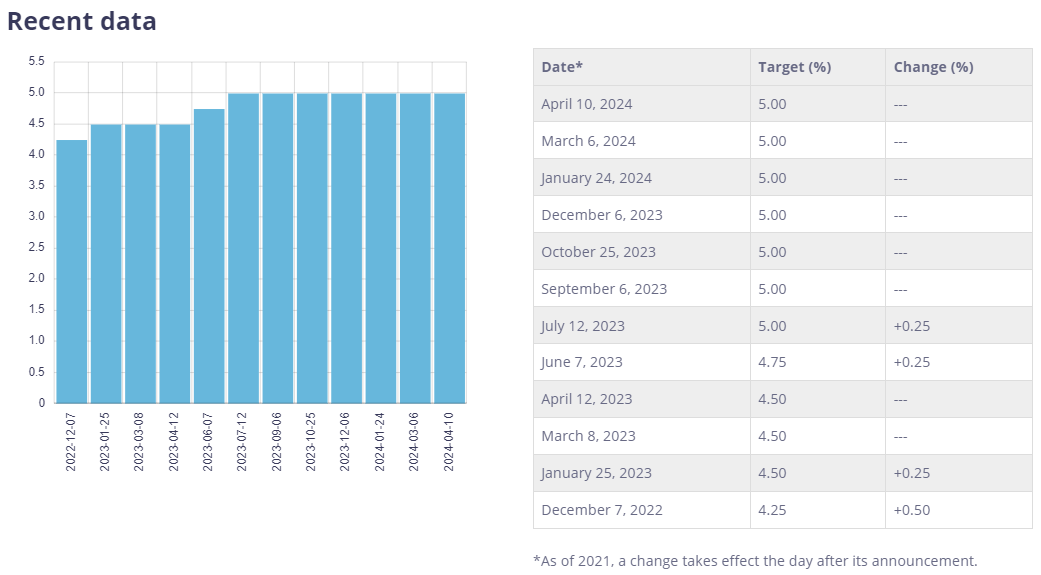

The Bank of Canada today held its target rate

Yesterday, the Bank of Canada announced that it will be maintaining its target rate for the overnight rate at 5%. This decision comes as no surprise, as the central bank aims to stabilize the economy amidst ongoing uncertainties in the mortgage and real estate market.

Navigating Through Steady Tides: Insights on the Bank of Canada's Recent Rate Stance

In a move that echoed through the corridors of finance and real estate markets, the Bank of Canada recently upheld its overnight rate target at 5%. This decision, largely anticipated by market analysts, underscores the central bank's strategic approach to fostering economic stability amid prevailing uncertainties that have notably impacted the mortgage and real estate sectors.

Maintaining the course with a 5¼% Bank Rate, the Bank of Canada has cast a reassuring signal to investors and property owners, reinforcing a semblance of equilibrium in these fluctuating times. This steadfast decision reflects a nuanced calibration by the Bank of Canada, meticulously balancing the multifaceted dynamics of the current economic landscape.

Unfurling the Sails Amidst Economic Flux

With the target for the overnight rate securely anchored at 5%, the latest policy announcement from the Bank of Canada resonates with a measured tone of resilience. Though the decision aligns with prevailing expectations, it harbors a nuanced hint of restraint from the anticipated more vigorous economic stimuli, considering the ongoing flux.

The Ripple Effects of a Constant Bank Rate

The unwavering stance on the Bank Rate at 5¼% emanates dual narratives. On one frontier, it embodies a sanctuary amid the tempestuous economic conditions, offering a beacon of stability for the market participants. Conversely, it raises contemplations about the potential inertia it could cast on the aspirations for a more robust economic resurgence.

The Mortgage Domain: A Calm Harbor Awaiting Winds of Change

Despite the tranquil façade, the mortgage landscape continues to be a domain of strategic advantage for numerous Canadians, buoyed by relatively tempered interest rates. Yet, the enduring demand for mortgages, coupled with an ascendant trajectory in homeownership rates, veils the undercurrents of concern prevailing among stakeholders about the foreseeable economic contours.

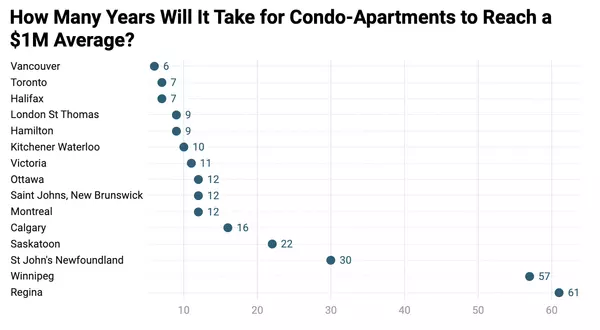

The Real Estate Vista: Steadfast Amidst the Economic Swells

The real estate sphere demonstrates resilience, buoyed by a robust demand catalyzed by demographic growth juxtaposed against a constrained housing inventory. This scenario, however, is punctuated by regional disparities, reminding us of the nuanced buoyancy across different market segments, with some areas possibly navigating through more challenging waters.

Advisory to Investors and Homebuyers

In this juncture, the Bank of Canada's decision to sustain the target rate serves as a prudent advisory to both investors and homebuyers to chart their course with caution. Amidst the horizons of hope, it is imperative to navigate with strategic foresight, preparing for any potential adversities that may arise.

As the rate remains steadfast at 5%, we are ushered into a phase where stability is cherished. It beckons us to delve into the opportunities it unveils, encouraging a forward-looking optimism, albeit with a grounded acknowledgment of the present-day challenges.

Categories

Recent Posts

GET MORE INFORMATION