The GTA's real estate market sees sales growth, but price recovery remains elusive

The stalemate continues between buyers and sellers in Toronto’s real estate market this month. It’s easy to get excited because sales are up from last year — but let’s remember that last year was an exceptionally bad year. In the broader view, the fall market has been relatively weak in the long-term context against the typical month of September.

Key September points

The Toronto Regional Real Estate Board (TRREB) posted its monthly Market Watch report, and here are the key points you need to know from the summary:

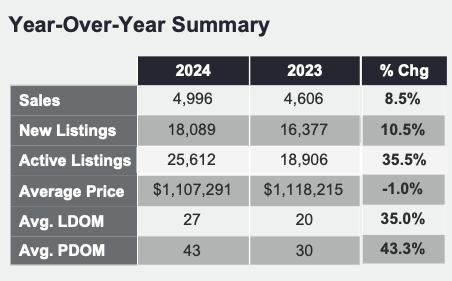

- Sales are up 8.5 per cent from last year.

- New listings are up 10.5 per cent, slightly outpacing sales.

- Properties taking 35-45 per cent longer to sell compared to last September.

- Because of slowed sales cycle, active listings are up 35.5 per cent! Supply accumulation is becoming substantial.

- House prices are still grinding down — nominally, 1.0 per cent below last year, with real house prices down 3.0 per cent when adjusted for inflation.

Source: TRREB

Recovery or rebalancing?

TRREB argues the uptick in sales we’re seeing is the result of favourable market conditions, such as interest rate cuts and revised mortgage lending guidelines. These factors are certainly important to recovery, but a deeper look suggests that the GTA market might be more balanced than on a path to full recovery.

It’s worth seeing a long-term “sideways” market, rather than an “upwards” one. The key factor here is the rate of growth in supply, which has outpaced demand, challenging the notion of a straightforward recovery. Until that changes meaningfully from buyers entering the market more quickly than sellers, it’s tough to imagine a complete recovery has begun.

Sales increase due to new opportunities for buyers, but price still most important factor

The 8.5 per cent year-over-year increase in home sales (4,996 in September 2024, up from 4,606 in September 2023) is presented as evidence of recovery. TRREB President Jennifer Pearce attributes this increase to buyers capitalizing on lower borrowing costs and adjustments to mortgage lending guidelines.

These changes include:

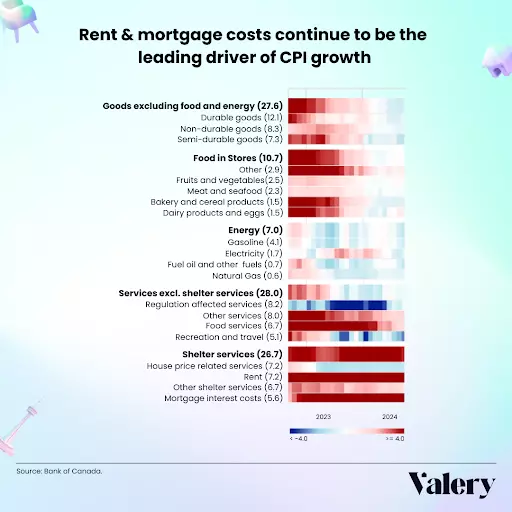

- rate cuts from the Bank of Canada

- reduced five-year fixed mortgages from a falling Canadian five-year bond yield

- the coming introduction of longer amortization periods

- the ability to insure mortgages for homes valued up to $1.5 million

These factors certainly make the market more affordable for some buyers who are limited by capital costs and the lending environment. However, with the B20 stress test still in place and buyers qualifying at rates over 5.0 per cent, price ultimately becomes the most important factor for many buyers looking to re-enter the market.

Easing of stress test could build staying power

To this end, TRREB highlights that the easing of the mortgage stress tests for existing homeowners on renewal could build some staying power into the market, by making homeowners and investors able to afford to keep their homes rather than selling when faced with financial stress.

TRREB also expects further rate cuts to allow a growing number of households to afford homeownership. This notion is especially pointed at first-time buyers, who have been outlined by the Bank of Canada as nearly 50 per cent of all homebuyers, representing a key demographic for those hoping for a recovery in the market.

Supply outpacing demand

A closer analysis reveals a more nuanced picture. While demand (measured in sales) grew, the rate of new listings entering the market has grown even faster, by 10.5 year-over-year, slightly outpacing sales growth. In September, 18,089 new listings were added to the MLS, contributing to an already better-supplied market. This gap between supply and demand, rather than indicating a shortage of homes, points to an easing of market pressures and a better market for buyers to enter.

Compounding this, we’re seeing a significantly increased “time to sell” — meaning it takes an extra week for a listing to sell, compared to the average 20 days on market from September last year. This slowing absorption has led supply to accumulate, with active listings now up 35.5 per cent compared to September 2023.

Ability to negotiate on price: Indicates a market no longer heavily favoured to sellers

Should this trend continue to hold, it’s reasonable to expect that buyers will resume their home search as they see more homes on the market and hope they can capitalize on the supply, shop around and negotiate with sellers. This is how the imbalance between supply and demand is further materialized, in a decline in prices.

The MLS Home Price Index Composite benchmark was down by 4.6 per cent year-over-year, and the average selling price in September dropped 1.0 per cent compared to the previous year.

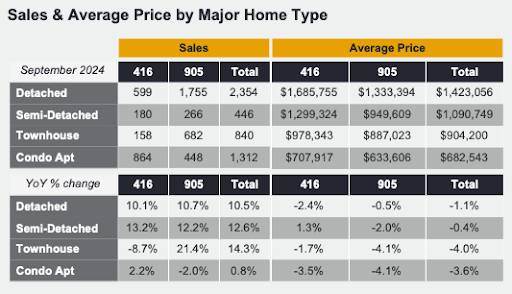

TRREB attributes this to increased negotiating power for buyers, especially in the more affordable segments like condominiums and townhouses, which are favoured by first-time buyers. More activity in the lower ends of the market can skew the average down. Interestingly, 416 condominium sales are actually up year-over-year, despite the market being in a severe state of excess supply. The ability to negotiate on price is a clear indicator of a market that’s no longer tilted heavily in favour of sellers.

Source: TRREB

The pricing context: A “recovery” in question

A true market recovery, by definition, would generally see home prices stabilizing or even increasing as demand starts to outpace supply. However, this is not currently the case in the GTA.

While average selling prices have edged up slightly on a seasonally adjusted basis compared to August 2024, the year-over-year decline in benchmark prices suggests that the market has not fully recovered to its previous highs. Affordability challenges that plagued the market before the interest rate hikes are being alleviated, but they haven’t disappeared.

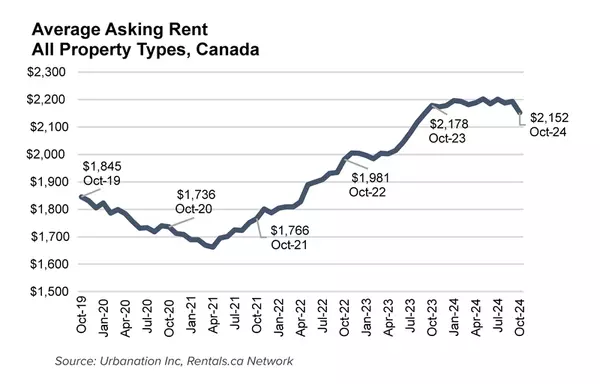

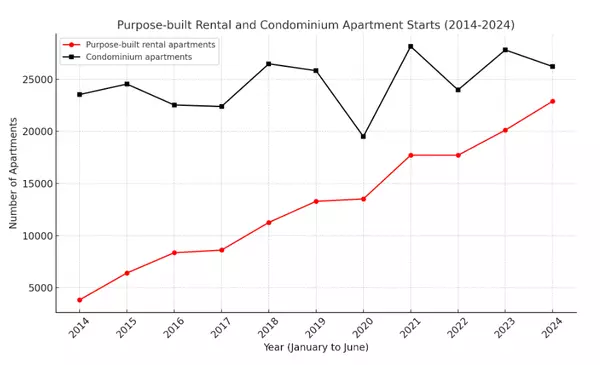

Furthermore, while rate cuts may improve affordability in the short term, they don’t necessarily address the long-term structural issues in the housing market, such as supply constraints or high construction costs. It’s worth noting that while lower borrowing costs can temporarily boost demand, they can also encourage speculative buying, which could further distort the market, particularly if supply doesn’t keep pace.

Recovering sales, but not prices

Despite TRREB’s optimistic messaging, the GTA housing market appears to be in a state of balance rather than recovery. Yes, sales are up, and rate cuts have eased some of the financial pressure on buyers and sellers. On the other hand, the growing supply of homes, coupled with modest price declines, suggests a more buyer-friendly market, one in which supply is catching up to — and in some cases, surpassing — demand.

This dynamic is providing more negotiating power to buyers, and while that’s a positive development for affordability, it doesn’t necessarily signal a robust recovery in price. Instead, the current market is best characterized as one where buyers have regained some control, but where underlying challenges around housing supply and affordability remain.

The return to a balanced market does point to a steady resurrection of sales activity, which is welcome news for the real estate profession that has been dealing with drastically reduced activity for some time now.

Categories

Recent Posts

GET MORE INFORMATION