Canadian housing market shows signs of revival in June following interest rate cut

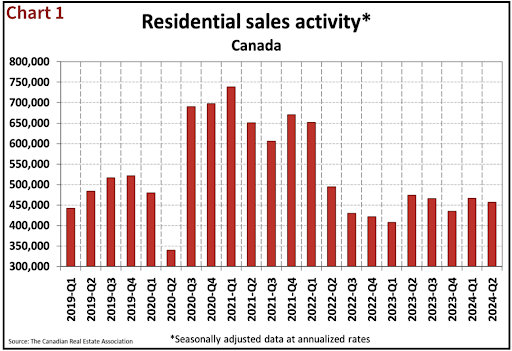

Canada’s housing market finds itself, as of June, poised for a comeback after a challenging year. The trigger? A strategic interest rate cut by the Bank of Canada, leading to a 3.7 per cent rise in national home sales compared to May. After months of declining activity, the market is showing signs of life, but the road ahead is filled with uncertainties and hardship for both industry professionals and buyers and sellers alike.

But will this interest rate cut be enough? Is it the start of a cutting cycle? Will it get worse before it gets better? We look into the story behind the numbers, examining how economic policy, consumer sentiment and regional differences are shaping the recovery of Canada’s real estate landscape.

Dialed back expectations around interest rate cuts — cuts that would draw in buyers

Since the last forecast in April, expectations surrounding interest rate cuts this year have been dialed back as the market has seen an influx of properties with many sellers listing their homes in the spring. However, buyer activity and consumer sentiment have remained low.

It’s anticipated that gradually lowering interest rates will eventually draw buyers back into the market. Nonetheless, the sluggish spring market and increasing supply levels have led to a downward revision in sales and average home price projections.

26% more listings than last June but below historical average

In 2024, approximately 472,395 residential properties are expected to be sold, marking a 6.1 per cent increase from 2023, whereas the total average home price is projected to rise by 2.5 per cent to $694,393.

Looking ahead to 2025, home sales are forecasted to increase by 6.2 per cent to 501,902 units, supported by continued declines in interest rates and returning demand. The national average home price is anticipated to climb by 5 per cent to $729,319.

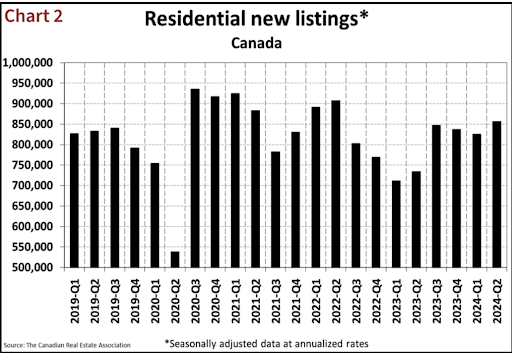

But what really happened is by the end of June, there were about 180,000 properties listed for sale, which is a 26 per cent improvement from the previous year but remains below the historical average of approximately 200,000 sales by this month.

Possible slowdown in inventory buildup, approaching balanced market conditions

The number of new listings increased modestly by 1.5 per cent month-over-month, while the MLS Home Price Index (HPI) edged up by 0.1 per cent from May 2024. Despite these slight gains, the HPI was down 3.4 per cent year-over-year, and the national average sale price decreased by 1.6 per cent compared to June 2023.

The end-of-June supply of properties was up by 26 per cent from the previous year but remained below the historical average, suggesting a possible slowdown in inventory buildup. The national sales-to-new listings ratio improved to 53.9 per cent in June from 52.8 per cent in May, approaching the long-term average of 55 per cent and indicative of balanced market conditions.

Housing prices fluctuating

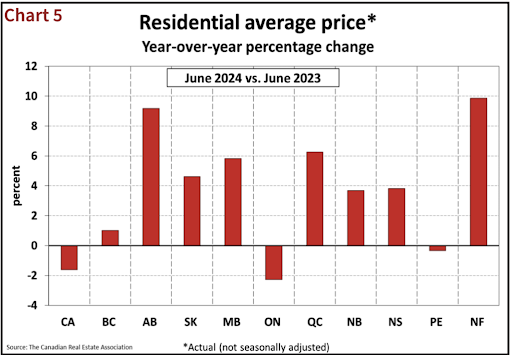

Regionally, housing prices continue to fluctuate. Calgary, Edmonton, Saskatoon, Montreal and Quebec City’s prices have been on an upward trajectory since early last year, while Ontario and Nova Scotia have also seen recent price increases starting late last year.

However, the non-seasonally adjusted National Composite MLS HPI remains 3.4 per cent below June 2023 levels, reflecting the sharp price increases that occurred in the spring and early summer of 2023. The national average home price in June was $696,179, down 1.6 per cent from the same month the previous year.

Our takeaways: the story of Canada’s housing market in June 2024 is one of cautious optimism and evolving dynamics. The early signs of revival triggered by the Bank of Canada’s interest rate strategy have laid the groundwork for continued cuts and expected (hopeful) growth in the coming years.

With a projected 6.1 per cent increase in property sales this year and continued growth into 2025, there’s a sense of nervous anticipation as buyers’ and sellers’ expectations have more ground to cover. However, the story is far from over.

The market’s future depends on overcoming challenges like rebuilding buyer confidence and managing the complex relationship of supply and demand. Looking ahead, the ongoing story of Canada’s housing market promises a mix of resilience, adaptation and hopeful progression.

Categories

Recent Posts

GET MORE INFORMATION