Introduction

Picture yourself walking through a grand foyer with soaring ceilings, or relaxing on a private terrace overlooking manicured gardens. Toronto's luxury real estate market offers these experiences and more, with properties that blend exceptional craftsmanship with lasting investment value. From historic mansions in tree-lined neighborhoods to contemporary penthouses with stunning city views, luxury homes for sale in Toronto represent the pinnacle of refined living.

The high-end property market here comprises roughly 0.8% of all real estate transactions, yet these exclusive homes command prices ranging from $4 million to well over $30 million. What makes these properties truly special isn't just their impressive price tags—it's the meticulous attention to detail, prime locations, and amenities that cater to the most discerning buyers.

What sets Toronto's luxury market apart from other major cities? The answer lies in its remarkable stability through economic shifts, making it a magnet for both local and international investors seeking secure long-term growth. Canada's political stability, combined with Toronto's status as a global financial hub and its rich cultural diversity, continues to fuel demand for premium properties across the city's most prestigious neighborhoods.

Modern luxury homebuyers aren't just looking for beautiful architecture and premium finishes anymore. They want properties that serve as private sanctuaries with integrated smart home technology, sustainable features, and flexible spaces that adapt to changing lifestyles. Whether you're seeking a historic estate in Rosedale or a modern masterpiece in Bridle Path, understanding the nuances of Toronto's luxury real estate landscape is essential for making informed decisions.

Key Takeaways

Toronto's luxury real estate market combines exceptional quality with strong investment potential, representing less than 1% of total market activity

Premium properties range from $4 million to over $30 million, featuring custom designs and exclusive locations in prestigious neighborhoods

The market shows remarkable resilience during economic fluctuations, attracting both domestic and international high-net-worth buyers

Each elite neighborhood offers unique character, from historic charm in Rosedale to expansive estates in Bridle Path

Contemporary luxury buyers prioritize smart home technology, outdoor spaces, and properties that offer both lifestyle benefits and investment security

Working with specialized luxury real estate professionals like the Ali Bolourchi Real Estate Team ensures access to exclusive listings and expert market guidance

Toronto's Most Prestigious Neighborhoods for Luxury Homes

Find Luxury homes and Condos for sale in Toronto's Communities such as:

Bridle Path, Post Road - Sunnybrook | Forest Hill, North and South | Rosedale | Lawrence Park, North and South | Willowdale and Netwonbrook

Toronto's most coveted luxury homes for sale are concentrated in neighborhoods that have earned international recognition for their sophistication and exclusivity. Each area offers distinct advantages that appeal to different buyer preferences and lifestyles.

Bridle Path and Sunnybrook, often referred to as "Millionaire's Row," epitomize luxury living in Toronto. Here, you'll find expansive estates on multi-acre lots, many featuring private gated entrances and park-like settings that provide ultimate privacy. Properties typically start at $15 million, with many exceptional homes exceeding $30 million. These estates showcase impressive architectural features like grand circular driveways, custom security systems, and seamlessly integrated outdoor living spaces that blur the lines between interior and exterior luxury.

Have you ever wondered what makes a neighborhood truly timeless? Rosedale provides the perfect answer with its winding streets lined with mature oak and maple trees, creating a canopy that changes dramatically with the seasons. This historic enclave features stately homes with period architectural details, meticulously maintained gardens, and an atmosphere of quiet elegance. The neighborhood's appeal stems from its perfect balance—offering tranquil, private living while maintaining convenient access to downtown Toronto's business and cultural districts.

"Rosedale represents the gold standard of Toronto luxury living. The combination of heritage architecture, mature landscaping, and proximity to downtown creates a market dynamic that consistently outperforms other luxury segments."

Forest Hill South and North present diverse luxury options, from grand single-family homes to sophisticated condominiums. Forest Hill South is known for its established prestige and elegant period homes, while Forest Hill North offers quieter residential streets with generous lot sizes and exceptional curb appeal. Both areas provide proximity to Toronto's top private schools and cultural institutions, making them particularly attractive to families seeking luxury with educational excellence.

The Casa Loma area, including select parts of the Annex, offers a unique blend of historical significance and modern luxury. Properties here often feature distinctive architectural elements, from Victorian-era details to contemporary renovations that honor the area's heritage while incorporating modern amenities. The proximity to cultural attractions like Casa Loma itself, the Royal Ontario Museum, and the University of Toronto adds intellectual and cultural richness to daily life.

Emerging luxury markets in areas like Leaside, Mount Pleasant, and parts of North York are gaining recognition among discerning buyers. These neighborhoods offer excellent accessibility to downtown Toronto, diverse architectural styles, and often more competitive pricing compared to traditional luxury enclaves. The appeal lies in their potential for continued appreciation while providing immediate access to excellent schools, shopping, and recreational facilities.

What truly distinguishes these neighborhoods isn't just the properties themselves, but the lifestyle they provide. Residents enjoy access to exclusive private clubs, prestigious educational institutions, high-end shopping districts, and cultural venues—all while maintaining the privacy and security that luxury living demands. The limited supply of premium homes in these established areas has historically supported strong price appreciation, making them attractive not just as places to live but as sound long-term investments.

Defining Features of Toronto Luxury Properties

Toronto's luxury real estate market encompasses a diverse range of property types, each designed to meet the sophisticated needs of affluent buyers with varying lifestyle preferences and investment goals.

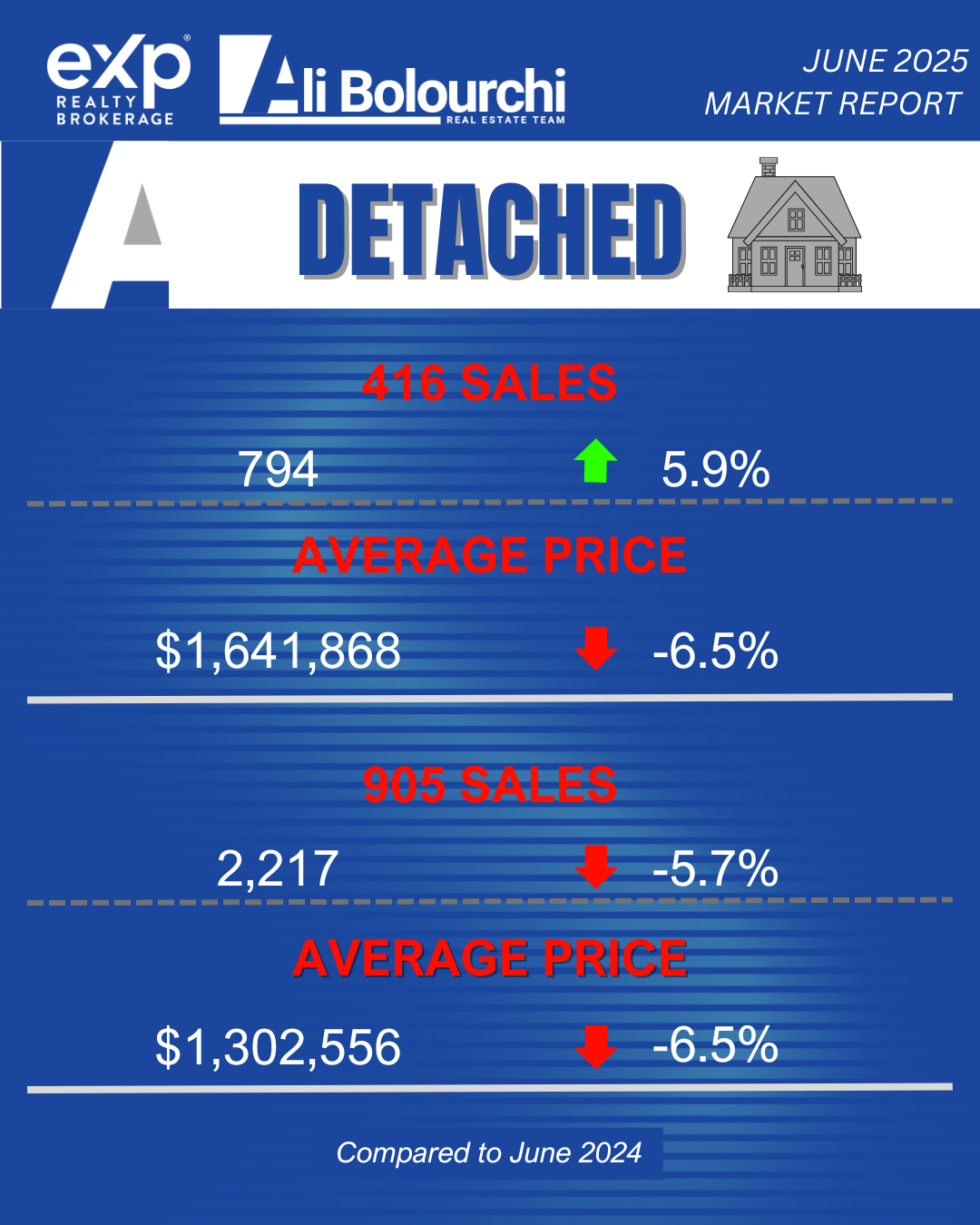

Luxury detached homes and mansions represent the crown jewels of Toronto's high-end market. These properties typically sit on expansive lots, sometimes exceeding one acre, with living spaces that can surpass 10,000 square feet across multiple levels. Step inside these homes and you'll discover meticulous craftsmanship throughout—from hand-crafted millwork and imported marble flooring to soaring ceilings and grand staircases that serve as architectural focal points. The outdoor spaces are equally impressive, featuring professionally designed landscapes, infinity pools, outdoor kitchens perfect for entertaining, and private gardens that provide serene retreats from city life.

For those drawn to sophisticated urban living, luxury condos and penthouses offer a different kind of elegance. These residences typically feature floor-to-ceiling windows that frame spectacular views of Toronto's skyline or Lake Ontario. Inside, you'll find high-end finishes, spacious layouts with flexible room configurations, and premium amenities that might include 24-hour concierge service, private fitness centers, rooftop gardens, and climate-controlled wine storage. Many luxury condominiums also offer residents private elevator access and enhanced security features for ultimate convenience and peace of mind.

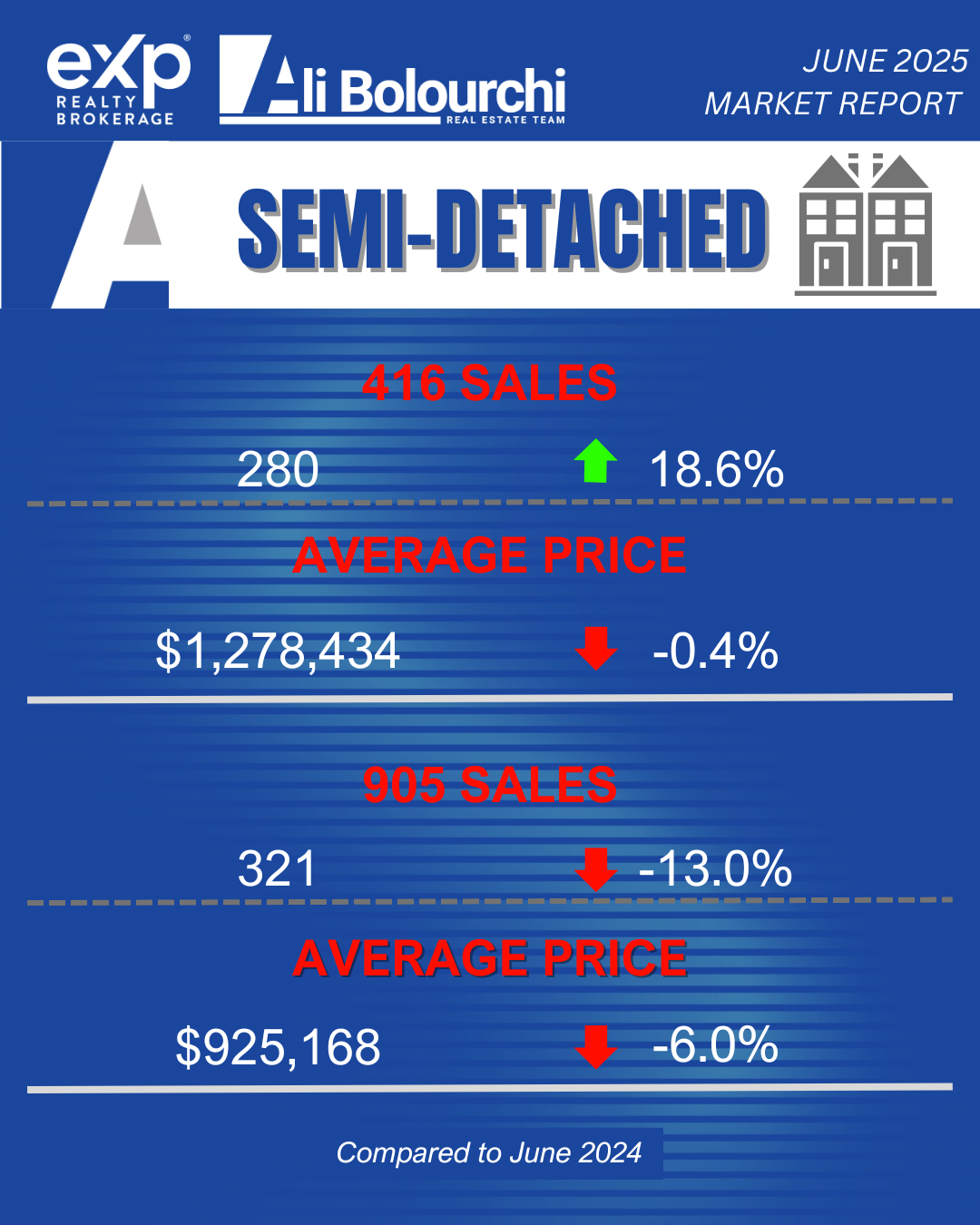

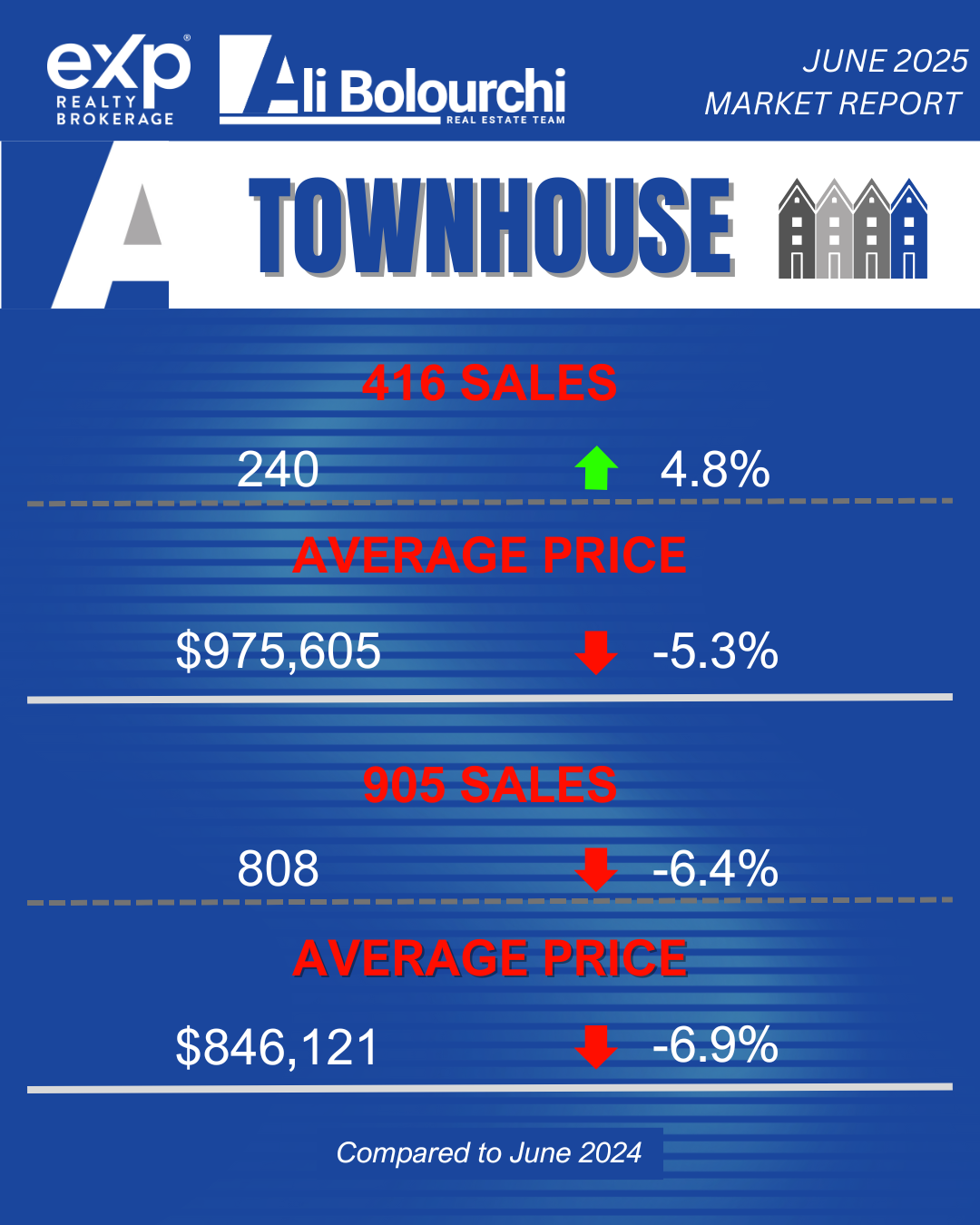

Townhouses and multi-generational homes provide an excellent middle ground for families seeking luxury with practical functionality. These properties often feature separate wings or guest suites, making them ideal for extended families or frequent entertaining. The layouts typically include spacious kitchens equipped with professional-grade appliances, multiple ensuite bathrooms with spa-like amenities, and flexible living spaces that can adapt to changing family needs over time.

Architectural masterpieces designed by renowned architects represent another fascinating segment of Toronto's luxury market. These unique properties showcase innovative design elements while maintaining timeless appeal. You might find a mid-century modern estate with floor-to-ceiling glass walls, or a French Chateau-inspired residence that combines Old World elegance with contemporary functionality and energy efficiency.

Regardless of property type, luxury homes for sale in Toronto typically include sophisticated amenities that enhance everyday living. Smart home automation systems allow residents to control lighting, climate, security, and entertainment systems with simple voice commands or smartphone apps. Gourmet kitchens feature top-of-the-line appliances from brands like Sub-Zero, Wolf, and Miele, paired with custom cabinetry and oversized islands perfect for casual dining and entertaining.

Smart home automation systems for lighting, climate, security, and entertainment

Gourmet kitchens with top-tier appliances (Sub-Zero, Wolf, Miele)

Custom cabinetry and oversized islands

Walk-in closets with custom organization systems

Spa-like ensuite bathrooms with heated floors and steam showers

Home theaters with professional sound systems

Temperature-controlled wine cellars

Multi-car garages with electric vehicle charging stations

Primary suites in these homes often rival those found in luxury hotels, featuring walk-in closets with custom organization systems, and ensuite bathrooms with heated marble floors, deep soaking tubs, and steam showers. Entertainment spaces might include dedicated home theaters with professional sound systems, temperature-controlled wine cellars, and game rooms designed for both intimate gatherings and larger celebrations.

Additional luxury features commonly found in Toronto's high-end properties include private elevators, multi-car garages with electric vehicle charging stations, separate guest quarters, and outdoor spaces designed for year-round enjoyment. These exceptional amenities don't just add comfort—they contribute significantly to the property's long-term value and appeal to future buyers.

The Ali Bolourchi Real Estate Team Advantage in Luxury Properties

When it comes to navigating Toronto's competitive luxury real estate market, the Ali Bolourchi Real Estate (A.B.R.E.) Team stands out as the premier choice for discerning buyers and sellers. Their extensive expertise and personalized approach have made them trusted advisors for high-net-worth individuals seeking exceptional properties throughout the Greater Toronto Area.

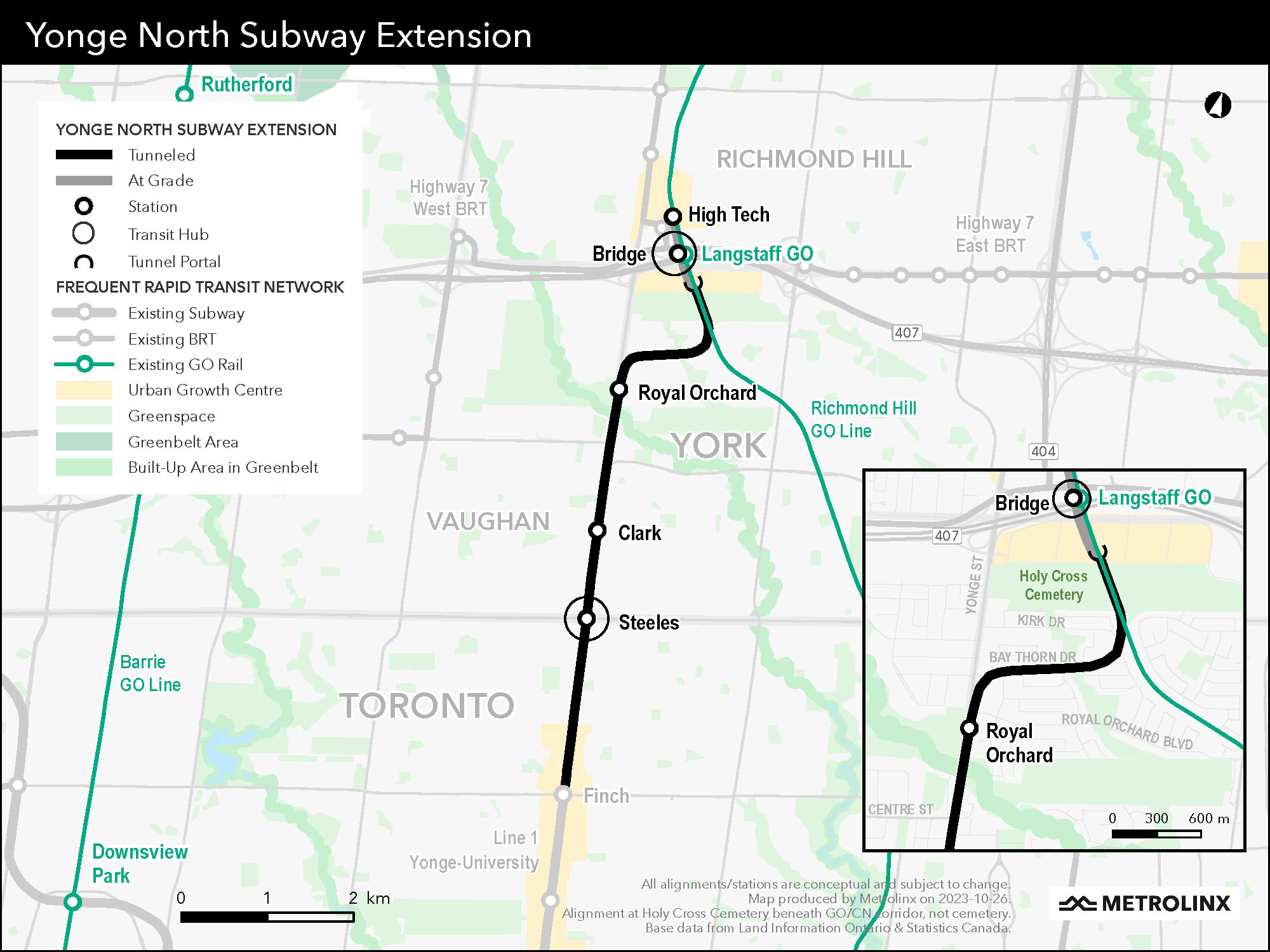

The A.B.R.E. Team brings specialized knowledge that extends far beyond typical real estate services. Their deep understanding of luxury markets in Toronto, Richmond Hill, Markham, Vaughan, Aurora, and Newmarket means they can identify properties that perfectly align with your specific lifestyle requirements and investment objectives. This neighborhood-specific expertise proves invaluable when evaluating factors like future development plans, school district quality, and local market trends that affect long-term property values.

What sets the A.B.R.E. Team apart is their access to exclusive listings and off-market opportunities. Through their extensive network of luxury property owners, developers, and high-net-worth clients, they often learn about exceptional properties before they appear on public listings. This insider access gives their clients a significant advantage in a competitive market where the best luxury homes for sale in Toronto can sell quickly to qualified buyers.

"The A.B.R.E. Team's deep market knowledge and discretion make them the go-to choice for luxury property transactions in Toronto's most exclusive neighborhoods."

For buyers, the team's comprehensive search process is tailored to your unique requirements, preferences, and timeline. They understand that purchasing a luxury property involves more than just finding a beautiful home—it's about discovering a property that enhances your lifestyle while serving as a sound investment. Their market analysis includes detailed comparisons of recent sales, pricing trends, and future appreciation potential to help you make informed decisions.

Sellers benefit from the A.B.R.E. Team's sophisticated marketing strategies specifically designed for luxury properties. They create compelling property presentations using professional photography, virtual tours, and targeted marketing campaigns that reach qualified buyers both locally and internationally. Their negotiation expertise, refined through years of high-value transactions, consistently helps sellers achieve optimal pricing while ensuring smooth, confidential transactions.

Privacy and discretion remain paramount throughout every client interaction. The A.B.R.E. Team understands that luxury real estate transactions often involve high-profile individuals who value confidentiality. They coordinate seamlessly with other professionals—including legal advisors, financial consultants, and interior designers—to ensure every aspect of the transaction proceeds smoothly and securely.

The team's commitment to integrity and transparency has established them as trusted advisors in Toronto's luxury real estate community. They take time to understand each client's unique situation, providing honest market assessments and strategic guidance that respects both immediate needs and long-term goals. Whether you're seeking a historic mansion in Rosedale or a contemporary penthouse in Yorkville, the A.B.R.E. Team delivers personalized service that exceeds expectations while ensuring optimal outcomes for every client.

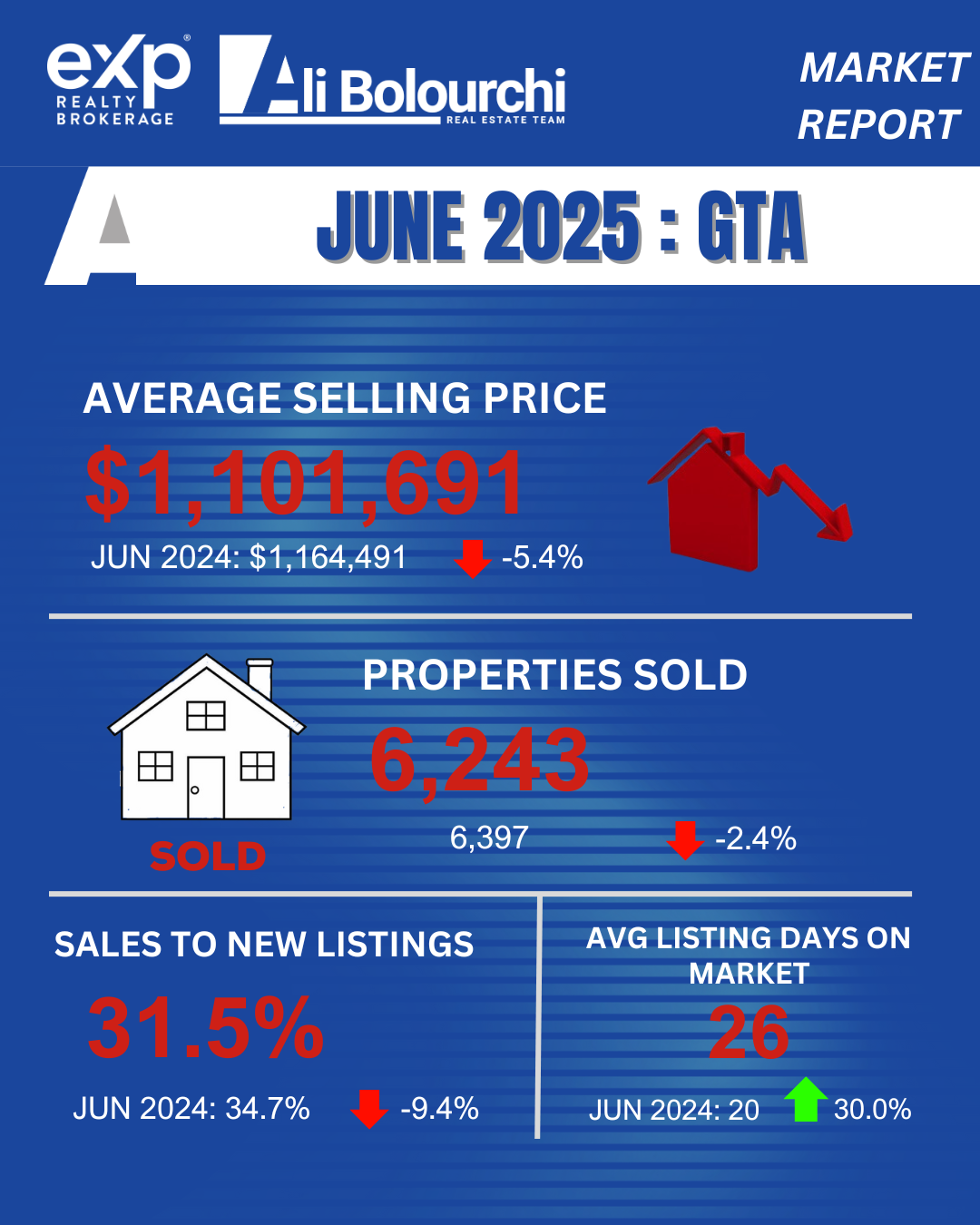

Market Trends and Investment Insights

Toronto's luxury real estate market continues to demonstrate remarkable resilience and growth potential, making it an attractive destination for both domestic and international investors seeking stable, long-term appreciation. Understanding current market dynamics and investment trends is crucial for making informed decisions in this exclusive segment.

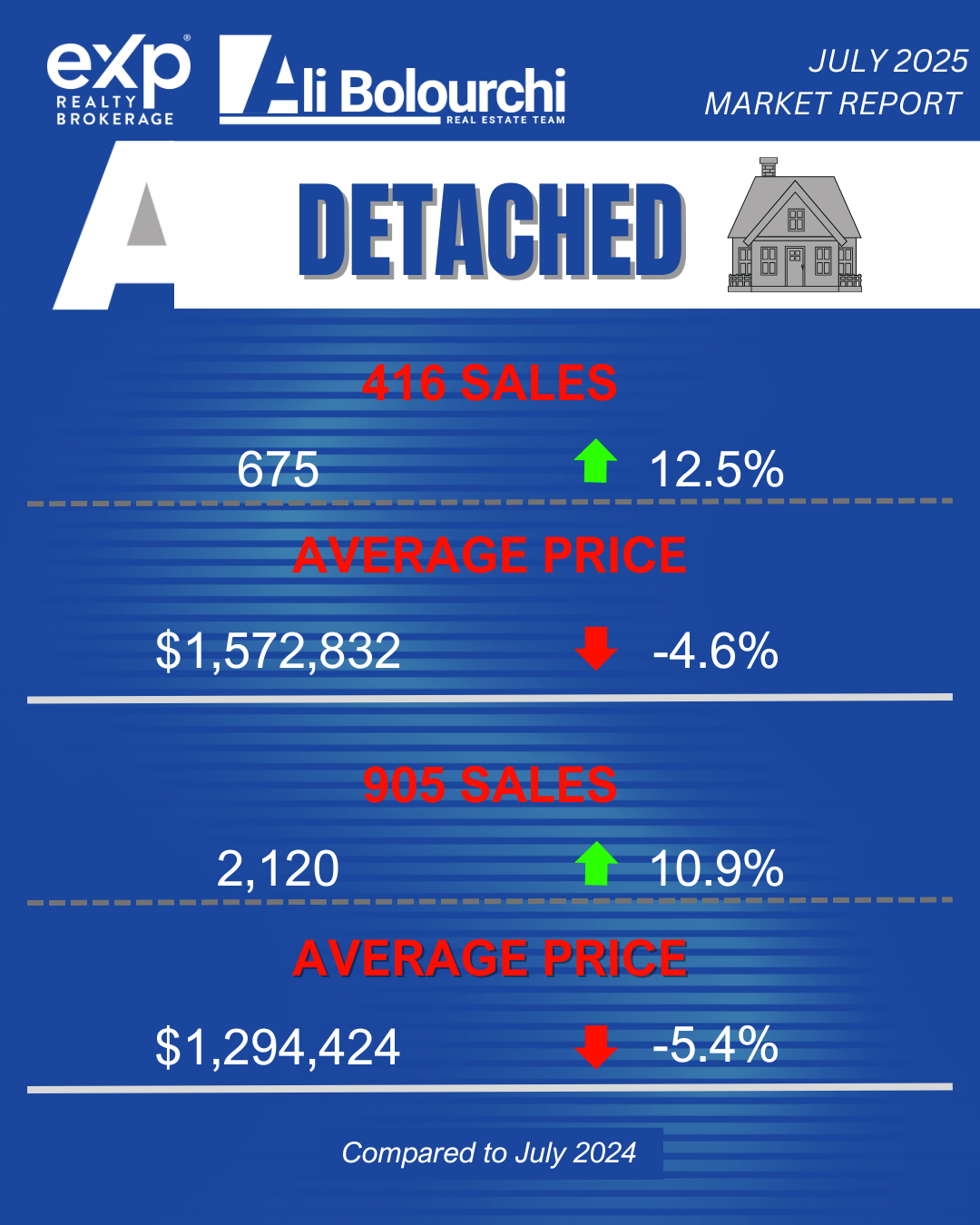

Recent price trends in Toronto's luxury sector show consistent strength despite periodic fluctuations in the broader housing market. While general real estate markets can experience volatility, premium properties in established neighborhoods like Rosedale, Forest Hill, and Bridle Path tend to maintain their value and appreciate steadily over time. The average luxury home sale price ranges from $4 million to $10 million, with exceptional properties commanding $20 million to $30 million or more. This price stability reflects the limited supply of truly exceptional homes and the ongoing demand from qualified buyers.

Property Category | Price Range |

|---|

Average Luxury Home | $4 million - $10 million |

Exceptional Properties | $20 million - $30 million+ |

Ultra-Premium Estates | $30 million+ |

Supply and demand dynamics heavily favor sellers in Toronto's luxury market. With high-end properties representing less than 1% of all listings, competition among qualified buyers remains intense for the most desirable homes. This scarcity naturally supports both sale prices and the frequency of multiple-offer situations, particularly for turnkey properties in prime locations. The limited inventory also means that well-maintained luxury homes often sell above their initial asking prices, especially when they feature unique architectural elements or prime locations.

The global appeal of Toronto's luxury market stems from several factors that extend beyond real estate fundamentals. Canada's political stability, combined with Toronto's role as a major financial center, attracts affluent buyers from around the world. The city's excellent educational institutions, multicultural environment, and high quality of life make it particularly appealing to international families seeking a secure environment for their children's education and development.

Post-pandemic lifestyle changes have significantly influenced buyer preferences in the luxury market. Recent trends show increased demand for properties featuring generous outdoor spaces, dedicated home offices, and wellness amenities like private gyms and spa facilities. Buyers are also prioritizing homes with flexible layouts that can accommodate multi-generational living, along with smart home technology that enhances both convenience and security.

"Toronto's luxury real estate market has shown remarkable resilience, with properties in prime neighborhoods maintaining their value even during broader economic uncertainty. The combination of limited supply and international demand creates a unique investment environment."

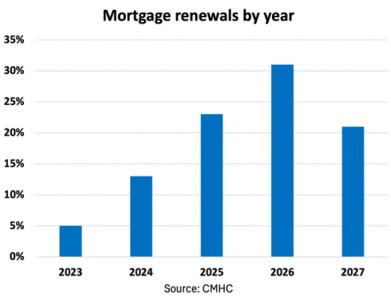

Investment considerations for luxury properties extend beyond their role as primary residences. Many sophisticated buyers view these properties as important components of their overall investment portfolios. Key factors influencing investment decisions include long-term appreciation potential, the possibility of rental income for secondary properties, tax implications of luxury property ownership, and financing strategies optimized for high-value assets.

Market analysts note that Toronto's luxury real estate offers several advantages for investors. The combination of limited supply, strong demand, and the city's continued growth as a global business center supports long-term value appreciation. Additionally, the Canadian government's stable economic policies and the real estate market's historical resilience during economic downturns provide additional security for luxury property investments.

For both investors and homeowners, Toronto's luxury market represents an opportunity for capital preservation and growth within one of North America's most dynamic and stable urban centers. The key to success lies in understanding these market dynamics and working with professionals who can provide insights into timing, pricing, and long-term trends that affect luxury property values.

Navigating the Luxury Home Buying Process

Purchasing a luxury home in Toronto requires a strategic approach that goes far beyond typical real estate transactions. The complexity of high-value properties, combined with the competitive nature of the luxury market, makes expert guidance essential for achieving successful outcomes.

Comprehensive market research forms the foundation of any successful luxury purchase. Understanding current pricing trends, recent sales data, and market conditions in your target neighborhoods helps you make informed decisions about timing and competitive positioning. The luxury market can be influenced by factors like interest rate changes, currency fluctuations, and global economic conditions, making it important to consider these broader economic trends when planning your purchase.

Defining your personal and investment objectives clearly before beginning your search will guide the entire process. Are you seeking a primary residence, a vacation home, or an investment property? Each purpose requires different considerations regarding location, size, amenities, and potential for future appreciation. Understanding your priorities helps narrow the search to properties that truly meet your needs while avoiding the distraction of homes that may be impressive but don't align with your goals.

Financing luxury properties often requires specialized approaches that differ from conventional mortgage processes. High-value homes typically require substantial down payments—often 40% or more—and may benefit from custom financing solutions. Working with financial advisors who understand luxury real estate can help you explore options beyond traditional mortgages, including portfolio lending, private banking solutions, and international financing structures for foreign buyers.

The due diligence process for luxury properties demands particular attention to detail. Professional home inspections should be conducted by specialists familiar with high-end construction materials, advanced building systems, and luxury amenities. Legal reviews become especially important for properties with complex features like elevators, pools, or extensive landscaping, as these elements can involve ongoing maintenance obligations and potential liability considerations.

Professional home inspections by high-end construction specialists

Legal reviews for complex features (elevators, pools, landscaping)

Assessment of advanced building systems and luxury amenities

Evaluation of ongoing maintenance obligations

Review of potential liability considerations

Negotiation strategies in the luxury market require finesse and market knowledge. Beyond price, terms like closing dates, inclusion of furnishings, inspection periods, and contingency clauses can significantly impact the transaction's success. Properties may have unique features or circumstances that affect their value, making it essential to work with professionals who understand how to position offers competitively while protecting your interests.

Timing your purchase can significantly impact both the selection of available properties and the final purchase price. The luxury market often follows seasonal patterns, with spring and fall typically offering the best selection of new listings. However, winter purchases might provide opportunities to negotiate with motivated sellers, while summer transactions can sometimes offer access to properties before the competitive fall market begins.

"Successful luxury home purchases in Toronto require more than just financial capability—they demand market timing, professional guidance, and an understanding of the unique factors that drive value in each prestigious neighborhood."

Working with real estate professionals who specialize in luxury properties provides access to market insights, exclusive listings, and professional networks that can streamline the entire process. The Ali Bolourchi Real Estate Team's expertise in Toronto's luxury market ensures that clients benefit from comprehensive market knowledge, skilled negotiation, and seamless transaction management from initial search through closing.

Living the Luxury Lifestyle in Toronto

Owning a luxury home in Toronto opens doors to an exceptional lifestyle that extends far beyond the boundaries of your property. The city's unique combination of world-class amenities, cultural richness, and natural beauty creates an environment where sophisticated living reaches its full potential.

Educational excellence represents one of Toronto's most compelling advantages for luxury homeowners, particularly those with families. The city's prestigious private schools, including Upper Canada College, Bishop Strachan School, and Branksome Hall, provide world-class education within convenient distance of luxury neighborhoods. These institutions offer not just academic excellence but also extensive extracurricular programs, strong alumni networks, and international recognition that opens doors to top universities worldwide.

Toronto's cultural landscape rivals that of any major global city, offering luxury residents unparalleled access to arts, entertainment, and intellectual pursuits. The city hosts world-class museums like the Royal Ontario Museum and the Art Gallery of Ontario, while venues like the Four Seasons Centre for the Performing Arts and Roy Thomson Hall present internationally acclaimed performances throughout the year. This cultural richness means that entertainment and educational opportunities are literally at your doorstep.

The dining and shopping experiences available to luxury homeowners reflect Toronto's international character and sophisticated tastes. The city's restaurant scene includes establishments that have earned recognition from prestigious culinary guides, while shopping districts like Bloor-Yorkville and the Hazelton Lanes cater to discerning tastes with international designer boutiques and specialty retailers. Private members' clubs provide exclusive venues for business and social networking, while the city's diverse culinary landscape offers everything from authentic international cuisine to innovative fusion concepts.

What role do outdoor spaces play in luxury living? Toronto's extensive ravine system and waterfront areas provide remarkable opportunities for recreation and relaxation within the urban environment. Many luxury neighborhoods border these natural areas, offering residents private access to hiking trails, cycling paths, and scenic viewpoints. The city's waterfront provides sailing, boating, and other water activities during warmer months, while winter brings opportunities for skiing and other seasonal sports in nearby areas.

The convenience and connectivity of Toronto's luxury neighborhoods cannot be overstated. Strategic locations provide easy access to the financial district, major transportation hubs, and Pearson International Airport, making both daily commutes and international travel efficient and convenient. This accessibility is particularly valuable for business executives and entrepreneurs who need to maintain connections with global markets and partners.

Community and social networks develop naturally within Toronto's established luxury neighborhoods. Residents often form meaningful connections through school communities, cultural patronage, philanthropic activities, and neighborhood associations. These relationships enhance quality of life while also providing valuable business and professional networking opportunities that can benefit both personal and career development.

The integration of technology and sustainability in luxury living continues to evolve, with many high-end properties incorporating smart home systems, energy-efficient features, and wellness amenities that enhance both comfort and environmental responsibility. From automated lighting and climate control to air purification systems and home fitness facilities, these features represent the cutting edge of luxury living.

Living in Toronto's luxury communities offers a rare combination of urban sophistication with neighborhood charm and natural beauty. For those who value world-class experiences alongside everyday livability, these prestigious enclaves provide not just exceptional homes but gateways to a lifestyle that balances privacy, community, culture, and convenience in one of North America's most vibrant and secure cities.

Conclusion

Toronto's luxury real estate market presents extraordinary opportunities for discerning buyers seeking both exceptional living experiences and sound investment potential. From the historic elegance of Rosedale to the grand estates of Bridle Path, the city's prestigious neighborhoods offer distinctive environments that combine privacy, security, and access to world-class amenities.

The market's continued resilience and appreciation potential make luxury homes for sale in Toronto attractive to sophisticated buyers from across Canada and around the world. These exclusive properties represent more than just beautiful homes—they offer entry into a lifestyle that encompasses educational excellence, cultural richness, and social opportunities that enhance both personal fulfillment and professional success.

For those ready to explore Toronto's luxury market, partnering with specialized professionals like the Ali Bolourchi Real Estate Team ensures access to exclusive listings, expert market insights, and personalized service that makes the complex process of luxury home buying both manageable and rewarding. Whether you're seeking an architectural masterpiece, a historic estate, or a contemporary urban residence, Toronto's premier luxury homes offer exceptional quality and enduring value in one of North America's most dynamic cities.

FAQs

What Defines a Luxury Property in Toronto's Current Market?

Luxury properties in Toronto typically start around $4 million, with ultra-premium homes reaching $10 million to $30 million or more. However, price alone doesn't define luxury—these properties must also feature exceptional locations in prestigious neighborhoods, superior construction quality, architectural significance, and distinctive amenities. Modern luxury homes often include smart home technology, sustainable features, wellness-focused spaces, and high-end finishes throughout. The definition continues to evolve as buyer expectations increase, with current luxury properties incorporating features like home automation, dedicated wellness areas, and flexible spaces that adapt to changing lifestyle needs.

Which Toronto Neighborhoods Hold the Strongest Appreciation Potential for Luxury Homes?

Established prestigious neighborhoods like Rosedale, Forest Hill, and Bridle Path have historically demonstrated the strongest long-term appreciation due to their limited supply, exclusive character, and enduring desirability among affluent buyers. These areas benefit from mature infrastructure, excellent schools, and proximity to cultural amenities. However, emerging luxury markets in areas like Yorkville, select Lawrence Park locations, and certain waterfront developments also show promising investment potential. The key factor driving appreciation remains location—neighborhoods with limited development potential, strong community character, and excellent amenities tend to maintain their value and appreciate consistently over time.

How Does Seasonality Affect Toronto's Luxury Real Estate Market?

Toronto's luxury market follows distinct seasonal patterns that can affect both inventory and pricing. Spring and fall (April through June and September through November) typically represent the most active periods for new listings and sales activity. Summer months often see reduced inventory as sellers wait for more favorable market conditions, while winter generally has fewer transactions but may attract more serious buyers with less competition. For sellers, timing listings to coincide with peak seasons can maximize exposure and potentially achieve higher sale prices. Buyers might find opportunities during quieter periods when there's less competition for exceptional properties.

What Financing Options Are Available for Luxury Home Purchases in Toronto?

Luxury property financing often requires specialized approaches beyond conventional mortgages. Options include jumbo mortgages from major banks, portfolio lending from private banks that cater to high-net-worth clients, and customized financing solutions from wealth management firms. Most luxury purchases require substantial down payments, typically 40% to 50% of the purchase price, to secure favorable interest rates and terms. International buyers may face additional requirements, including larger down payments or establishing Canadian banking relationships. Working with financial advisors experienced in luxury real estate transactions helps buyers explore the full range of financing options and structure purchases to optimize both cash flow and tax implications.

How Can the Ali Bolourchi Real Estate Team Assist With Finding Off-Market Luxury Properties?

The Ali Bolourchi Real Estate Team maintains an extensive network of connections with luxury property owners, developers, and fellow real estate professionals throughout the Greater Toronto Area. This network provides access to exclusive off-market opportunities that never reach public listings. Through their established relationships and proactive outreach strategies, they often learn about exceptional properties before they're formally marketed, giving their clients first access to rare opportunities. The team also employs targeted marketing to identify potential sellers in desired neighborhoods, facilitating private transactions that benefit both buyers and sellers who value discretion and want to avoid competitive bidding situations.