The GTA's real estate market sees sales growth, but price recovery remains elusive

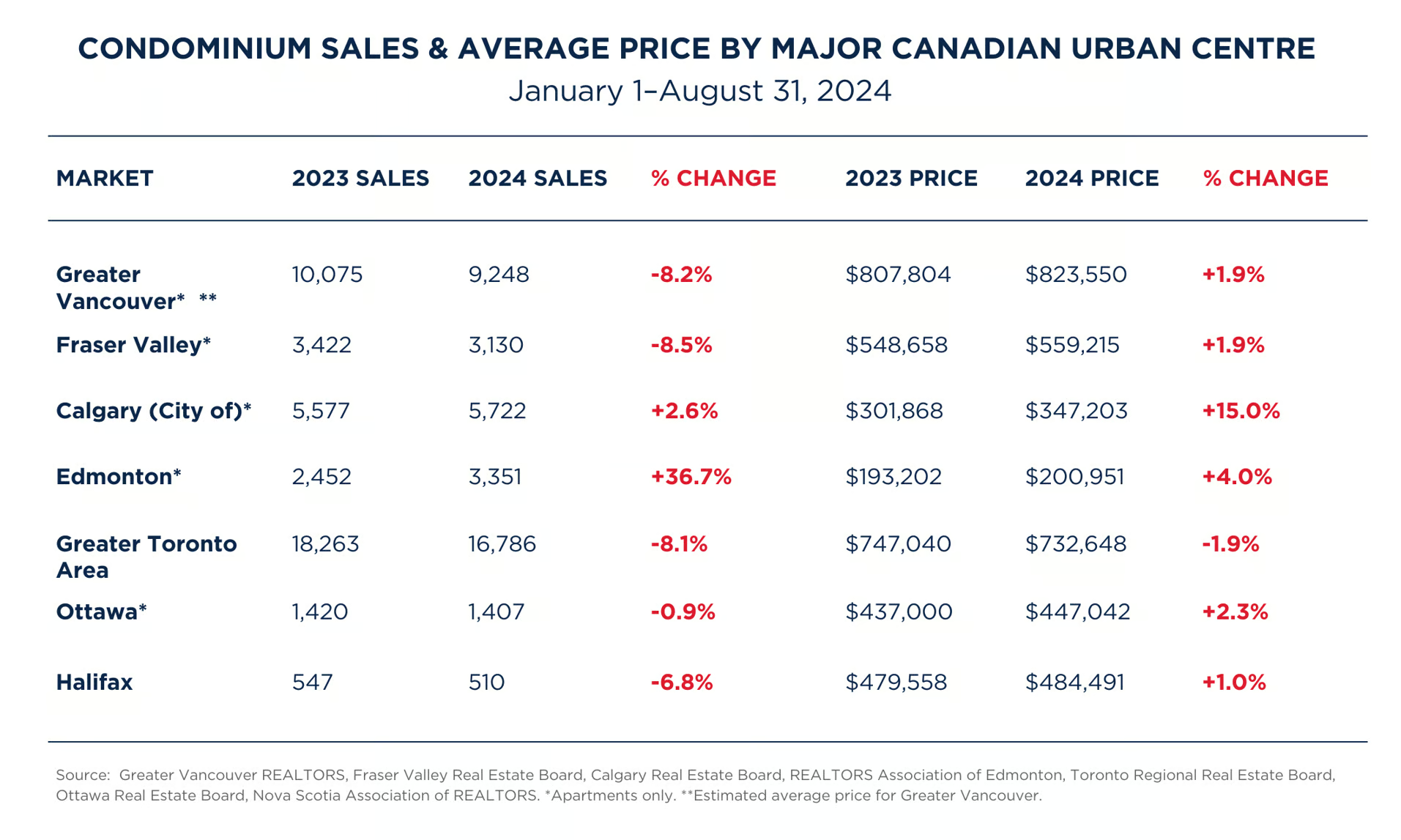

The stalemate continues between buyers and sellers in Toronto’s real estate market this month. It’s easy to get excited because sales are up from last year — but let’s remember that last year was an exceptionally bad year. In the broader view, the fall market has been relatively weak in the long-term context against the typical month of September. Key September points The Toronto Regional Real Estate Board (TRREB) posted its monthly Market Watch report, and here are the key points you need to know from the summary: Sales are up 8.5 per cent from last year. New listings are up 10.5 per cent, slightly outpacing sales. Properties taking 35-45 per cent longer to sell compared to last September. Because of slowed sales cycle, active listings are up 35.5 per cent! Supply accumulation is becoming substantial. House prices are still grinding down — nominally, 1.0 per cent below last year, with real house prices down 3.0 per cent when adjusted for inflation. Source: TRREB Recovery or rebalancing? TRREB argues the uptick in sales we’re seeing is the result of favourable market conditions, such as interest rate cuts and revised mortgage lending guidelines. These factors are certainly important to recovery, but a deeper look suggests that the GTA market might be more balanced than on a path to full recovery. It’s worth seeing a long-term “sideways” market, rather than an “upwards” one. The key factor here is the rate of growth in supply, which has outpaced demand, challenging the notion of a straightforward recovery. Until that changes meaningfully from buyers entering the market more quickly than sellers, it’s tough to imagine a complete recovery has begun. Sales increase due to new opportunities for buyers, but price still most important factor The 8.5 per cent year-over-year increase in home sales (4,996 in September 2024, up from 4,606 in September 2023) is presented as evidence of recovery. TRREB President Jennifer Pearce attributes this increase to buyers capitalizing on lower borrowing costs and adjustments to mortgage lending guidelines. These changes include: rate cuts from the Bank of Canada reduced five-year fixed mortgages from a falling Canadian five-year bond yield the coming introduction of longer amortization periods the ability to insure mortgages for homes valued up to $1.5 million These factors certainly make the market more affordable for some buyers who are limited by capital costs and the lending environment. However, with the B20 stress test still in place and buyers qualifying at rates over 5.0 per cent, price ultimately becomes the most important factor for many buyers looking to re-enter the market. Easing of stress test could build staying power To this end, TRREB highlights that the easing of the mortgage stress tests for existing homeowners on renewal could build some staying power into the market, by making homeowners and investors able to afford to keep their homes rather than selling when faced with financial stress. TRREB also expects further rate cuts to allow a growing number of households to afford homeownership. This notion is especially pointed at first-time buyers, who have been outlined by the Bank of Canada as nearly 50 per cent of all homebuyers, representing a key demographic for those hoping for a recovery in the market. Supply outpacing demand A closer analysis reveals a more nuanced picture. While demand (measured in sales) grew, the rate of new listings entering the market has grown even faster, by 10.5 year-over-year, slightly outpacing sales growth. In September, 18,089 new listings were added to the MLS, contributing to an already better-supplied market. This gap between supply and demand, rather than indicating a shortage of homes, points to an easing of market pressures and a better market for buyers to enter. Compounding this, we’re seeing a significantly increased “time to sell” — meaning it takes an extra week for a listing to sell, compared to the average 20 days on market from September last year. This slowing absorption has led supply to accumulate, with active listings now up 35.5 per cent compared to September 2023. Ability to negotiate on price: Indicates a market no longer heavily favoured to sellers Should this trend continue to hold, it’s reasonable to expect that buyers will resume their home search as they see more homes on the market and hope they can capitalize on the supply, shop around and negotiate with sellers. This is how the imbalance between supply and demand is further materialized, in a decline in prices. The MLS Home Price Index Composite benchmark was down by 4.6 per cent year-over-year, and the average selling price in September dropped 1.0 per cent compared to the previous year. TRREB attributes this to increased negotiating power for buyers, especially in the more affordable segments like condominiums and townhouses, which are favoured by first-time buyers. More activity in the lower ends of the market can skew the average down. Interestingly, 416 condominium sales are actually up year-over-year, despite the market being in a severe state of excess supply. The ability to negotiate on price is a clear indicator of a market that’s no longer tilted heavily in favour of sellers. Source: TRREB The pricing context: A “recovery” in question A true market recovery, by definition, would generally see home prices stabilizing or even increasing as demand starts to outpace supply. However, this is not currently the case in the GTA. While average selling prices have edged up slightly on a seasonally adjusted basis compared to August 2024, the year-over-year decline in benchmark prices suggests that the market has not fully recovered to its previous highs. Affordability challenges that plagued the market before the interest rate hikes are being alleviated, but they haven’t disappeared. Furthermore, while rate cuts may improve affordability in the short term, they don’t necessarily address the long-term structural issues in the housing market, such as supply constraints or high construction costs. It’s worth noting that while lower borrowing costs can temporarily boost demand, they can also encourage speculative buying, which could further distort the market, particularly if supply doesn’t keep pace. Recovering sales, but not prices Despite TRREB’s optimistic messaging, the GTA housing market appears to be in a state of balance rather than recovery. Yes, sales are up, and rate cuts have eased some of the financial pressure on buyers and sellers. On the other hand, the growing supply of homes, coupled with modest price declines, suggests a more buyer-friendly market, one in which supply is catching up to — and in some cases, surpassing — demand. This dynamic is providing more negotiating power to buyers, and while that’s a positive development for affordability, it doesn’t necessarily signal a robust recovery in price. Instead, the current market is best characterized as one where buyers have regained some control, but where underlying challenges around housing supply and affordability remain. The return to a balanced market does point to a steady resurrection of sales activity, which is welcome news for the real estate profession that has been dealing with drastically reduced activity for some time now.

Retirement planning: Help your clients explore real estate strategies to unlock financial freedom

Recently, I had a productive conversation with clients who were planning their retirement. We discussed timelines and strategies to secure their future, including selling their current home and weighing the benefits of continuing homeownership versus stepping away from the housing market. Their current home is valued at around $1.2 million, with no mortgage. They also have savings and RRSPs, but most of our focus was on how to optimize their real estate assets for retirement. If they sold their home, they’d have around $1.14 million in equity to invest, so the key question was how to best use that money to achieve their goals, including frequent travel. Here’s a look at the options we explored based on their real estate and assets. A scenario like this could apply to many of your clients and come in handy when discussing their options. Option 1: Sell and invest locally One possibility was selling their home and purchasing a property in Oshawa with a legal accessory apartment for around $800,000. After covering purchase and closing costs, they would have $300,000 left to invest. At a 4.0 per cent return, this would generate approximately $12,000 in annual income. In addition, the accessory apartment could be rented for about $1,800 per month, bringing in an additional $21,600 annually. This would give them a total of $33,600 per year in combined income, which would be taxable but with minimal tax implications given their lower retirement income. Plus, some home expenses could be written off as rental deductions. Option 2: Buy a seasonal or vacation home Another appealing option was using the $300,000 to purchase a winter home in Florida instead of investing it in the stock market. After converting the funds to American dollars, they would have about $225,000 to buy a property in “The Villages” northwest of Orlando. The carrying costs would be about $300 per month. Although this option wouldn’t generate investment income, they would still earn $21,600 annually from renting out their Oshawa property. Additionally, they could rent out their Florida home when not using it, potentially generating $3,000 to $4,000 per month in U.S. dollars. Helping your clients explore equity-shifting opportunities This conversation highlighted how many homeowners, particularly those who have lived in their homes for decades, overlook the financial potential of downsizing or shifting their equity into different types of properties. Even if they opted to rent rather than purchase a vacation home, the income from investments or property rentals could still comfortably cover their travel and living expenses. For homeowners in the Durham Region and many other areas, selling and reinvesting home equity offers a range of benefits, from financial freedom to increased quality of life. I’ve spoken to many who regret holding onto their homes for too long, only to find that rising maintenance costs strained their budget and limited their ability to enjoy retirement luxuries like travel. At a certain point, it’s important to reassess whether homeownership continues to make sense or if downsizing is the smarter financial move. For my clients, their next step was to consult their accountant about the tax implications of owning rental properties both locally and in Florida. It’s a good problem to have as they enter this exciting new phase of life. Your clients might be in a very similar position.

Climate Resilience in Canada’s Construction Industry

In recent years, Canada’s construction industry has made strides toward enhancing sustainability in response to climate change. The sector is increasingly adopting renewable energy sources, green building standards, and innovative technologies to reduce environmental impact. Collaboration among governments, industry associations, and other stakeholders has intensified, focusing on reducing carbon footprints and improving infrastructure resilience.The Canadian Construction Association is emphasizing the need for strategic partnerships and policy reforms to meet Canada’s emissions targets for 2030 and 2050, as part of efforts towards resilience and sustainability. The CCA released a report this September, Climate Resilience in Construction: Building for a Sustainable Future, which outlines the interplay between climate risks and infrastructure decisions, and highlights the urgent need for investments in resilient infrastructure.Industry Impact and PotentialThe construction industry is a major component of Canada’s economy, employing over 1.6 million people and contributing approximately $165 billion annually, representing 7.5% of the GDP. Buildings account for nearly 40% of global greenhouse gas (GHG) emissions, placing a significant emphasis on sustainability in the sector.The CCA links investment in sustainable infrastructure to reduced GHG emissions. In Q4 2023:Slowed Emissions Growth: Emissions per million dollars invested in infrastructure decreased from 230 tonnes in 2010 to 140.9 tonnes in 2022.Increased Investment: Infrastructure investment grew by 31% from 2009 to 2023, while GHG emissions increased by only 22%.Rise in Clean Inputs: The ratio of clean input investments in construction nearly doubled from 2.3% in 2009 to 4.3% in 2023.Policy LandscapeSince October 2020, the Canadian government has committed substantial funds to green infrastructure through various initiatives, including:$5 Billion in loan guarantees for Indigenous communities.$7.2 Billion for the Clean Electricity Investment Tax Credit starting in 2024-25.$776.3 Million to extend the Clean Fuels Fund until 2029-30.$800 Million over five years for the Canada Greener Homes Affordability Program starting in 2025-26.These investments complement a broader policy framework aimed at reducing emissions and achieving a net-zero economy by 2050. However, the CCA indicates that more is necessary.Key regulations to support sustainability include:2030 Emissions Reduction Plan (ERP): Targets a 40% reduction in emissions from 2005 levels by 2030.Clean Fuel Regulations: Promote the use of clean fuels.Oil and Gas Methane Regulations: Aim to cut methane emissions by 75% by 2030.Net-Zero Emissions Accountability Act: Ensures transparency in meeting climate targets.Clean Electricity Regulation: Focuses on achieving net-zero emissions in electricity generation by 2035.Innovation and AdaptationThe construction sector is working towards innovations to enhance climate resilience. Enhancing Building ResilienceAdaptation strategies for buildings involve:Structural Improvements: Upgrades to ventilation systems, window shades, and protective structures.Climate-Informed Planning: Utilizing climate risk assessments and modelling tools to guide building design.Emerging Technologies: Incorporating Building Information Modelling (BIM) and smart city systems for better decision-making.Driving Energy EfficiencyWith buildings contributing significantly to GHG emissions, energy efficiency is critical. Strategies include:Certification Programs: Ensuring new buildings meet energy efficiency standards.Energy Benchmarking: Assessing and improving a building’s energy consumption.Recommissioning: Re-optimizing existing buildings to save energy.Integrating Sustainable MaterialsMaterial selection plays a crucial role in reducing environmental impact. Innovations include:Mass Timber: A sustainable material offering carbon sequestration benefits.Greener Concrete Production: Exploring methods to reduce the environmental footprint of concrete.Life Cycle Assessments (LCA): Evaluating the environmental impacts of materials throughout their life cycle.Managing Costs Through CollaborationAddressing climate resilience involves higher costs. Effective management requires:Collaborative Procurement: Encouraging early contractor engagement and moving away from lowest bid models.Partnerships: Collaborating with governments, academia, and industry to share knowledge and resources.Financial Strategies: Adapting federal procurement to support innovation and sustainability.Implementation ChallengesSeveral challenges to more sustainable construction need addressing:Modernizing ProcurementThe CCA suggests that the current federal procurement process should be updated to support fair competition and innovation. Engaging contractors early and focusing on long-term value can promote the use of new practices and sustainable materials.Sustainable Procurement GuidelinesThe Canada Green Buildings Strategy includes initiatives like the Buy-Clean Strategy, which mandates GHG emissions disclosure and reduction targets for major projects. However, broader implementation is pending, affecting full industry participation.Alignment and ConsultationEffective policy requires alignment across federal, provincial, and municipal levels. Improved consultation with the construction industry can lead to better-informed policies and standards, fostering innovation and efficiency.Canada’s construction industry is making efforts towards climate resilience through policy support, innovation, and strategic investment. However, continued government support, collaboration, and adaptation will be essential to achieving long-term sustainability and reducing the sector’s environmental impact.

Categories

Recent Posts