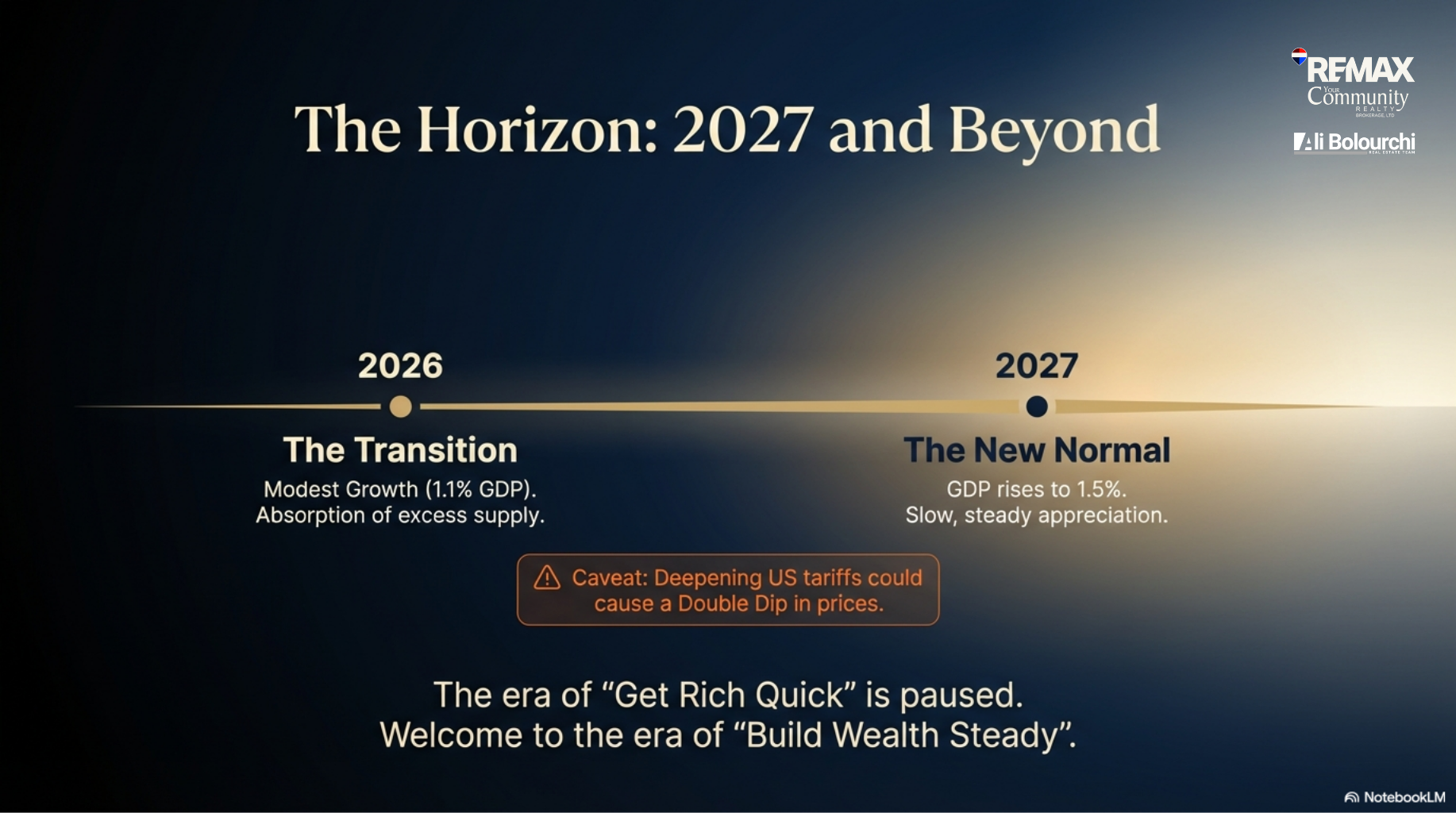

The GTA housing market has finally found its breath. After years of relentless movement, 2026 brings a "sober equilibrium"—a rare moment where the noise fades, and the signal becomes clear. With interest rates holding steady and a new era of "build wealth steady" replacing the frantic "get rich quick" mindset, the power has shifted back to the diligent buyer and the patient renter.

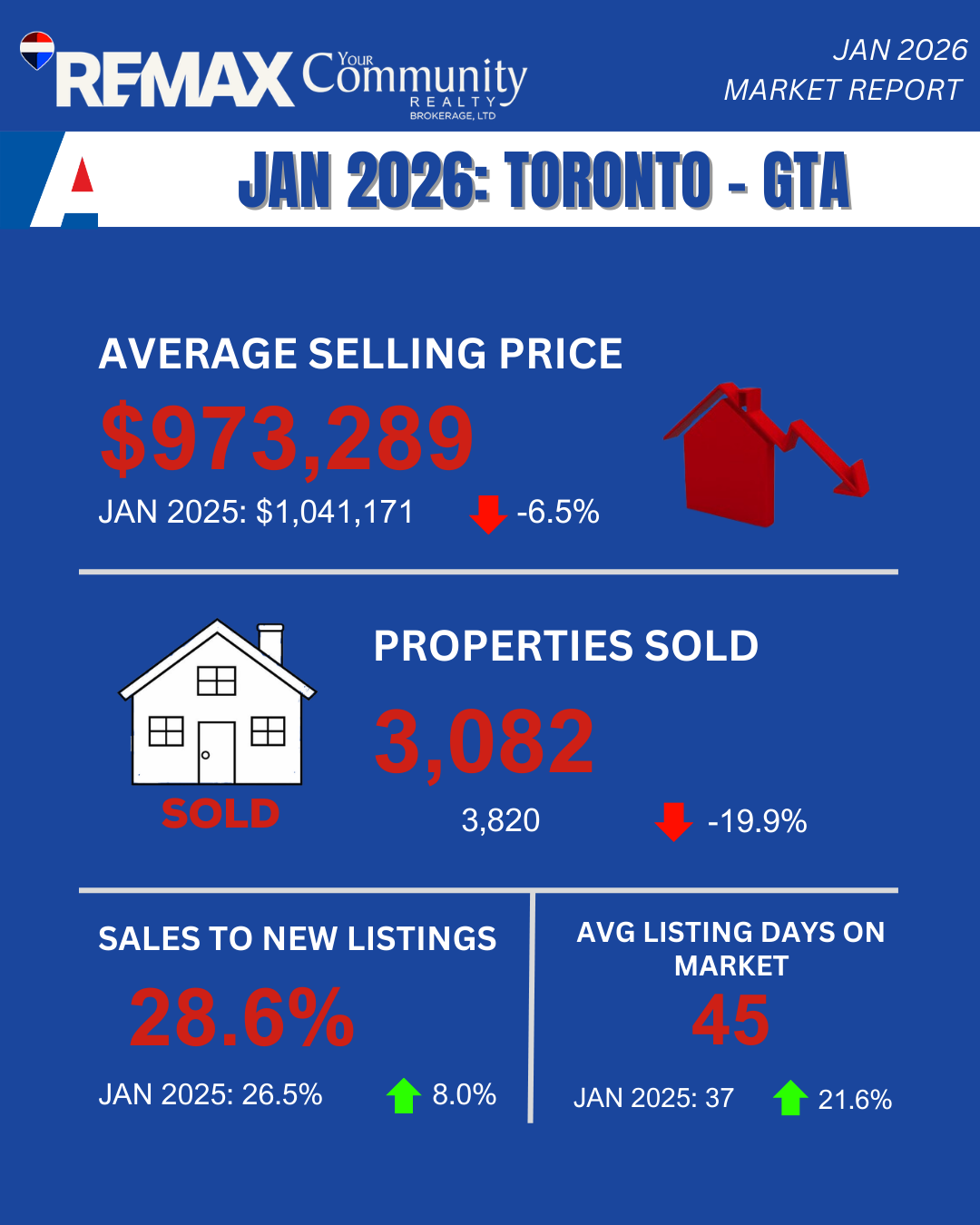

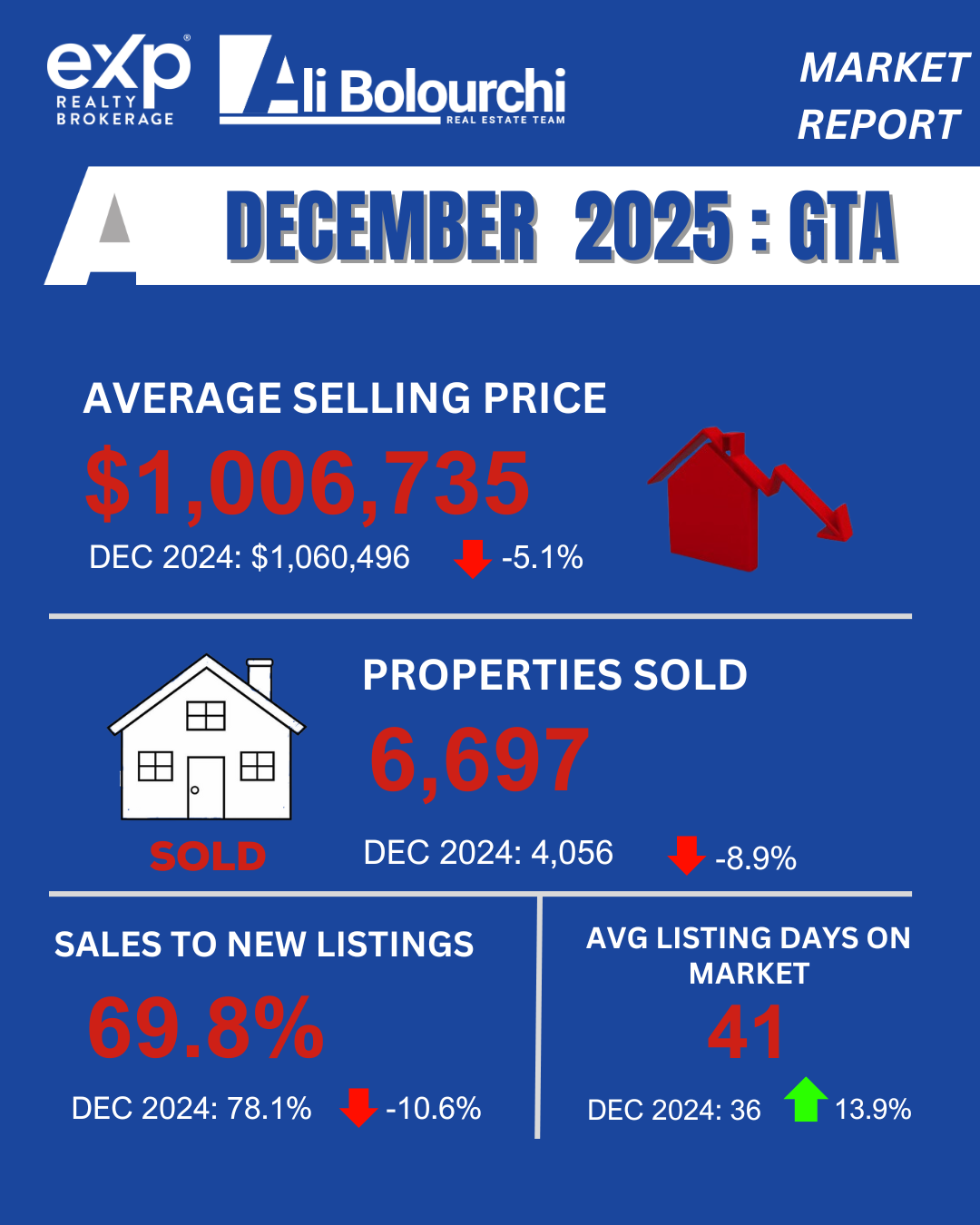

The Signal in the Noise: A Window of Stabilization

We are currently living through a rare pause in the relentless price climbs of the last decade. The "Macro-to-Micro" effect is real: global trade pivots are acting as a cushion against economic shocks, creating a unique window for those looking to secure their next home. This is not a market for the desperate; it is a market for the prepared.

The Trade Squeeze and the Canadian Shield

Our economy is currently navigating a "Trade Squeeze". While US tariffs have caused some pressure, Canada has built a "Shield" through new partnerships—including a $70B investment from the UAE and lowered tariffs on electric vehicles. This global balancing act keeps "hot money" away from Ontario, cooling the speculative fever and allowing for a more calm, authentic market temperature.

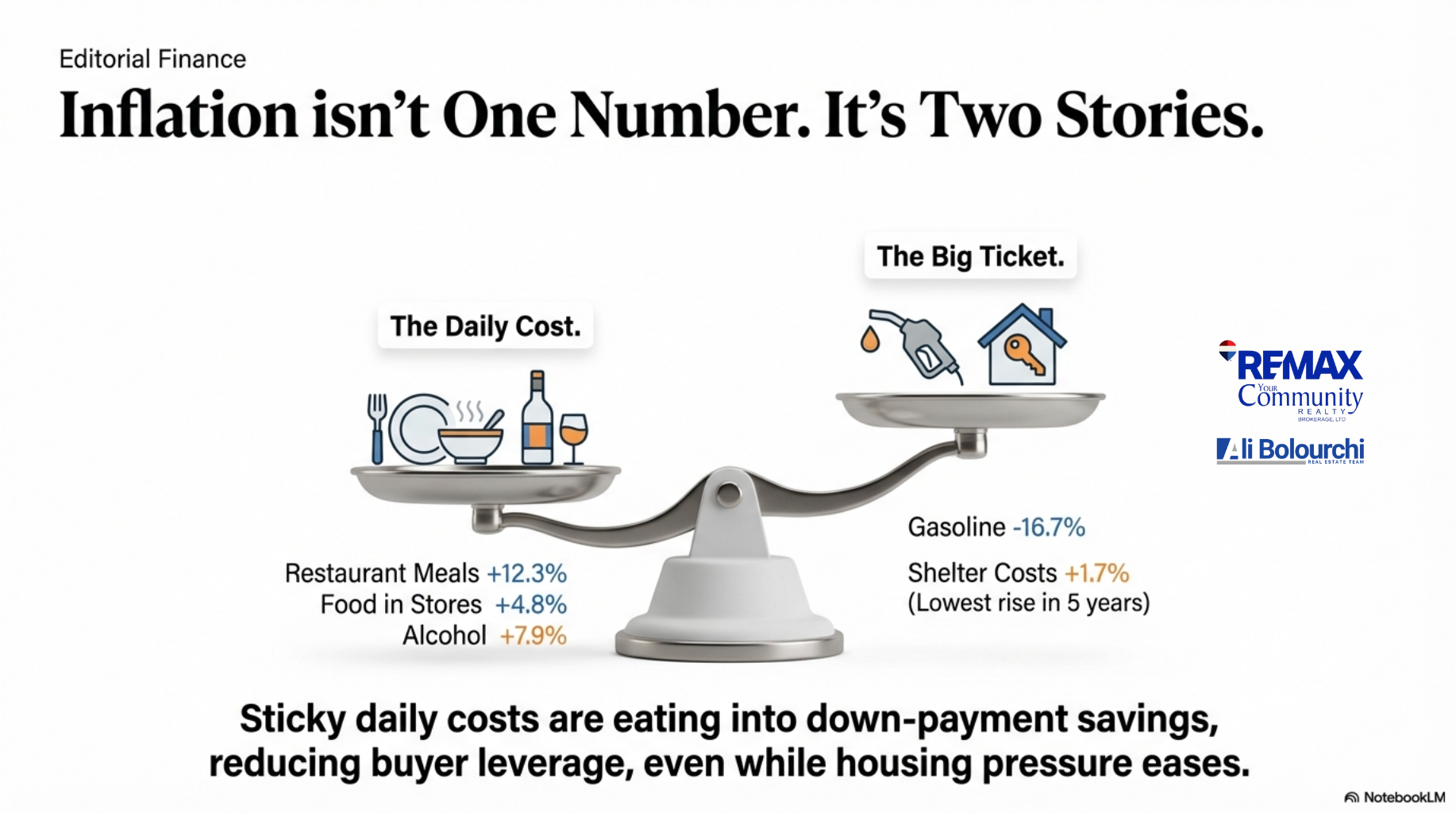

A Tale of Two Inflations

When you look at the data, you see two very different stories. "The Big Ticket" items are finally easing, with gasoline prices dropping significantly and shelter costs seeing their lowest rise in five years. However, "The Daily Cost" of living remains sticky. These high grocery and restaurant prices are quietly eating into down-payment savings, making it even more important to be strategic with your mortgage and rental choices.

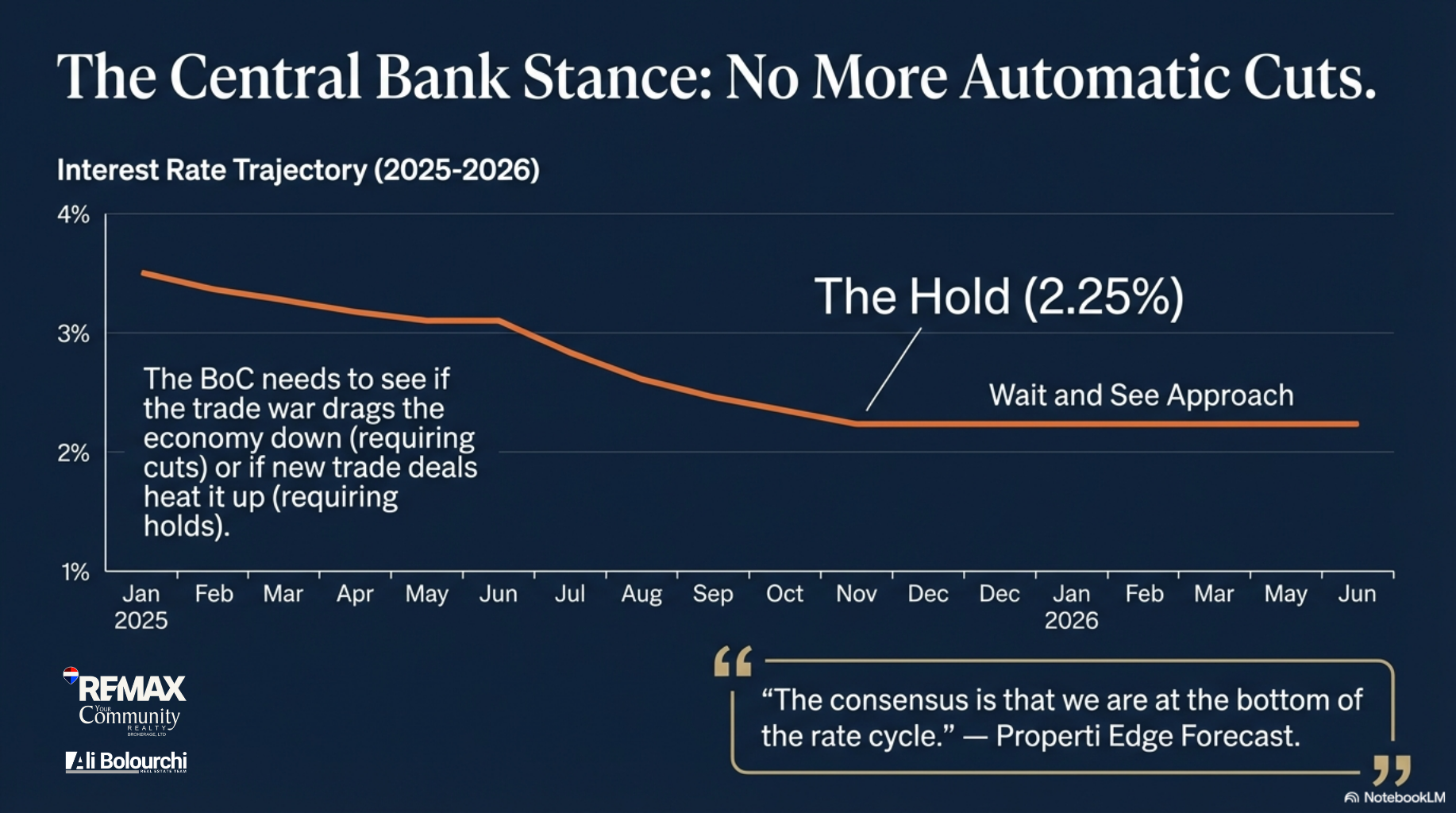

The Central Bank: A Season of Certainty

The Bank of Canada has moved away from automatic rate cuts and into a "Wait and See" approach. The policy rate has found a stable floor at 2.25%, which experts agree is the bottom of this cycle. For the first time in years, you can plan your future with a sense of predictability rather than fear of the next rate hike.

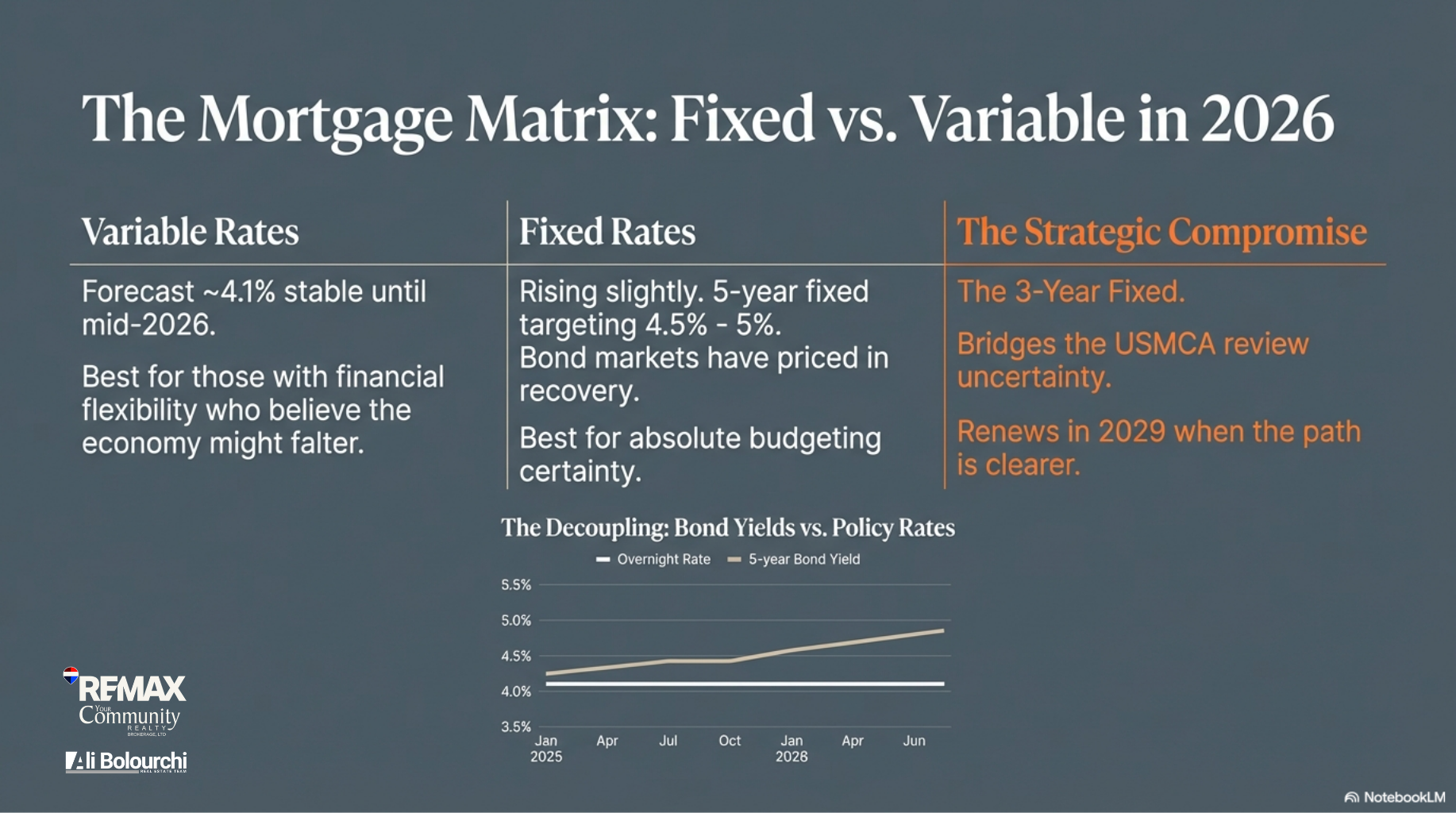

The Mortgage Matrix: Your Strategic Bridge

In 2026, choosing a mortgage is about more than just a number; it is about creating a bridge to your future. While variable rates offer flexibility, many are choosing the 3-Year Fixed mortgage. This strategy provides absolute certainty through the upcoming 2026 trade reviews and allows you to renew in 2029 when the global path is much clearer.

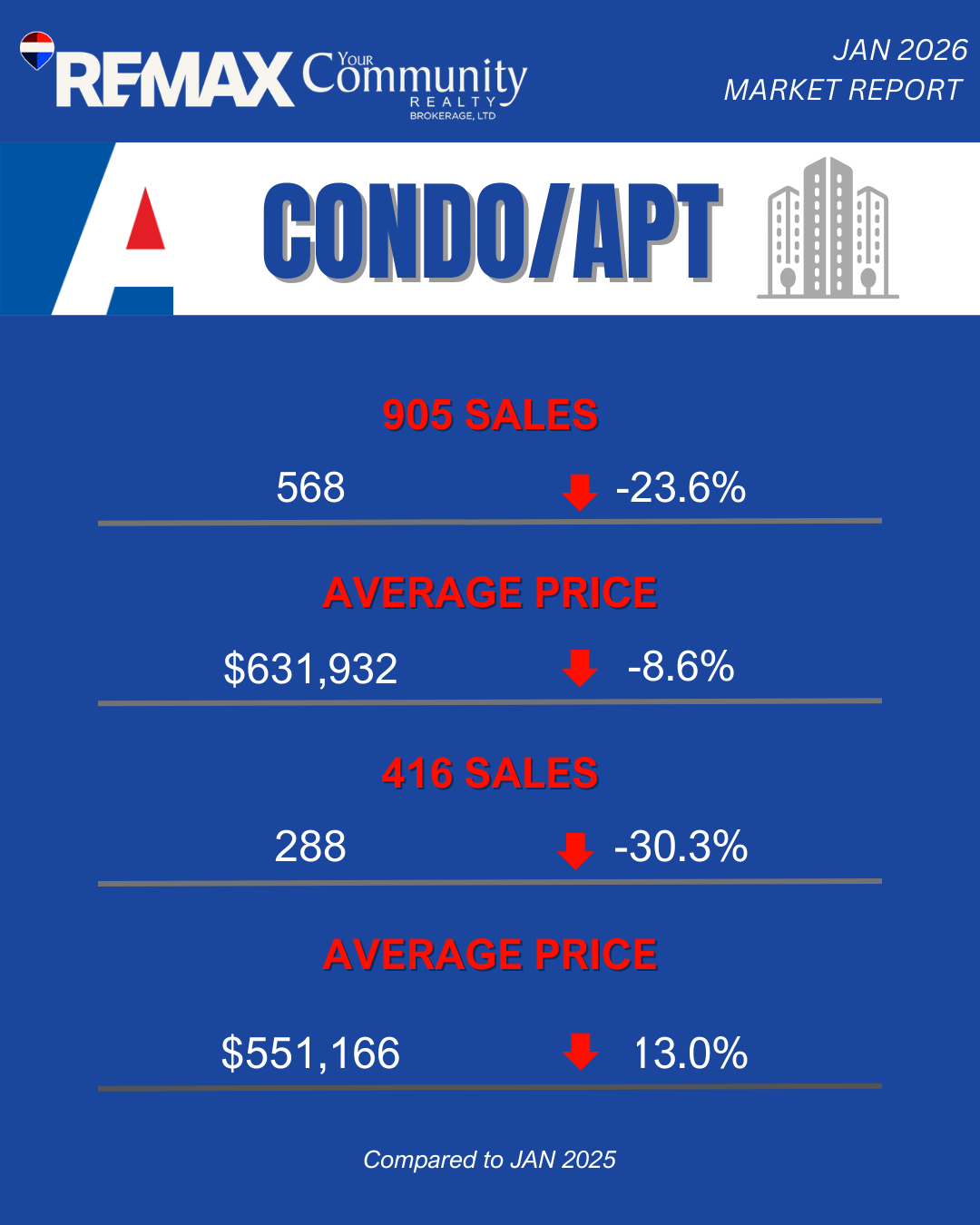

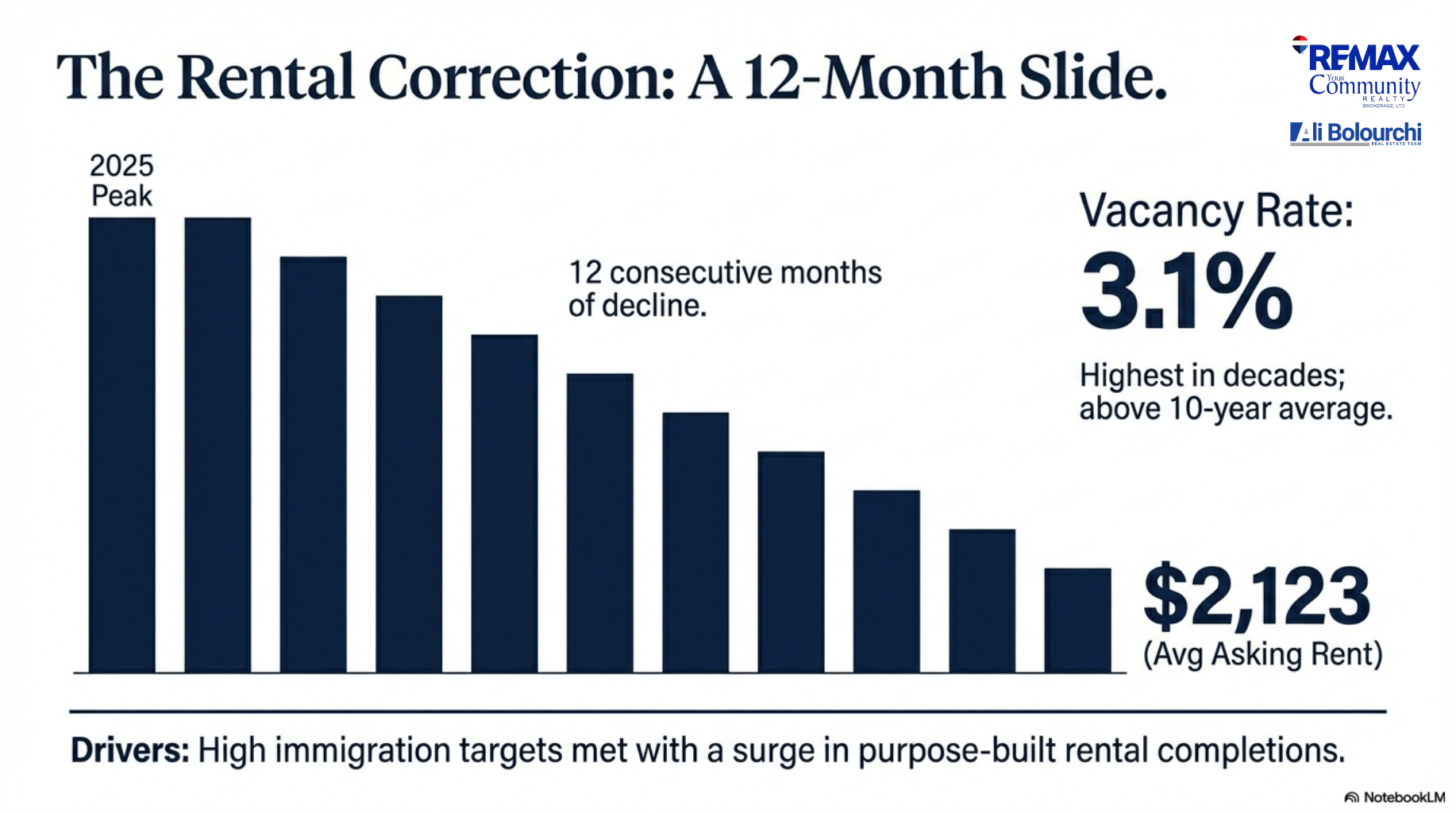

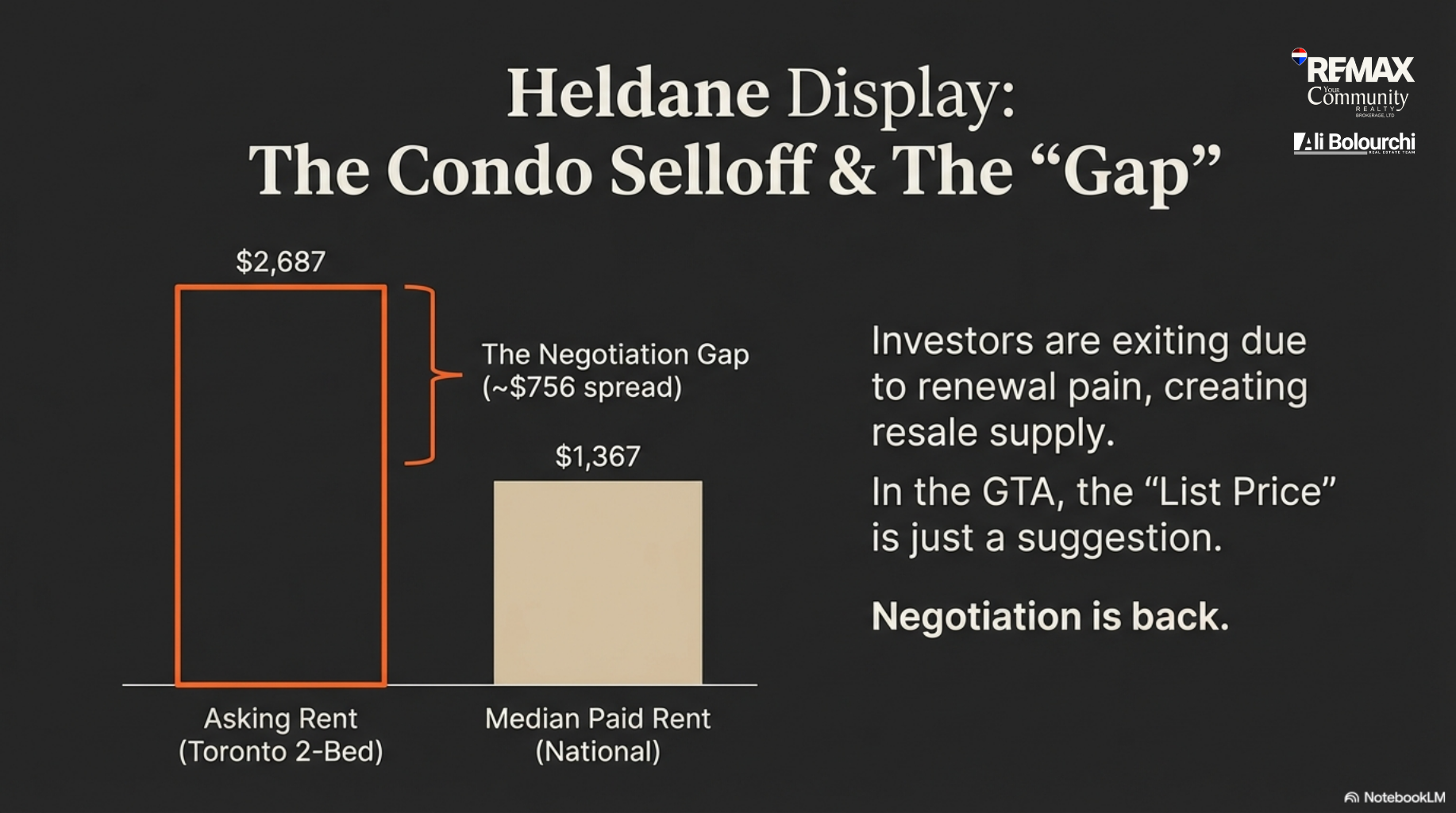

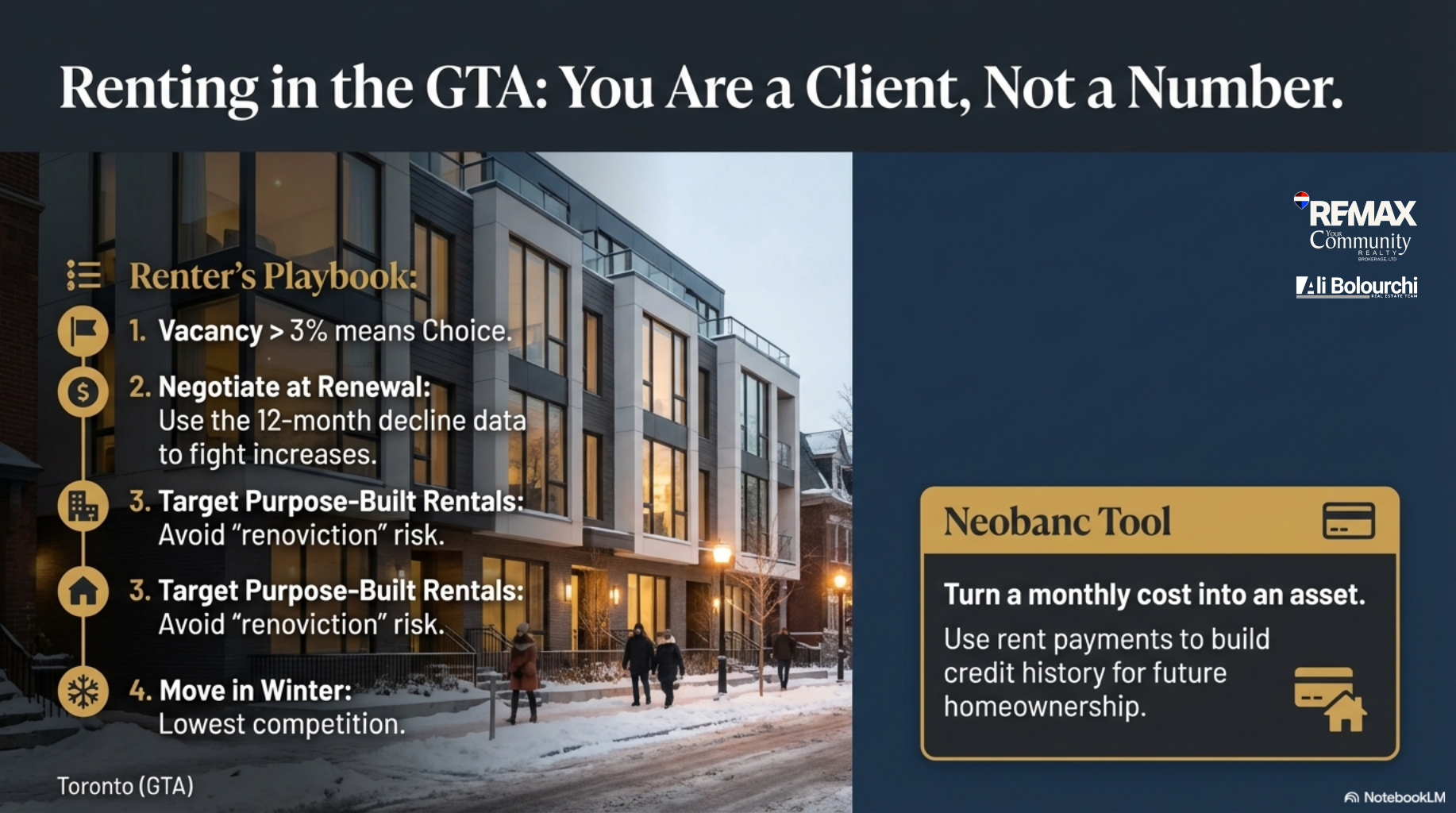

The Rental Correction: From Stress to Success

The power dynamic has officially flipped in the rental market. We are seeing a 12-month slide in prices, with vacancy rates hitting 3.1%—the highest in decades. This has created a massive "Negotiation Gap". With more supply available, you are no longer just "lucky to find a place"—you are a client who deserves a space that fits your lifestyle.

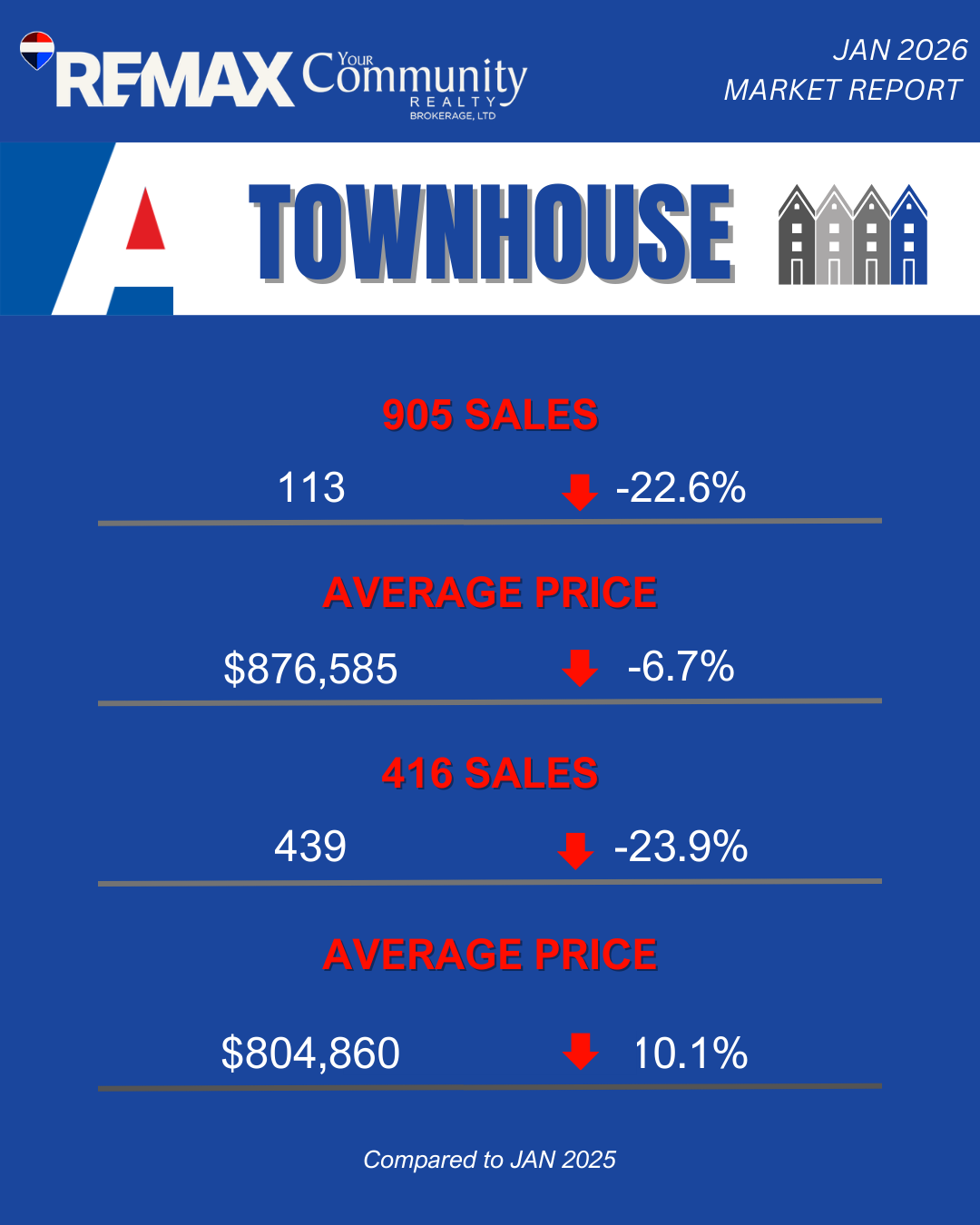

Finding Value in the Ring

As the "softening premium" of the Downtown Core continues, savvy buyers are looking toward "The Value Ring". Areas like Mississauga, Vaughan, and Scarborough are offering 15-25% savings, allowing you to find a larger sanctuary without sacrificing connectivity.

The Horizon: A New Normal

The era of the "quick flip" is paused. As we look toward 2027 and beyond, we expect a transition into a "New Normal" defined by slow, steady appreciation and modest growth. The 2026 CUSMA review remains the biggest variable, but it also acts as a "cap" that keeps the market from returning to a frantic state.

Your Strategic Path Forward

This is a market for the prepared.

Buyers: Target investor-owned units where sellers are motivated by renewal pain.

Renters: Negotiate aggressively and use tools to build your credit through your rent payments.

Everyone: Keep a close eye on monthly inflation reports—they are your new crystal ball.

Download Your 2026 Diligent Buyer’s Roadmap

To help you navigate these trade winds, I have curated a strategic checklist for the modern buyer. This document covers everything from finding the "Value Ring" to leveraging the current "Negotiation Gap."

Click Here to Download: 2026_Diligent_Buyer_Checklist