Investing in Pre-Construction vs. Multi-Family Investments: Which Strategy is Right for You?

When considering real estate investments, it’s crucial to compare different property types to determine which strategy aligns best with your goals and risk tolerance. Two popular niches in the Canadian market are pre-construction and multi-family property investments, as they each offer unique advantages. It’s important to be aware of all of the considerations involved with these two investments and assess your personal situation and goals, in order to make an informed decision on which strategy is right for you.

Pre-Construction Investments

Pre-construction investments involve purchasing properties before they are built or completed, offering several benefits.

Early investors can acquire properties at lower prices compared to completed units. This can lead to substantial returns as property values increase over time, especially in developing areas. Investors may also have the opportunity to choose finishes, layouts, and other aspects of the property. Customization can add value and appeal, tailoring the property to market demands and preferences.

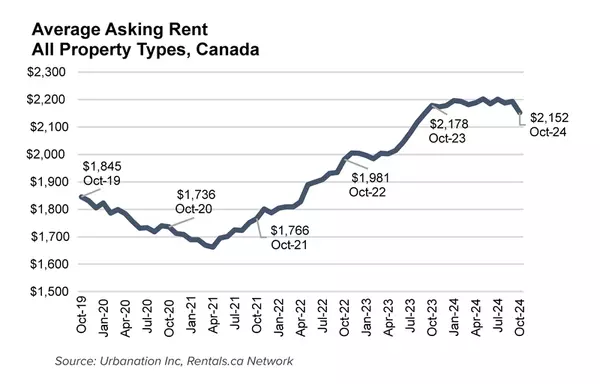

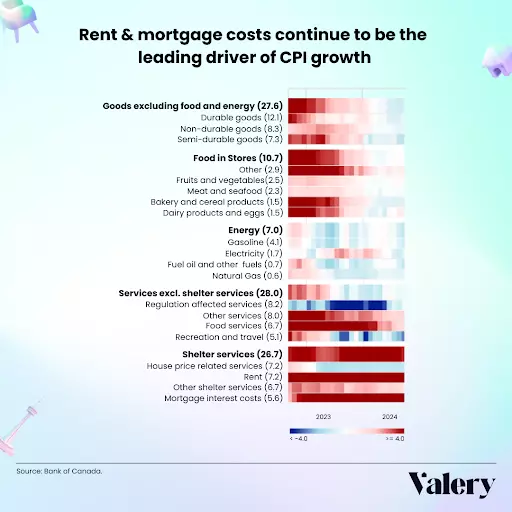

However, pre-construction investments also come with risks. Construction issues, permitting challenges, or market condition changes can delay projects, which can impact the anticipated return on investment. Additionally, the property’s value can fluctuate during the construction period. Investors need to carefully assess current market trends and potential risks before committing to a pre-construction investment.

Multi-Family Investments

Multi-family investments, or properties with multiple rental units, such as duplexes, triplexes, or apartment complexes provide their own, distinct advantages, too.

With multiple tenants, investors benefit from more stable revenue streams. If you have a vacancy in one unit, it doesn’t have such a major impact on your overall income, as you still have several other tenants. This reduces your financial risk. Investors can expand and diversify their portfolios by acquiring additional units as they are able, enhancing overall cash flow and investment potential.

However, multi-family properties require effective property management. Handling tenant relations, maintenance, and operational tasks can be demanding. Investors should be prepared for these responsibilities or consider partnering with professional property management firms. The initial cost for multi-family properties tend to be higher due to the larger scale and associated costs. Investors need to carefully and honestly assess their financial capacity and investment goals to determine if this strategy aligns with their objectives.

Comparison of Strategies

When deciding between pre-construction and multi-family investments, consider a variety of factors.

Investment Goals and Risk Tolerance

For those seeking lower entry costs and potential appreciation, pre-construction investments may be suitable. These are ideal for investors who can wait for project completion and are comfortable with market fluctuations. On the other hand, multi-family investments are better for those looking for immediate rental income and stable cash flow. They provide a steady income stream and reduce the impact of vacancies, making them suitable for investors with a lower risk tolerance.

Market Conditions

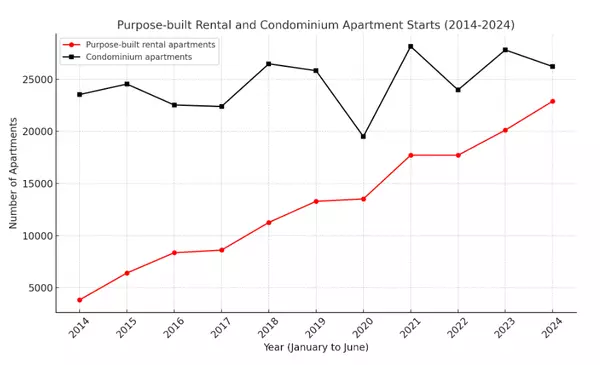

Pre-construction investments are best in markets with strong growth potential and high demand for new developments. Multi-family investments work well in stable or growing rental markets with steady demand for rental properties.

Final Decisions

To make the best investment decision, evaluate your goals, risk tolerance, market conditions, and investment horizon. Understand the advantages and challenges of each strategy, and how they fit with your situation, to ensure you align your investments with your objectives.

As always, conduct thorough market research and analyze comprehensive data and reports to gauge future demand and appreciation potential.

In conclusion, choosing between pre-construction and multi-family investments requires careful consideration of your financial capacity, investment goals, and market conditions. By staying informed and evaluating all factors, you can make investment decisions that align with your long-term objectives and risk tolerance.

Categories

Recent Posts

GET MORE INFORMATION