Redefining the Canadian dream: The rise of co-ownership among young Canadians

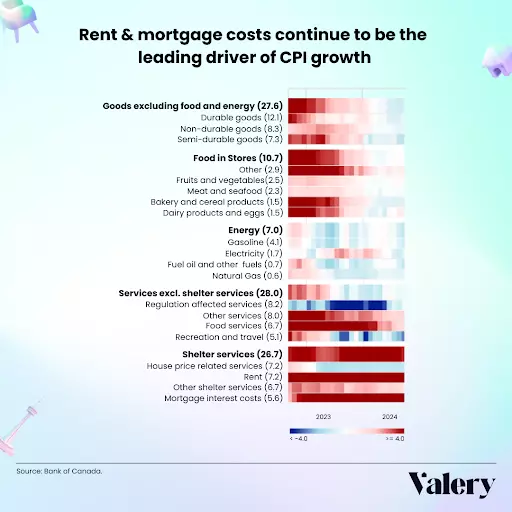

As real estate professionals, we’re well aware of the challenges facing today’s housing market, especially for younger buyers. Millennials and Gen Z are finding it increasingly difficult to break into the market due to soaring property prices, high interest rates and the ongoing cost of living crisis.

However, shared homeownership is emerging as a strategic solution, offering a creative pathway to homeownership that aligns perfectly with current market trends.

A shift in homeownership dreams

Homeownership has long been synonymous with stability, wealth and personal success — the quintessential Canadian dream. Yet, this dream seems increasingly out of reach for many younger Canadians.

A recent BMO survey highlights a significant generational shift, with 68 per cent of Canadians believing that buying a home is less attainable now than it was for their parents. This sentiment is even stronger among Gen Z and younger Millennials, who are navigating an unprecedented affordability crisis.

The financial landscape

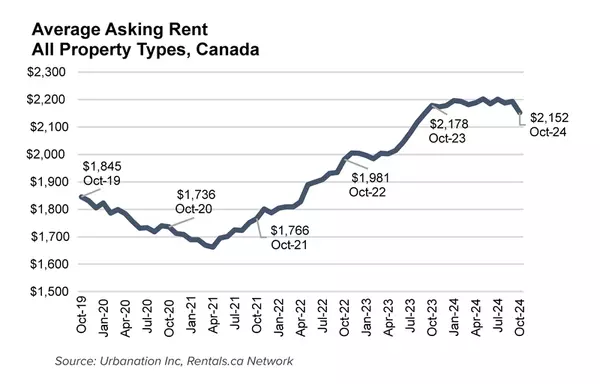

The National Bank of Canada reports that housing affordability has reached record lows, particularly in major urban centres. For example, in Vancouver, the cost of a home has surged to 14.5 times the median household income, while in Toronto it stands at 11.8 times and in Victoria, 10.7 times. Meanwhile, the cost of living has increased substantially, with rent prices in urban centres like Vancouver and Toronto averaging $2,500 to $3,000 per month for a two-bedroom apartment and exceeding $3,500 for single-family homes.

These financial pressures highlight the need for innovative solutions to make the dream of owning a home achievable for younger generations once again.

The co-ownership advantage

Shared homeownership offers many benefits that make it an attractive option for prospective buyers. By dividing the costs of a down payment, mortgage and maintenance fees, this approach makes it possible for individuals to enter the housing market sooner and with less financial impact. Sharing the financial responsibility reduces the risk for each co-owner, making the investment and monthly obligations more manageable.

A Royal LePage survey conducted by Leger reveals that six per cent of Canadian homeowners co-own their property with another party, not including their spouse or significant other, and that number is growing. According to a study by Compare the Market, 61 per cent of Canadian respondents expressed willingness to buy a home with friends or family to offset costs. The concept is simple: multiple parties jointly purchase a property, sharing the costs and benefits.

One approach to shared homeownership involves parents co-signing mortgages to help their children qualify for better financing, leveraging their financial stability for improved terms and interest rates. This has led to more multigenerational homes, where families either live together or parents provide a financial investment while living separately.

Another common structure is Tenancy in Common (TIC), allowing multiple parties to own undivided shares of a property. Each owner holds a specific percentage and has the right to use the entire property, making TIC ideal for friends or family members co-owning a home while maintaining individual ownership stakes.

A case study in modern shared homeownership

Consider the case of Liane Van Raalte, a Squamish, British Columbia-based realtor. She and her family invested in two presale units at Sokana, a Kerkhoff Develop-Build development in Penticton, B.C. Developments like this go beyond simply providing homes; they offer a lifestyle specifically designed for the new generation of homebuyers.

Increasingly, new developments are transforming the concept of co-ownership by including resort-style amenities that elevate the shared living experience. These features make shared ownership even more appealing by providing benefits that individual buyers might struggle to afford on their own.

Co-owners can enjoy state-of-the-art co-working spaces, fitness centers, rooftop pools and communal areas, enhancing their overall lifestyle. This approach shows that shared ownership not only makes homeownership more affordable but also enriches the living experience, making it a highly attractive option for today’s younger generation of buyers.

For Van Raalte, the decision to invest in Sokana was driven by the development’s unique offerings and blend of practical and luxurious amenities. “We wanted to invest in something with our children that they may potentially live in down the road while starting to build equity now, rather than wait until they are more settled in their lives,” she explains.

Key considerations for co-ownership

While shared homeownership offers many benefits, it requires careful planning and clear agreements to ensure a smooth experience. Here are some essential factors to consider when counselling clients on co-ownership options:

1. Legal agreements. Advise clients to draft a comprehensive co-ownership agreement. This document should clearly outline each party’s rights and obligations, detail financial contributions and include processes for dispute resolution and exit strategies. A well-drafted agreement is crucial for protecting all parties involved.

2. Financial contributions. Emphasize the importance of clearly defining each party’s financial responsibilities. This includes the initial down payment, mortgage payments, property taxes and ongoing maintenance costs. Clear financial delineation helps prevent misunderstandings and conflicts.

3. Responsibilities and maintenance. Encourage clients to establish a detailed plan for property upkeep and repairs. This ensures that the property is well-maintained and helps prevent disputes over maintenance responsibilities.

4. Exit strategies. Stress the necessity of a well-defined exit strategy. This should cover the process for selling a party’s share of the property, valuation methods and rights of first refusal for remaining co-owners. Having these details sorted in advance can prevent contentious separations.

5. Conflict resolution. Recommend including mediation or arbitration clauses in the co-ownership agreement. These can help resolve disputes amicably and avoid costly legal battles.

Understanding and promoting shared homeownership can help you better serve your clients, particularly Millennials and Gen Z. This model not only makes homeownership more accessible but also aligns with the evolving needs and financial realities of younger generations. By embracing innovative approaches like co-ownership, you can help turn the dream of homeownership into a reality for more Canadians.

Categories

Recent Posts

GET MORE INFORMATION