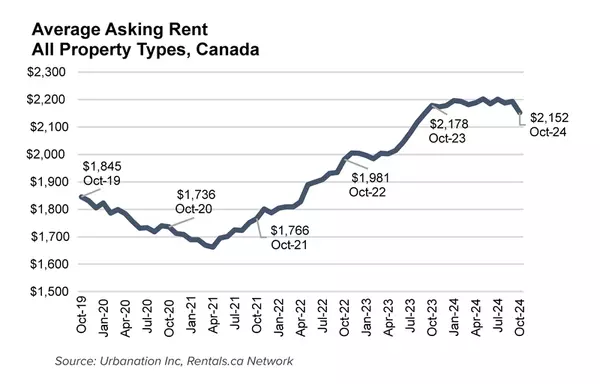

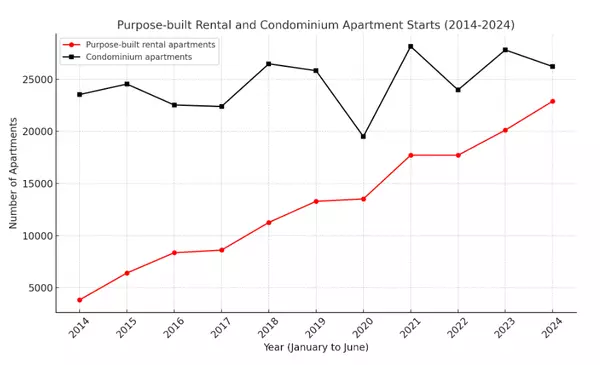

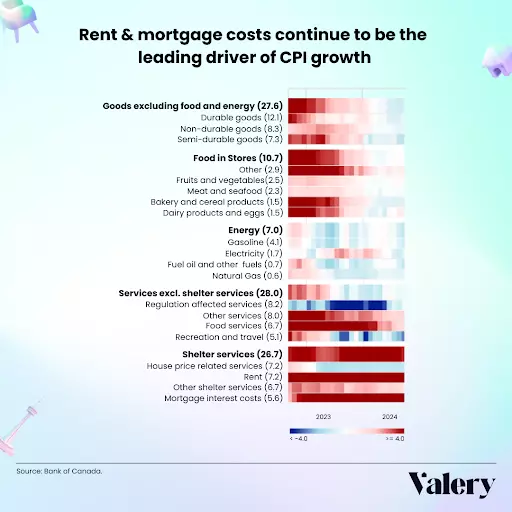

In cities where property values have significantly increased, house hacking has become a common solution to the affordability issue. As a growing number of Canadians face challenges when trying to afford the down payment and monthly costs associated with owning a home, house hacking presents a viable alternative. It’s especially beneficial in areas where rental demand is high, ensuring consistent rental income.

Financing a House-Hacked Property

Financing a house-hacked property involves more than just securing a mortgage. Since house hacking requires larger properties offering distinct spaces with rental potential, a more expensive property is often required, creating additional considerations for potential homeowners. A mortgage broker can offer valuable advice on the best way to structure financing.

Since the home is used as the primary residence, homeowners will have access to insured mortgage rates, with a maximum amortization period of 25 years, or 30 in certain cases, for CMHC-insured mortgages.

If the property costs more than $1.5 million, you won’t qualify for a CMHC-insured mortgage which permits down payments as low as 5%. In this case, you’ll need a minimum 20% down payment. While opting for a longer amortization period of up to 35 years may lower your monthly mortgage payments, the interest rate will typically be higher than what you’d get with a CMHC-insured mortgage. For homes under $1.5 million, the process is more flexible. Homeowners can qualify for an insured mortgage with a down payment ranging from 5% to 10%, depending on the number of units in the property.

How House Hacking Works

House hacking minimizes the financial burden of homeownership by generating rental income to offset the cost of owning a property. For example, if a homeowner buys a property for $500,000 with a 5% down payment of $25,000, that would leave a mortgage of $475,000. The monthly mortgage payment would be roughly $2,760. However, by renting out a basement unit for $1,500 per month, housing costs can be reduced.

On a monthly basis, in addition to the mortgage payment, the homeowner will also have property taxes and insurance costs. Assuming tax payments of $400, and insurance costs of $140, this results in housing costs of $3,300. The $1,500 in rental income reduces the net monthly cost of owning the home to $1,800, making ownership more affordable and starting owners on the first rung of leveraging real estate for investment income.

Of course, actual numbers and circumstances will vary, but the ability to rent out a portion of the home can provide significant income for homeowners.

Benefits of House Hacking

House hacking generates a steady source of income. For many homeowners, this income helps cover the cost of their mortgage and other housing expenses, thus reducing the financial burden of owning a home. In addition to making monthly payments more manageable, house hacking enables homeowners to build equity faster. This additional income can accelerate mortgage payments, and in turn, lead to greater savings in interest over time.

House hacking also allows homeowners to claim certain tax benefits. Expenses associated with managing rental units—such as repairs, maintenance, and even some utilities—can be tax deductible, which can lower overall costs. This strategy gives homeowners practical experience in property management, which can be a useful skill if they eventually want to expand their real estate holdings.

Drawbacks and Considerations of House Hacking

However, there are potential downsides that homeowners should be aware of.

Renting out part of your home inevitably impacts your privacy. Sharing space with tenants, even if they live in a separate unit, can mean limited personal freedom. In addition to this, house hacking comes with landlord responsibilities, including maintenance, tenant management, lease agreements, and ensuring compliance with provincial rental regulations. These tasks can be time-consuming and stressful for those unfamiliar with property management.

Moreover, there are potential financial risks. Renovations may be required to make the rental unit suitable for tenants, and these upfront costs can be significant. Insurance premiums may rise when a home includes a rental unit, adding to ongoing costs. Utility bills may also increase, especially if the rental unit isn’t separately metered.

Taxes are another consideration. Rental income is taxable, and homeowners will need to report this when filing. Additionally, the portion of the home rented out will not qualify for the principal residence capital gains exemption when the home is sold, meaning that capital gains tax could be owed on the rental portion of the property.

What Properties Work Well for this Strategy?

Areas intended for rental must comply with both municipal and provincial codes and regulations. Homeowners considering house hacking should ensure the property provides suitable, private living spaces for both themselves and tenants, while also meeting all applicable legal requirements.

Some property types are better suited for the strategy. Homes with a legal basement suite work well, as homeowners can rent out a portion of the home without significantly altering their lifestyle. Many Canadian municipalities and provinces offer incentives to encourage the development of secondary suites, which are a great fit for house hacking. By using these programs, homeowners can reduce the upfront costs of creating rental units and maximize the potential of their property, making house hacking an even more attractive option.

Garage apartments, carriage houses, guest houses, or in-law suites are other options that provide privacy for both homeowners and renters. Multi-family homes, such as duplexes, triplexes, and fourplexes, are ideal because they provide separate units that can easily be rented out, and multiplexes with fewer than four units can still qualify as owner-occupied properties.

When looking for a potential home-hacking property, consult with a mortgage broker for the best financing options to help reduce your borrowing costs and improve affordability further.

Categories

Recent Posts

GET MORE INFORMATION