Uniting community impact in 2024 with REALTORS Care® Days

A new chapter for social impact will unfold for members of the Canadian Real Estate Association (CREA), as REALTORS Care® Days takes the stage in 2024. The initiative evolved from REALTORS Care® Week, a national volunteering initiative where for one week each year, together, REALTORS® contributed to organizations that serve some of the most vulnerable members of their communities.The new REALTORS Care® Days program is designed to offer greater flexibility and unite the volunteerism efforts of REALTORS®, with a dedicated focus on housing and shelter-related causes.Boards and associations across Canada can now register their spot for a REALTORS Care® Day, tailored to suit the unique needs of each community coast to coast.To celebrate the launch of this program, CREA hosted their inaugural REALTORS Care® Day on January 24. Members of CREA’s board of directors spent the day at Habitat for Humanity Greater Ottawa’s Kemptville Korners build site, where they tallied a combined 54 hours of volunteer work. Habitat for Humanity Greater Ottawa’s Kemptville Korners development consists of 15 affordable townhomes and stacked townhomes, including accessible, barrier-free units that 64 individuals, including over 30 children, will call home.Throughout the day, the REALTOR® volunteers helped get affordable housing units ready for families looking to lay their roots in the Ottawa region by completing several tasks, including strapping ceilings and preparing the homes for siding.“CREA’s board of directors was thrilled to help Habitat for Humanity Greater Ottawa get these affordable homes ready for 15 families,” shares CREA chair-elect, James Mabey. “Today was a very rewarding experience, and I encourage REALTORS® across the country to volunteer their time at a REALTORS Care® Day when they get the opportunity.”Each REALTORS Care® Day will offer a snapshot into how REALTORS® are giving back to local communities. As it was with REALTORS Care® Week events, CREA will highlight the volunteerism efforts at REALTORS Care® Days across Canada, but members can expect to now see these stories year-round.Previous REALTORS Care® Week initiatives have included painting affordable housing units, preparing care packages for those experiencing homelessness, bringing the holiday spirit to families seeking medical care far from home, distributing meals to community members in need, collecting essentials for shelter clients and raising much-needed funds, among others.To ensure a seamless transition, CREA’s REALTORS Care® team has set up program supports for boards and associations. This includes a bursary to alleviate REALTORS Care® Day-related expenses, a comprehensive guidebook for planning volunteering days and marketing assets to support sharing the experience and local impact stories with the broader REALTOR® community.While REALTORS Care® Days can happen any time of the year, to officially participate in the national program, boards and associations must register for their chosen day. For more information, please visit REALTORSCareDays.ca or contact REALTORSCare@crea.ca. Enjoying this article?Get the latest REM articles in your inbox 3x week so you stay up to date on the latest in the Canadian real estate industry Success! Email Subscribe The post Uniting community impact in 2024 with REALTORS Care® Days first appeared on REM.The post Uniting community impact in 2024 with REALTORS Care® Days appeared first on REM.

How International Buyers Shape Canada’s Property Scene

In the active urban centres of Toronto and Vancouver, the impact of international buyers on the housing market has been a topic of heated debate. The Canadian government’s recent foreign buyer ban, effective from January 1st, targets new purchases by non-Canadians, aiming to cool the red-hot housing market. Yet, with data on the ban’s effectiveness still pending, you’re poised to delve into the complexities of international investment and its true influence on Canada’s housing landscape.Impact of International Buyers on the Housing Market CanadaAs you explore the ramifications of international investment in Canada’s housing market, consider the weight of non-resident ownership. In Toronto, 2.6% of the housing stock fell under non-resident ownership as of 2021. The situation in Vancouver was even more pronounced, with 4.3% of homes owned by non-residents.While these percentages might seem small, the influence of international buyers is often felt most in the high-end property segment, skewing perceptions and potentially influencing market trends. Their presence has raised concerns about affordability and availability, particularly for local first-time buyers. To counter these effects, the government introduced a ban, targeting purchases made by non-Canadians from January 1, 2023, onward.Certain exceptions to the ban, including international students and individuals with temporary work permits who meet certain criteria, suggest the government’s approach is not absolute. Such nuanced measures aim to manage the market’s complexity without stifling equitable opportunities for internationals legitimately residing in Canada.Economic Implications of International BuyersThe influx of international buyers has been a double-edged sword for the housing market in Canada. Increase in Housing DemandInternational buyers have historically contributed to an upsurge in housing demand within Canada, particularly in major cities like Toronto and Vancouver. This demand often outpaces supply, leading to several significant ramifications:Intensified competition for propertyReduced housing stock for local residentsPressure on infrastructure due to increased densityIn the context of Toronto and Vancouver, a minority stake in property ownership is held by non-residents. Yet, their presence is felt strongly in the luxury housing market, skewing perceptions and creating ripple effects throughout the entire housing spectrum.Rise in Housing PricesThe entry of foreign capital into the real estate market has been closely associated with the escalation of housing prices. While it’s important to note that their actual market share varies, the psychological impact on pricing can be considerable.International buyers often set higher benchmarks for property pricesLuxury property segments feel the most pronounced impactThere is a potential cascading effect on mid and lower-tier property segmentsData reveals that in some areas, the introduction of the Foreign Buyers Tax (FBT) has been linked to reduced price inflation, yet experts argue that the critical long-term solution lies in increasing housing supply.Impact on Local EconomyThe role of international buyers extends beyond housing prices and into broader economic considerations. With the Foreign Buyer Ban, there has been a notable shift in the investment landscape. Here’s how it may unfold:Capital reallocation: The ban might divert foreign investments from residential real estate to other sectors like technology and manufacturingJob creation: As investments spread into diverse industries, new employment opportunities could ariseDomestic market benefits: Canadians might find fewer barriers to homeownership, potentially increasing local investment and stabilizing the housing marketSocial and Cultural ImplicationsChanges in Neighbourhood DynamicsWhen assessing the impact of international buyers on Canada’s housing market, it’s essential to consider how neighbourhood dynamics shift. Properties often bought as investments by non-residents can lead to increased vacancy rates, changing the fabric of communities. This transforms bustling streets into quieter enclaves, which can have mixed effects.On the one hand, vacant properties might result in reduced wear on local infrastructure. But the pitfalls are significant; fewer residents means less patronage for small businesses, potential for increased crime due to less community vigilance, and a general erosion of the neighbourhood’s vibrancy. Furthermore, cultural disconnection may arise when international buyers with no strong ties to the community invest in housing primarily for financial gain, rather than contributing to the area’s social and cultural tapestry.Housing Affordability for Local ResidentsThe surge of international capital into the Canadian real estate landscape has arguably been a double-edged sword for local residents. While some communities have experienced economic benefits from foreign investment, the escalation of housing prices has created significant barriers to entry for locals looking to purchase homes.Data has shown that the median price of homes has increased substantially in cities like Toronto and Vancouver, where international buying is prevalent. Here is a comparison of house price growth in these cities:YearMedian House Price in Toronto (CAD)Median House Price in Vancouver (CAD)2015630,858902,8012018785,2231,092,00020211,025,9251,225,000For locals, these price increments translate into a lesser chance of home ownership, especially for younger generations and first-time buyers. The dream of owning a home seems to drift further away as the market favours those with more substantial financial means. This condition fosters a divide, where the housing market is increasingly seen as an exclusive club, inaccessible to the average Canadian.The Role of Real Estate Agents in International Buyer TransactionsIf you’re navigating the Canadian housing market as an international buyer, real estate agents are your firsthand ambassadors. These professionals are pivotal in ensuring transactions are compliant with the latest policies, including stringent government regulations that mandate additional scrutiny.The Canadian Real Estate Association (CREA) has expressed its concerns regarding the complexities these policies introduce. Realtors are now entrenched in a process that requires them to verify the eligibility of buyers with greater diligence. As a result:You’ll be asked more probing questions.You’ll need to provide comprehensive documentation.Real estate agents are adapting to this new regulatory environment. They’re sharpening their knowledge to sidestep potential legal pitfalls that could arise from misinterpreting a client’s eligibility under the new rules.It’s no secret the Canadian housing landscape has witnessed a seismic shift. With the Foreign-Buyer Ban, even entities like REITs and private equity funds with more than 3% foreign ownership, are now considered foreign buyers if they invest in zoned residential or mixed-use areas. The implications extend to acquisitions related to residential property, including mortgages and leases.ConclusionStaying informed and adaptable about managing the complexities of international buyers in Canada’s housing market is key to navigating this dynamic landscape effectively. As regulations evolve, your expertise becomes even more crucial in guiding clients through these changes. Remember, the market’s constant flux demands vigilance and a keen understanding of both local and global trends to ensure success in your transactions.

Can first-time buyers save Canada’s real estate market?

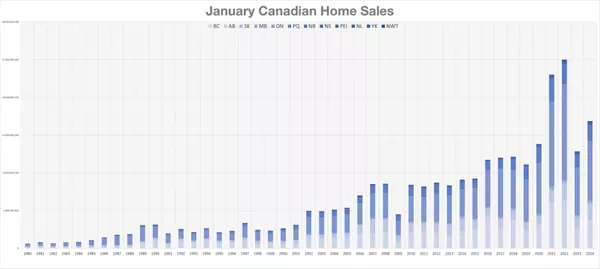

Is Canadian real estate in recovery mode yet? Only time will tell, but this year is off to a decent start for those hoping that is the case.Based on dollar volume (total value of all real estate sold), we just saw the third-strongest January on record. But, it’s still well behind the record-setting years of 2021 and 2022 — peaks we may never see again for many years: Source: realist.ca, CREA Recovery in sales but still under-average The Canadian Real Estate Association (CREA) reports a recovery in home sales in early 2024, following a weaker second half of 2023. January saw a 3.7 per cent increase in sales, continuing from December’s 7.9 per cent rise.Despite these gains, sales are still below the 10-year average by about 9 per cent. This is unsurprising as January sales are typically below the average, but they’re trending up pretty quickly toward it and could break the streak below the line this February. Market growth from waiting first-time buyers The market shows signs of tightening, with increases in competition among buyers being reported by professionals across the country. That being said, prices in rapidly recovering areas continue to trend lower based on CREA’s assessment, and this seems to be in line with what market anecdotes are telling us.Much of the growth is coming from first-time buyers who were sidelined during the frenzied market of the last few years. It would stand to reason that we’re seeing an uptick in price in more affordable markets:Yukon: + 3 per centNova Scotia: + 4 per centAlberta: + 5 per centNew Brunswick: + 5 per centPrince Edward Island: + 6 per cent Spring opportunities for sellers looking to upsize However, prices are falling by 4 per cent in Ontario, and prices did not grow at all in British Columbia, where affordability is some of the worst in Canada.Source: realist.ca, CREA This could create a good opportunity in the spring market for sellers looking to upsize upon mortgage renewal for a few reasons:1. The house they’re selling has clear excess demand from CMHC-insured first-time homebuyers.2. Demand for larger products has been muted by interest rates, meaning there is often less competition in the higher price ranges.3. They’ll be buying and selling in the same market, so their risk exposure to volatility or further upward or downward price movements is reduced by them selling to lock in prices. This means most upsizers feel they’re only risk-exposed to the difference in value between the asset they’re selling and the asset they’re buying.4. If they’re facing a mortgage renewal, they’ll be absorbing the increased capital cost regardless of their existing mortgage, so their consumer psychology tells them they’re functionally only paying the increased capital cost on the difference mentioned above in value, as well. This is generally how price-floor support and CMHC policy can push recovery through the market. As first-time home buyers purchase entry-level supply, existing owners sell and realize the excess demand in that market.These non-owners are now faced with the decision between a rental market growing at record rates, per CMHC’s most recent report, or entering a volatile and scary housing market. As we know from Bank of Canada statistics, close to half of all homebuyers are first-timers, which makes it clear why we’re seeing a volume resurrection in the lower end of the market. Enjoying this article?Get the latest REM articles in your inbox 3x week so you stay up to date on the latest in the Canadian real estate industry Success! Email Subscribe The post Can first-time buyers save Canada’s real estate market? first appeared on REM.The post Can first-time buyers save Canada’s real estate market? appeared first on REM.

Categories

Recent Posts