Mortgage Update: Mortgage growth ticks up

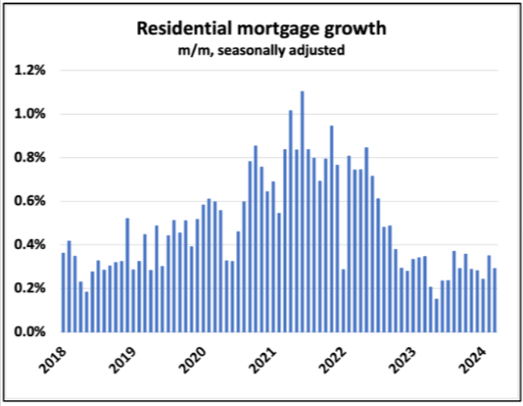

In March, residential mortgage debt in Canada increased by 0.3% compared to the previous month (when adjusted for seasonal variations). On a year-over-year basis, mortgage debt rose by 3.4%. This annual growth rate is the slowest Canada has seen since the year 2000.

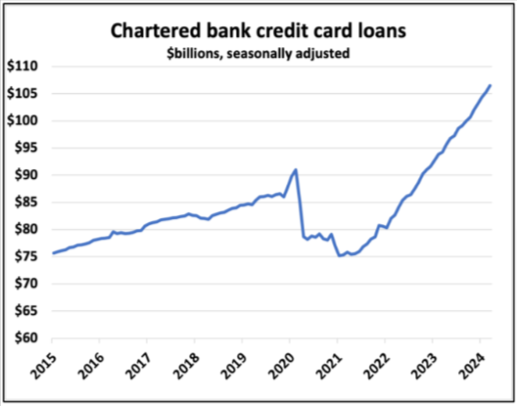

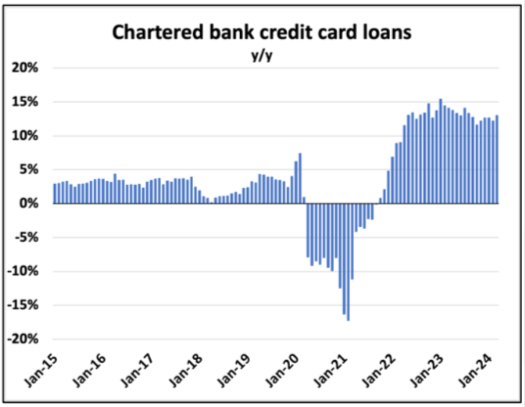

For non-mortgage consumer lending, there was a 0.4% rise in March. This increase was primarily driven by a significant 1.1% growth in credit card balances at chartered banks. Over the past year, credit card debt at these banks has surged by 13%.

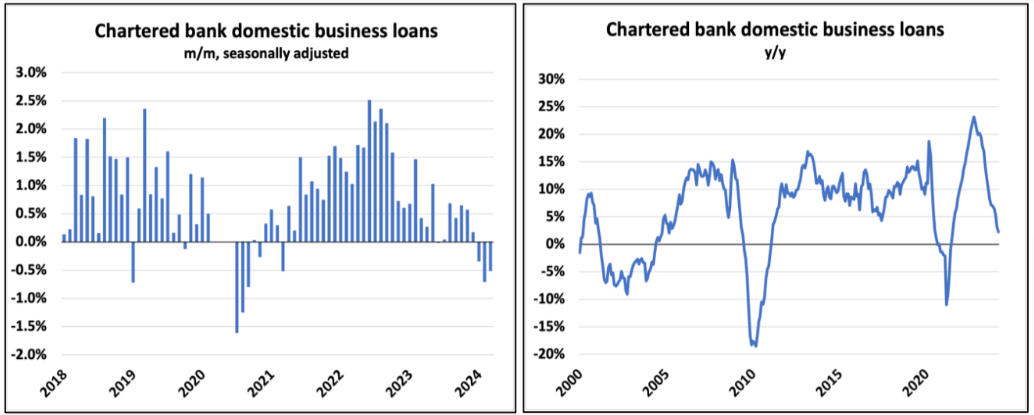

In March, domestic business lending by chartered banks in Canada declined for the third consecutive month. This marks a notable trend as the last similar three-month decline occurred during mid-2020. On a year-over-year basis, the growth rate of business loans has slowed to its lowest level outside of recessionary periods since the early 2000s.

Bank Updates

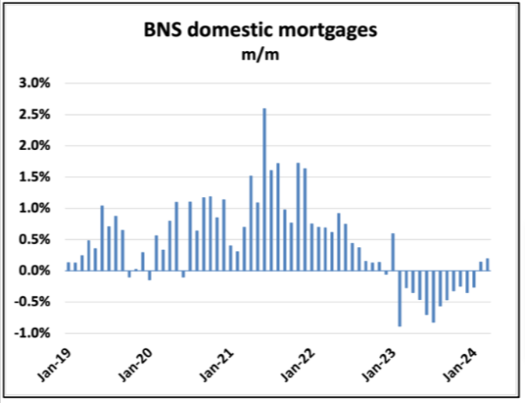

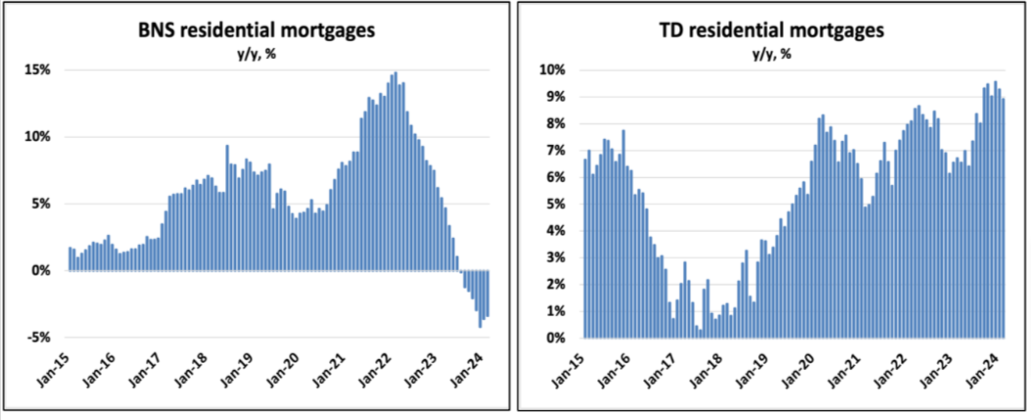

The Bank of Nova Scotia (BNS) has reported positive growth in its mortgage portfolio for the second month in a row as of March, following a year of consecutive declines. This uptick marks a significant turnaround for BNS, as its mortgage balances had been falling for the previous 12 months.

Despite this recent growth, BNS’s annual mortgage growth rate remains negative and is significantly lower than that of its competitor, Toronto-Dominion Bank (TD), which continues to enjoy a robust 9% annual growth rate.

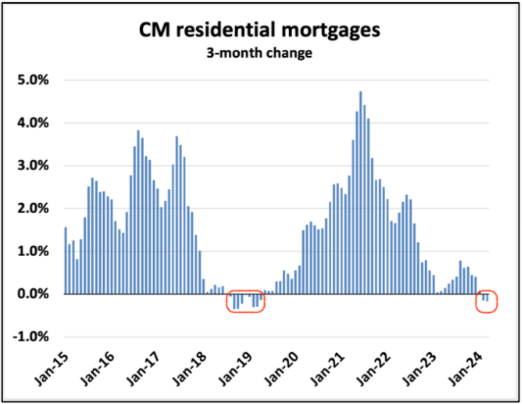

CIBC has been experiencing an ongoing shift. A year ago, CIBC was ordered by the banking regulator, the Office of the Superintendent of Financial Institutions (OSFI), to address significant lapses in its mortgage underwriting practices. This regulatory intervention came after a period of turbulence in CIBC’s mortgage business. From 2017 to 2019, CIBC transitioned from being a leading bank in adding new mortgages to falling behind its competitors. This decline coincided with heightened regulatory scrutiny from OSFI, particularly because mortgages comprised more than half of CIBC’s total loan portfolio, and because of its substantial involvement in high-value housing markets like Toronto and Vancouver.

In 2019, CIBC’s CEO, Victor Dodig, acknowledged that the bank had overreacted to the regulatory pressure by severely curtailing its mortgage growth. This overcorrection stifled its competitiveness in the mortgage market. The influence of OSFI’s scrutiny during 2018 and 2019 is now evident as it appears to have significantly constrained CIBC’s loan growth. Currently, CIBC is again experiencing a decline in mortgage balances, raising questions about whether this is a strategic reduction in response to current market conditions or if CIBC is once more under regulatory watch.

Non-Prime Lending Slowdown

In March, Equitable Bank (EQB) experienced a second consecutive monthly decline in its total residential mortgage loans. This trend is notable as it reflects a shift in their uninsured balances, which are considered their core non-prime product. For the first time since Q4 2020, these uninsured balances have been declining over a three-month period.

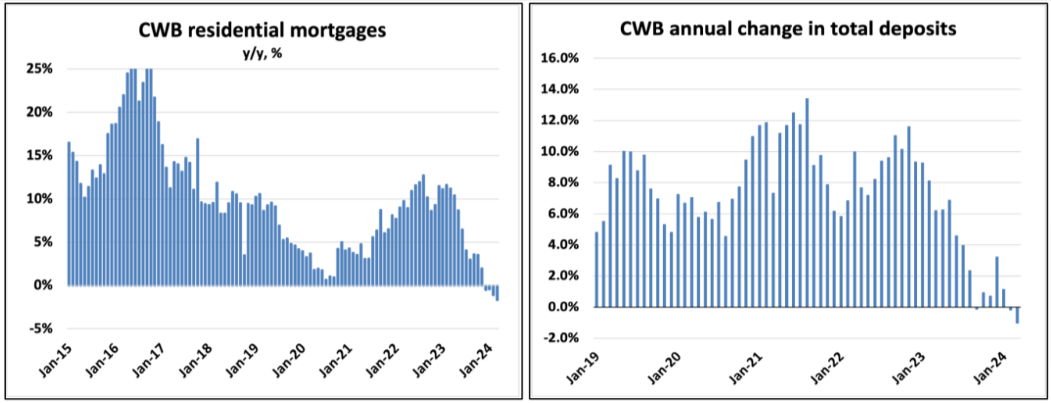

Similarly, Canadian Western Bank (CWB), which offers Optimum mortgages as part of its active non-prime strategy, is observing comparable trends. Residential loans at CWB are declining year-over-year for the first time on record. Additionally, there is now an annual decrease in CWB’s total deposits, marking a significant change in its financial dynamics.

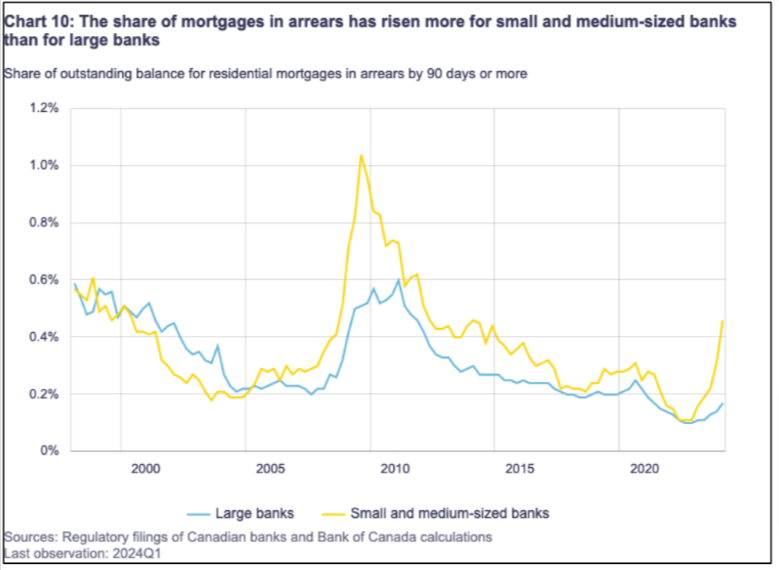

Mortgage Arrears and Small Lenders

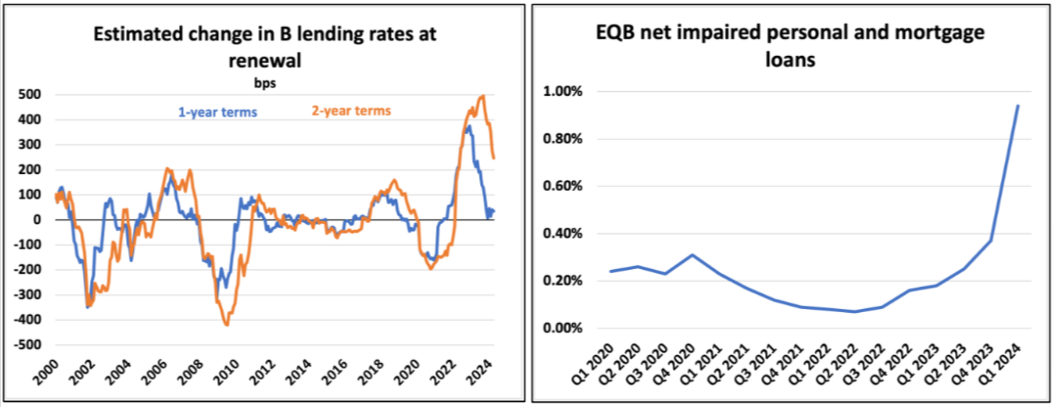

Mortgage arrears are experiencing a notable increase at small lenders, particularly those focused on non-prime lending in Canada. This trend is highlighted in recent data from the Bank of Canada’s Financial System Review, indicating a sharper rise in mortgage arrears in these lenders compared to larger financial institutions.

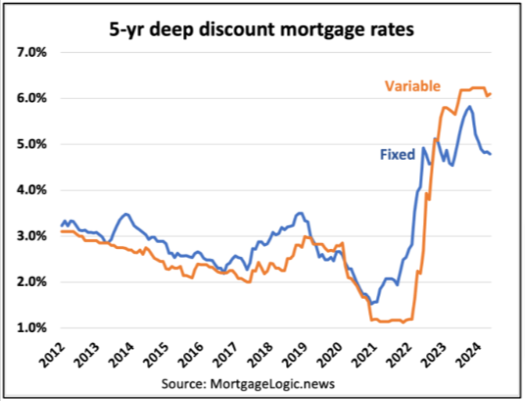

In Canada, almost all non-prime mortgages have short-term durations of 1 or 2 years. Equitable Bank exemplifies this with a weighted average loan term of 1.5 years for uninsured mortgages. Borrowers with 2-year non-prime terms facing renewal today are encountering an average increase of approximately 250 basis points (bps) in interest rates. Although this rate hike has eased from its peak, its cumulative impact on borrowers takes time to manifest.

Over the past year, there has been a significant increase in net impaired loans already, rising from 20 basis points (bps) to 90 bps. This is a notable trend, and there is a concern that this upward trend may extend to prime lenders in the future.

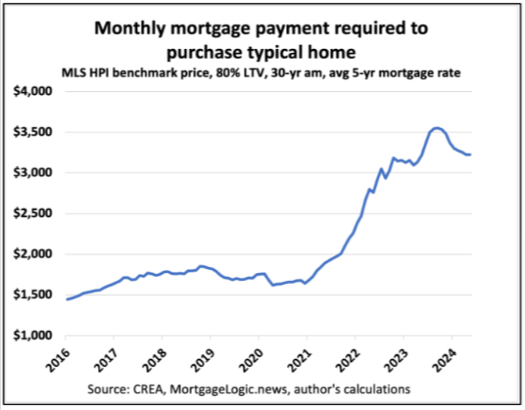

Falling Mortgage Rates

Recent data shows a decrease in mortgage rates last week, particularly notable in deep discounted 5-year fixed rates, which dropped by 5 basis points (bps). As a result, using these updated rates and assuming stable housing prices in May, the monthly mortgage payment required to purchase a typical home has declined to $3,225. This figure represents a $330 decrease from the peak observed in September 2023, but remains double the amount compared to 2021.

Categories

Recent Posts

GET MORE INFORMATION