The elephant in the room is high taxes, fees and levies on housing

By all accounts, our housing supply and affordability crisis is getting worse. I feel sorry for the next generation. We are not following in the footsteps of our parents by leaving the world a better place.

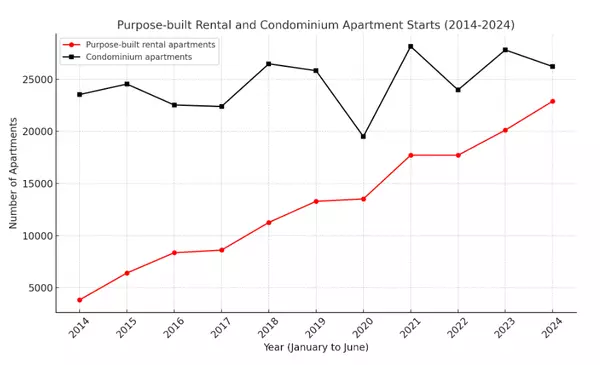

The recent housing metrics are not good. It appears the situation could get a lot worse over the next few years as housing starts have dropped considerably, especially in the condo market.

The cost of building, meanwhile, continues to rise. Taxes, fees and levies are out of control and building delays due to slow and antiquated approvals processes are adding to the cost of a home.

The housing targets set by governments appear to be in jeopardy. In Ontario, for example, 31 of the 50 municipalities did not meet the targets set by the provincial government in 2023. Presently, we’re on track to produce just half the 1.5 million homes that are needed in Ontario by 2031. According to the Financial Accountability Office, housing starts in the second quarter of this year declined by 24.5 per cent from where they were the same time in 2023.

To meet future growth, housing completions would have to rise from an average of 218,000 in the past three years to about 320,000 annually over the 2023-2030 period, says an RBC report. But we aren’t even close to that figure. Our all-time peak for completions was 257,000 in 1974.

Condo market has been hit

The high-rise condo market, in particular, is in bad shape in Toronto. Yes, there are cranes in the city but the projects were started years ago and will soon end.

What then?

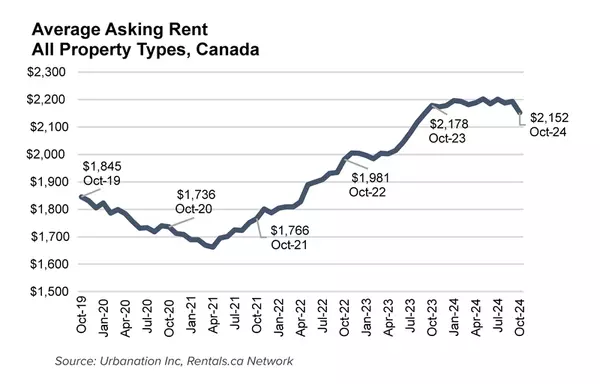

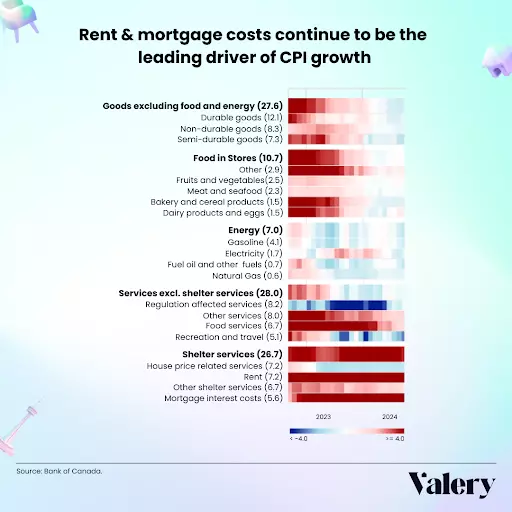

Rents, meanwhile, continue to rise as well. Rent inflation in Ontario reached 7.2 per cent in the second quarter of this year, the largest quarterly rental price inflation increase since 1983.

In the last six months, the population of Ontario has grown by nearly 200,000 but we started less than 38,000 homes. That’s a decline of more than 6,000 from the first half of 2023. A third of these starts are apartments, with the most common being one-bedroom or studio units.

Unfortunately, the housing situation is like a slow-moving train wreck. We have multiple conductors, disjointed announcements and no agreed-upon schedule. Ticket prices have exploded, the locomotive is barreling down the track and no one sees the approaching bridge is out.

While there is currently a glut of condo listings in Toronto, starts are now lower than the amount of condos that are needed to keep up with population growth. The supply will evaporate once interest rates decline.

Urbanation projects that in 2027, just 23,900 condos and purpose-built rentals are projected to be completed in the Greater Toronto and Hamilton Area – 10,000 fewer than 2024. And, the numbers are expected to continue to decline.

We must lower taxes on housing

Governments are scrambling around at the periphery without touching the elephant in the room, which is the 31 per cent in taxes, fees, and levies, combined with arguably the worst development approvals process.

The housing crisis will continue until we stop taxing housing at a higher rate than cannabis and gambling. The taxes are simply too high and brutally unfair.

For years, RESCON has consistently raised concerns about taxes on housing, as well as the moribund and antiquated development approvals process. We have called for taxes to be lowered and for the approvals process to be modernized and digitized. But that has not happened.

By failing to plan, we are planning to fail.

Governments have been running out various programs and policies, but they haven’t addressed the problem. The market is dysfunctional due to red tape and bureaucracy, excessive taxation, and a costly approvals process. Those that bear the burden are the new home buyers.

Lack of housing will have a disastrous economic impact.

In a recent LinkedIn post, Julie Di Lorenzo, president at Mirabella Development Corporation, noted there are 45 fewer cranes up today in Toronto than last year and, based on 2021 data and a calculation of 350 new condo units per crane, that would translate to 72,000 fewer jobs and $4.7 billion less in wages in construction and other industries that provide goods and services, $67 million less in annual property tax revenue and $2.7 billion less in one-time government revenue.

It will take a serious epiphany to fix the situation. Unfortunately, the clock is ticking.

Richard Lyall is president of the Residential Construction Council of Ontario (RESCON). He has represented the building industry in Ontario since 1991. Contact him at media@rescon.com.

Categories

Recent Posts

GET MORE INFORMATION