Making Your Money Work Harder with Private Mortgages

Real estate is well-known for being a solid choice for investment and diversification, but many investors overlook a major related investment opportunity, which offers lucrative returns and a true passive income. Private mortgages offer an attractive investment opportunity for people looking for steady cash flow and passive income, backed by real property, offering a tangible asset to support your investment.

Chad Robinson, president of Align Mortgage Corporation, emphasises, “You don’t need to limit your investment options to stocks or the responsibilities of property ownership to build wealth. Consider real estate private mortgage lending as a smart and stable strategy. It offers a straightforward path to growing your wealth with less volatility of the stock market or the complexities of property management.”

Varied Types of Private Mortgages for Flexibility

Private mortgages come in various forms, tailored to different risk levels and investment goals. One common way is through direct lending, where investors give mortgages to borrowers, backed by real estate. This allows investors to have a lot of control over their investments, negotiate good terms, and carefully assess borrower risk. Another option is mortgage funds or pools, which gather money from many investors to fund a mix of mortgages. These funds offer diversification, professional management, and exposure to a broader market. It is important to note that pooled investments generally require investing through an exempt market dealer or other financial professional and are not appropriate for all investors.

Steady Income and Higher Rates

Private mortgages are attractive because they can provide steady, passive income while securing your initial investment with solid real estate. Unlike the ups and downs of other investments or the work involved in managing rental properties, private mortgages offer a reliable income from fixed interest payments. This steady income, along with the potential gradual repayment of the loan, helps investors build wealth over time.

According to Chad Robinson, president of Align Mortgage Corporation, “Private mortgages can generate between 8% to12% annually. These higher rates make up for the potential added risk. What’s more, depending on factors like risk level, investor experience, loan structure, and the length of the loan, you could see returns of up to 15% annually. It is important to note higher returns generally signify higher risk.”

Capitalize on Lending Gaps

Private mortgages offer a chance for investors to benefit from weaknesses in the traditional lending system. Regular lenders usually have strict rules and complicated procedures, which means many good borrowers don’t get the loans they need. With tightening requirements for traditional lending situations, more potential borrowers than ever are seeking alternative financing to purchase homes or take advantage of other opportunities.

By stepping in to fill this gap, private mortgage investors can benefit from higher interest rates and fees, thereby enhancing the yield on their investments. Moreover, securing these loans with tangible assets like real estate adds an extra level of safety, reducing the chance of default and the risk of losing money.

Advantages Over Real Estate Investments

Compared to traditional real estate ventures like rental properties, private mortgages offer several distinct advantages that appeal to passive income seekers.

Liquidity and Flexibility

Private mortgages may provide better liquidity and flexibility than owning actual properties. Unlike real estate, which can be hard to sell quickly, private mortgages have shorter terms; typically 1 year. This flexibility allows investors to adjust their portfolios and take advantage of new opportunities without dealing with the complexities of property transactions. It is important to plan that not all borrowers are able to exit or refinance on time, renewals/extensions sometimes happen.

They can be tailored to suit specific risk profiles and investment objectives, allowing investors to optimize their returns while preserving capital. Because these private mortgages do follow the same underwriting rules as large lenders, there is greater flexibility for both investors and borrowers, with interest rates typically reflecting the level of risk involved.

Offering Truly Passive Income

Many individuals are drawn to real estate investments for their perceived passive nature. However, the reality of property ownership often entails significant time, effort, and ongoing management responsibilities.

While rentals and other real estate investments are often touted as passive income streams, the truth is far from it. Managing rental properties in fact involves many tasks, including finding suitable properties, negotiating purchases, overseeing renovations or upgrades for flipping purposes, and carefully timing market conditions to maximize profits upon selling. Moreover, the day-to-day management of rental properties entails ongoing responsibilities such as tenant communication, property maintenance, rent collection, and addressing tenant issues or disputes. These tasks can be time-consuming and demanding, requiring a considerable investment of both time and energy.

On the other hand, private mortgages entail minimal operational involvement, sparing investors from the day-to-day responsibilities of property management and tenant relations. Investors do not have to be hands-on and physically nearby and available to deal with concerns, or pay management fees for professionals to handle these tasks for them, which cuts into the profitability of the investment.

Mortgage investment fund companies will handle underwriting, servicing, and administration of mortgage loans, allowing investors to pool funds for investment and participate with a minimum-effort process.

Risks and Challenges in Rental Property Investments

While investing in private mortgages obviously includes risks, as all investments do, they can be mitigated. In private mortgage lending, risks can be minimized by thoroughly assessing borrowers’ ability to repay, securing loans with tangible assets like real estate, and adjusting interest rates to compensate for risk. Diversifying investments across multiple borrowers and properties spreads risk, while ongoing monitoring and proactive management help address potential issues early on.

In addition to the operational demands, rental property investments also carry inherent risks. Tenancy loss, for example, can result in periods of vacancy, leading to a loss of rental income and potential financial strain. Furthermore, the quality of tenants can significantly impact the profitability and stability of rental investments. Dealing with non-payment of rent, property damage, or eviction proceedings can be arduous and costly for landlords.

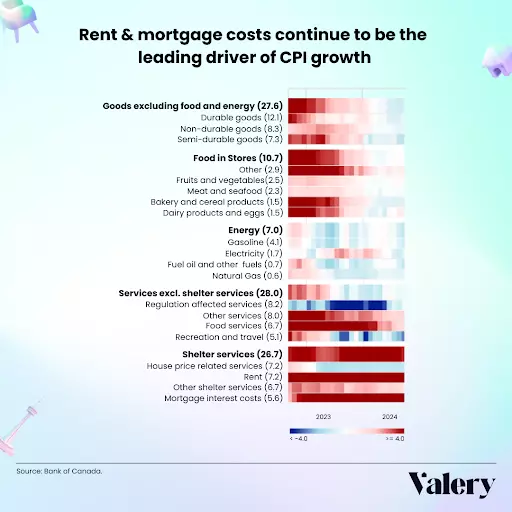

Increasing Regulatory Restrictions on Rentals

Moreover, the regulatory landscape surrounding rental properties is subject to change, with increasing restrictions on short-term rentals posing challenges for investors. Various municipalities and provinces have started to ban short-term rentals, while the Canadian government has announced it will deny deducting expenses for short-term rentals in these regions. Additionally, underused housing taxes, anti-flipping rules, and other efforts have made it increasingly difficult to generate profits in certain rental markets.

Private Mortgage Investor Profile

With private mortgage investment company funds, where investors pool resources to offer mortgages, an individual does not need to have a high net worth to participate, so more people are able to invest.

Private mortgage investing is well-suited for investors seeking stable fixed-income assets with a potential for higher yields than traditional securities. Private mortgage funds can be structured to accommodate varying levels of capital and risk tolerance, making them suitable for both conservative and more aggressive investors.

The Growth of Private Mortgage Investments

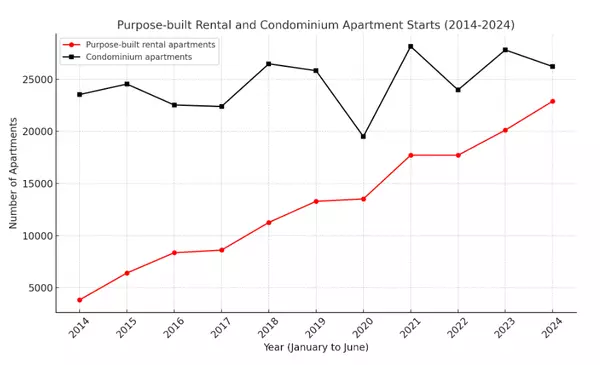

Private mortgages are a rapidly growing sector of lending, according to the CMHC, and for good reason.

Beyond passive income generation, private mortgage investments offer many benefits that contribute to their appeal. Investors have the flexibility to tailor their investment strategies to align with their risk tolerance and financial objectives, whether seeking stable income, capital appreciation, or portfolio diversification.

Despite inherent risks, Mortgage Investment Entities (MIEs) typically do well because of their link to the Canadian real estate market, offering flexibility, higher yields, and diversification. Private mortgages offer predictable cash flows and lower volatility than stocks, appealing to investors seeking stability. Additionally, they can act as a hedge against economic fluctuations, deriving value from collateral rather than external market forces. This low correlation enhances portfolio resilience, especially during financial market volatility.

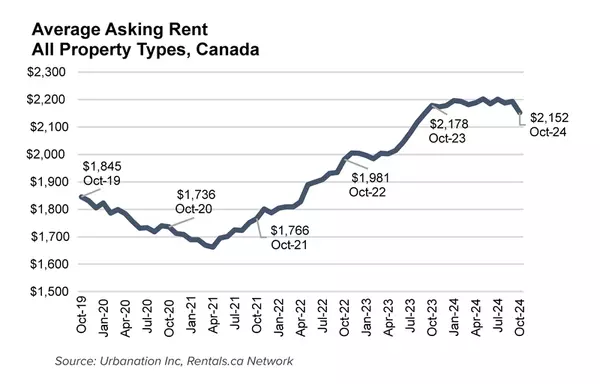

Chad Robinson comments, “The need for alternative lending is increasing rapidly. Soaring rents are pushing people towards home ownership if at all possible. Many people don’t fit the requirements for traditional mortgages, so there’s a growing demand for private mortgages to get off the rental treadmill.”

Those who are self-employed, bruised credit, and others, can have difficulties getting financing. Private mortgages offer a needed opportunity to these individuals to enable their homeownership aspirations or other goals. In this way, investors can play a vital role in expanding access to housing and fostering economic health.

Interested investors can learn more about generating passive income from Chad Robinson’s book, Becoming the Bank.

Government of Canada – Canada’s Housing Action Plan

Government of Canada – Underused Housing Tax

Government of Canada – Residential Property Flipping Rule

OSFI – Minimum qualifying rate for uninsured mortgages

Disclaimer:

- Trust Units are available to qualified investors on a private placement basis only via Offering Memorandum . The statements contained herein are qualified in their entirety by the Offering Memorandum. The foregoing does not constitute an offer to sell or a solicitation of interest to purchase any securities in any jurisdiction in which such offer or solicitation is not authorized. For more information on investment visit www.atlasone.ca

- All mortgage investments carry a risk. There is a relationship between risk and return. In general, the higher the rate of return, the higher the risk of the investment. You should very carefully assess the risk of the mortgage transaction described and if applicable and in the supporting documentation before making a commitment.

- Private Mortgages are regulated in Canada. Ensure you are working with licensed individuals in your province.

Categories

Recent Posts

GET MORE INFORMATION