Canada's Bold Mortgage Reforms: Unlocking Homeownership

In an unprecedented move, the Canadian government has announced major mortgage reforms to help Canadians achieve homeownership. The reforms, effective December 2024, aim to ease financial burdens and increase accessibility to homes.

Key Reforms:

- Increased Insured Mortgage Cap: Raised from $1M to $1.5M, enabling more buyers to qualify for insured mortgages in high-priced markets.

- Extended 30-Year Amortizations: Available for first-time buyers and new builds, reducing monthly mortgage payments.

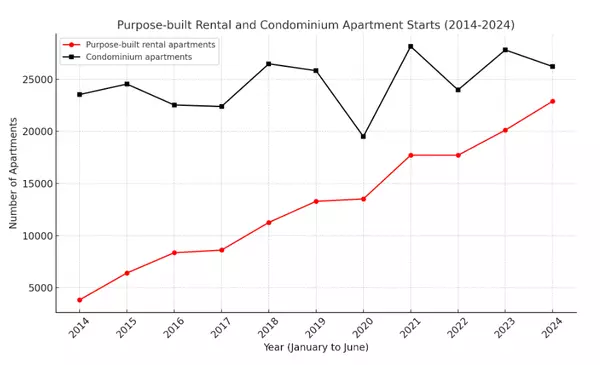

- Focus on Boosting Housing Supply: By encouraging construction and home development.

Benefits:

- Affordability for First-Time Buyers: Lower monthly payments will ease financial pressure, especially in urban centers like Toronto and Vancouver, where housing prices have soared. This is a big win for younger Canadians who have been priced out of the market due to high monthly mortgage obligations under shorter amortizations.

- Stimulating Housing Supply: Expanding the availability of insured mortgages for new builds encourages developers to create more housing, addressing Canada's current housing shortage.

Drawbacks:

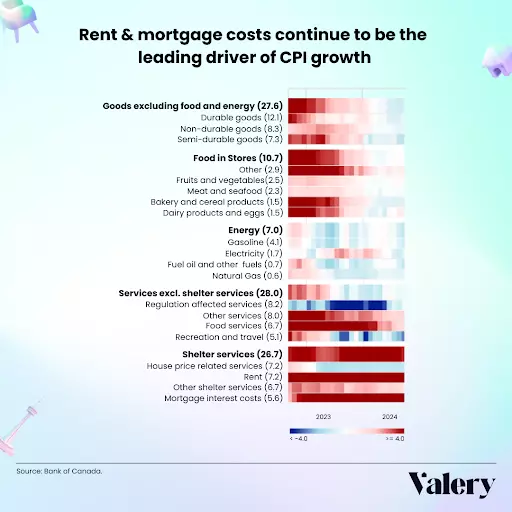

- Risk of Housing Price Inflation: Easier access to larger loans may push housing prices even higher, making homes less affordable for those still struggling to enter the market.

- Long-Term Financial Burden: While monthly payments will be lower, extending the mortgage to 30 years means buyers will pay significantly more in interest over the life of the loan, potentially increasing the overall cost of homeownership.

- Debt Load Risks: Buyers may be tempted to take on larger mortgages than they can afford, particularly if interest rates rise during the term of the mortgage, putting them at risk of financial instability.

What This Means for Canadian Buyers

For first-time buyers and young families, these reforms present a unique opportunity to enter the housing market. However, prospective homeowners should weigh the potential long-term costs of lower monthly payments against the increased lifetime interest burden.

Conclusion: The Canadian government’s bold mortgage reforms have the potential to reshape the real estate market, making homeownership more accessible for many Canadians. However, both the short-term gains and long-term financial impacts should be considered when making homeownership decisions.

For more information, visit: Government Mortgage Reforms.

Categories

Recent Posts

GET MORE INFORMATION