1. Introduction: Turning Toronto Homeownership Dreams into Reality

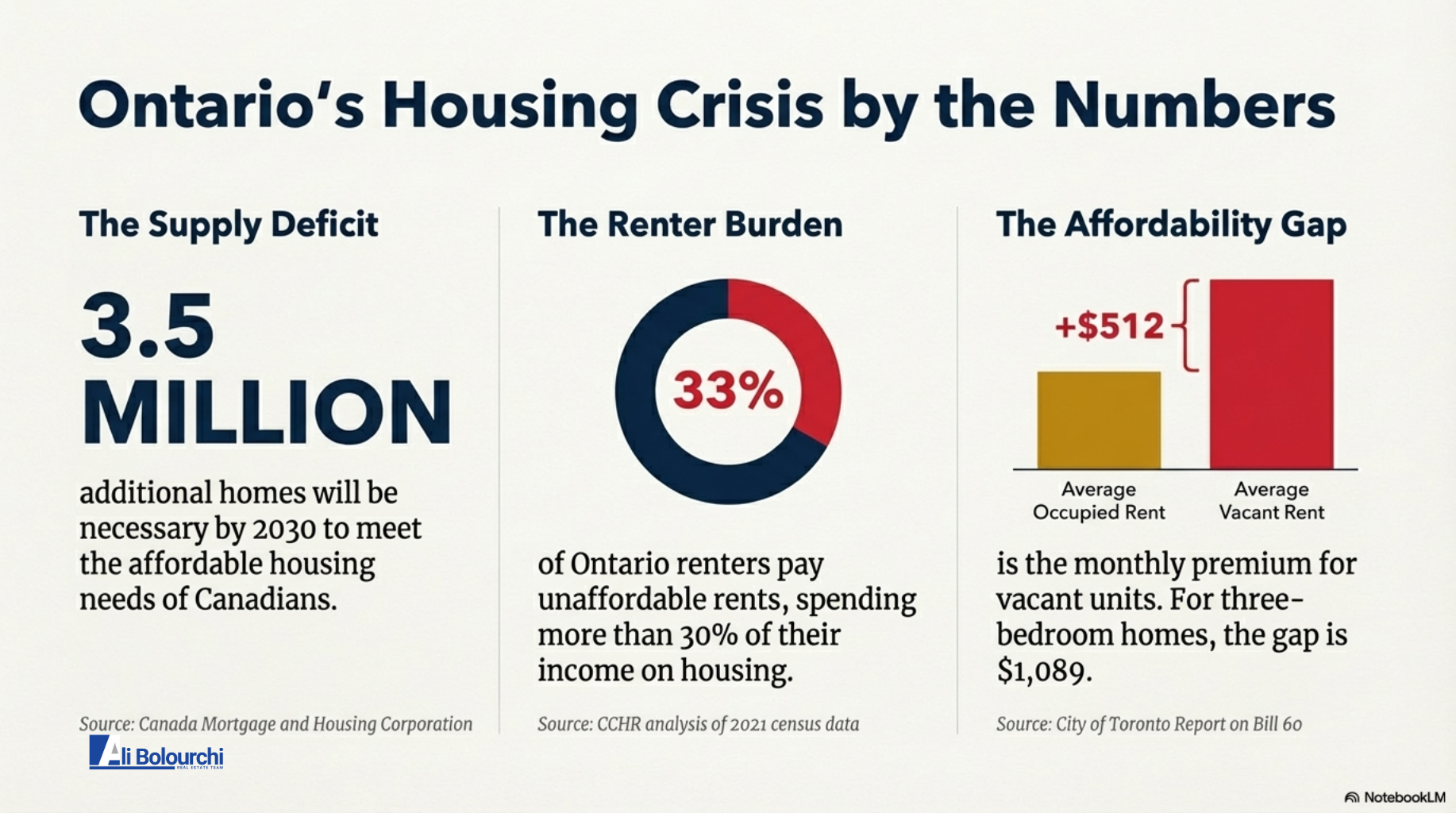

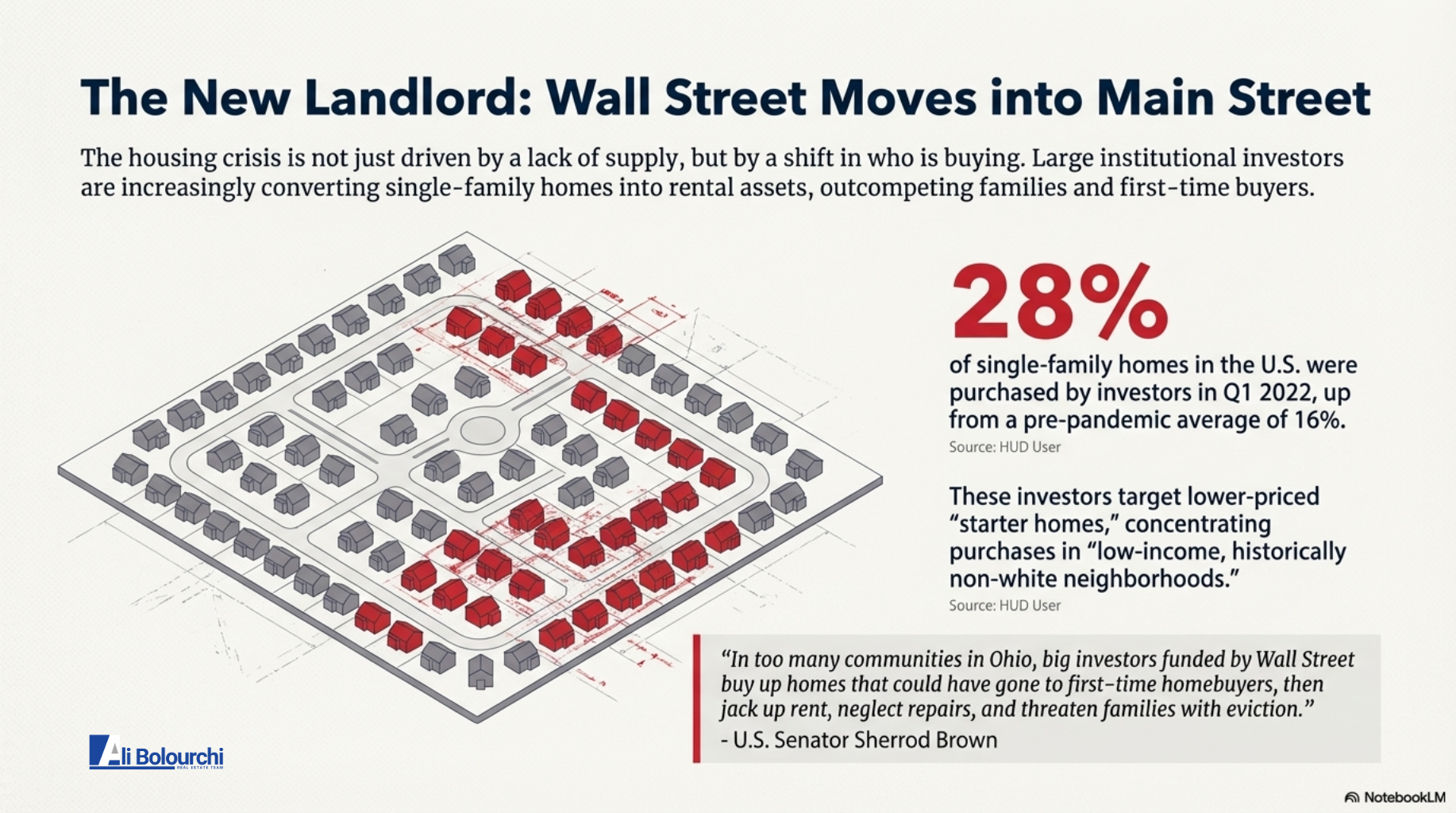

For many aspiring first-time home buyers, the Greater Toronto Area (GTA) housing market can feel impossibly out of reach. The dream of ownership often seems to clash with the reality of high prices and intense competition. However, a unique window of opportunity is opening in 2026, driven by a combination of key market shifts and the most significant government incentives seen in recent memory.

This guide provides a clear, step-by-step roadmap for navigating the 2026 GTA market. Its purpose is to demystify the powerful new federal and provincial rebate programs that can dramatically increase your purchasing power and turn the dream of homeownership into a practical, achievable plan.

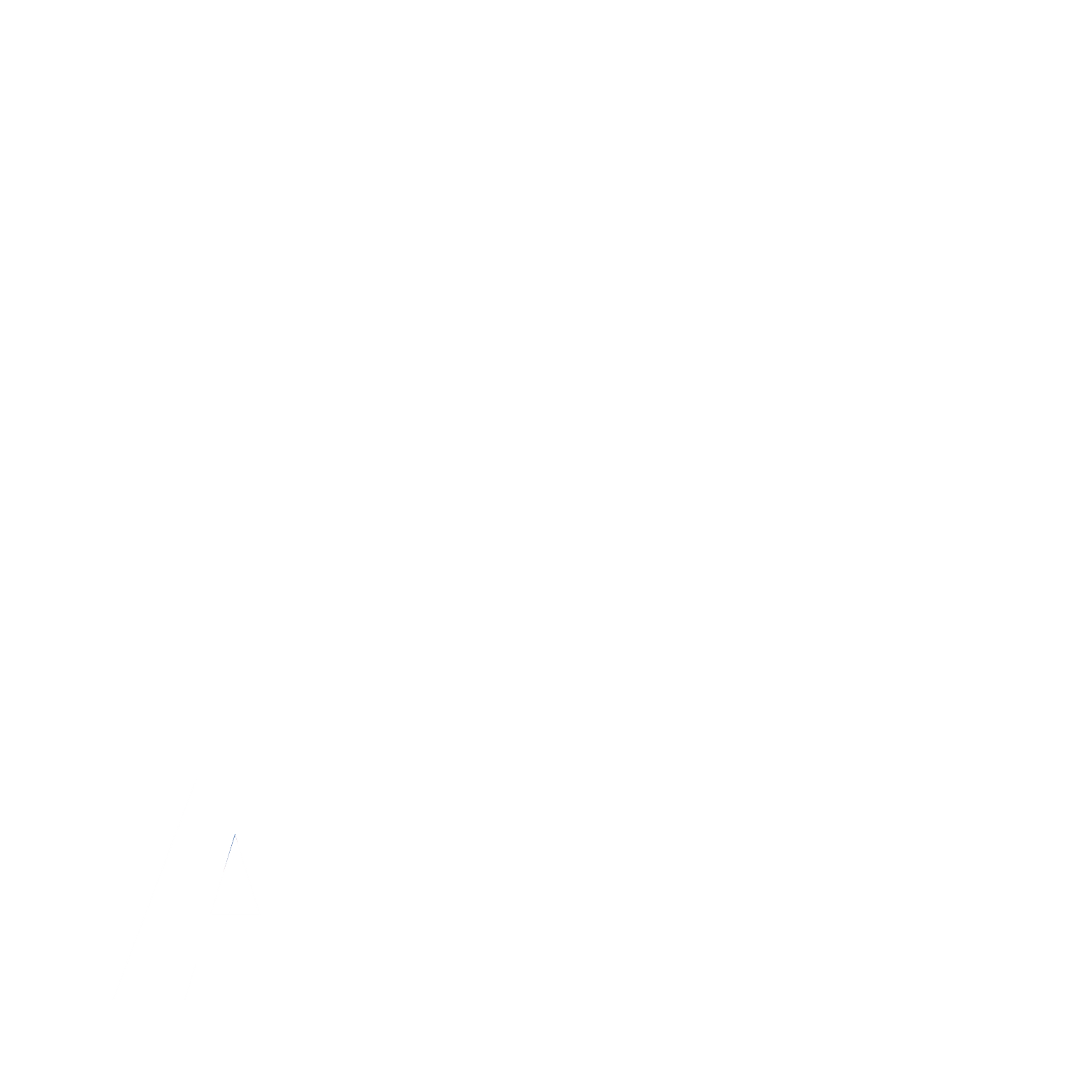

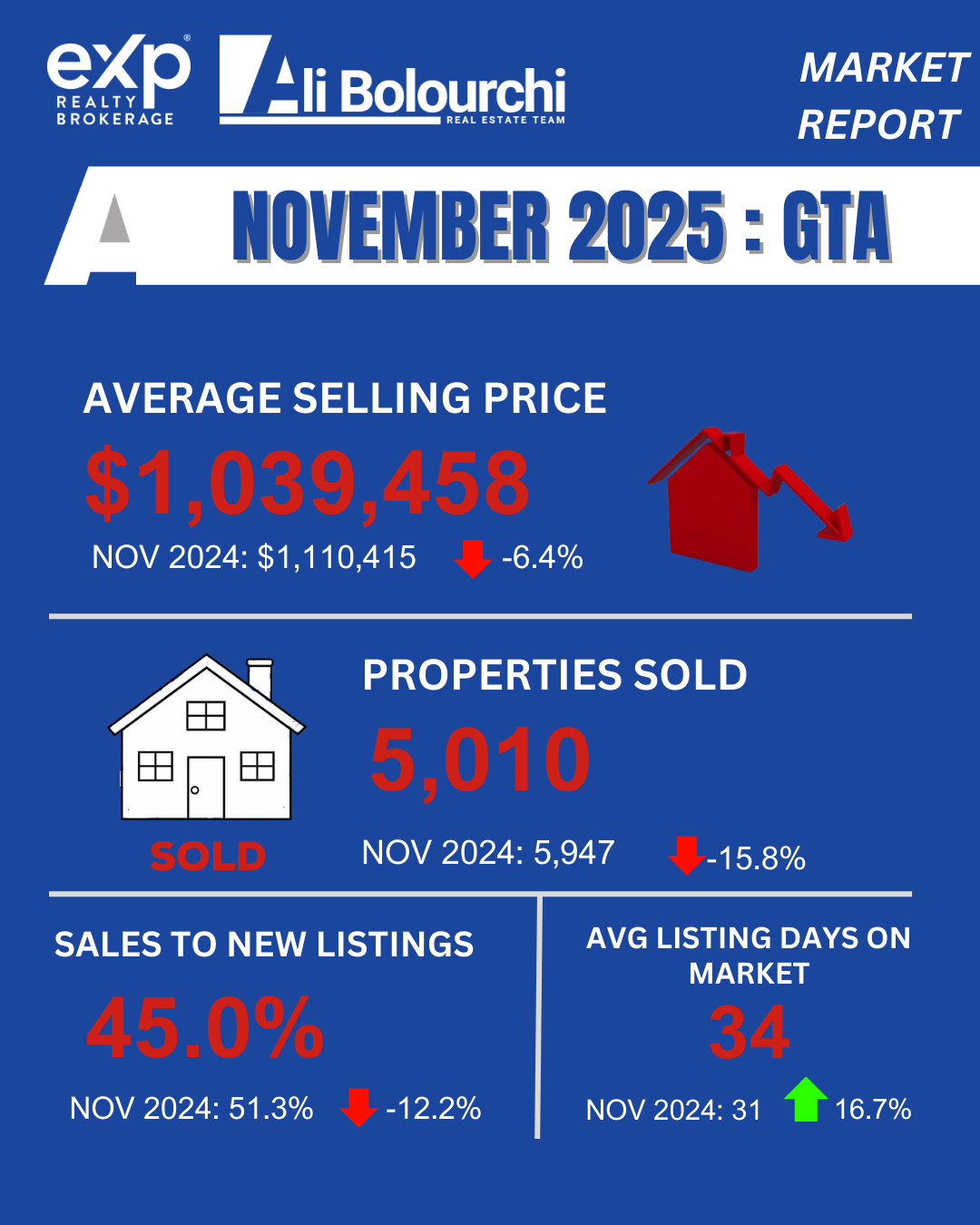

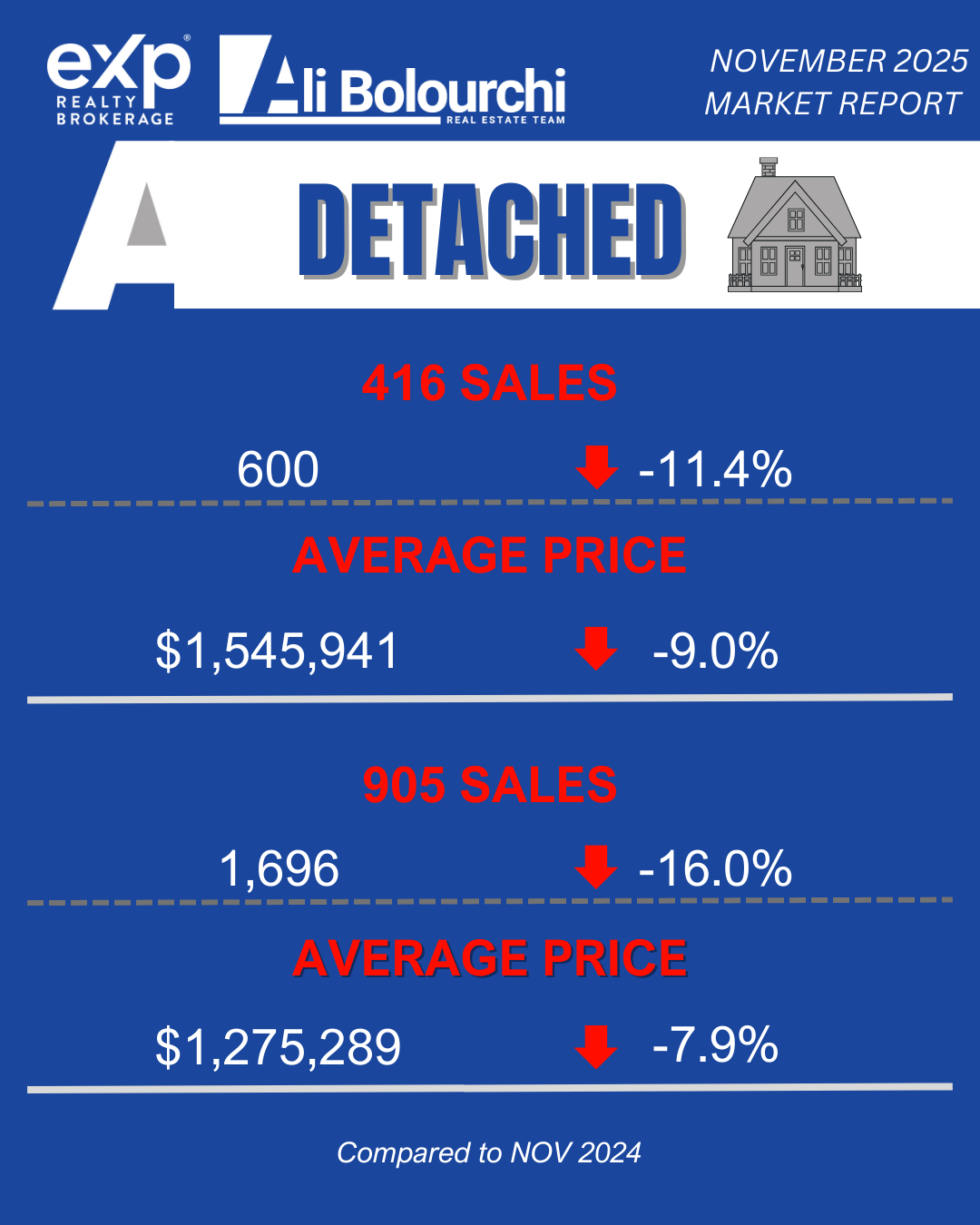

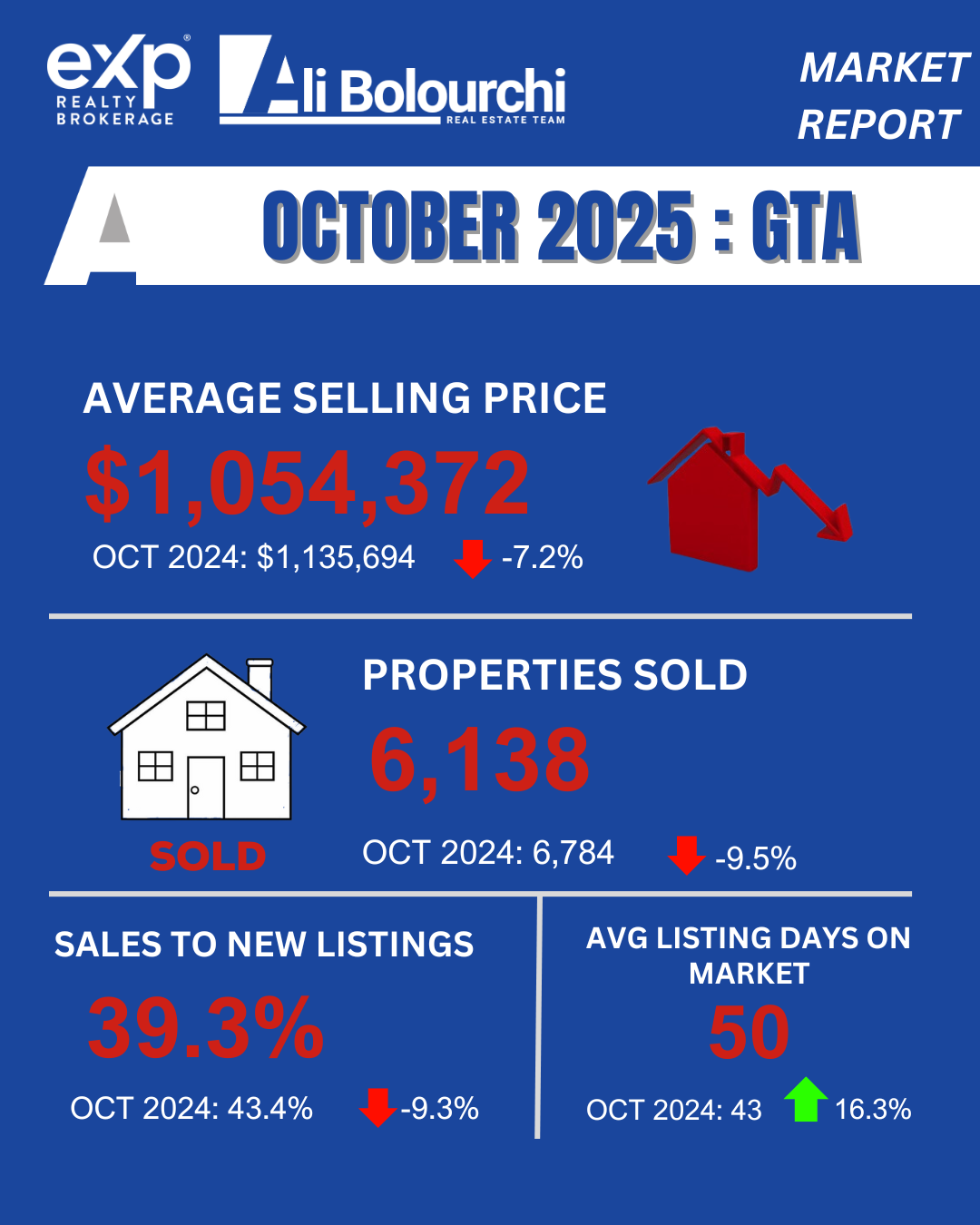

2. The 2026 GTA Real Estate Landscape: A First-Time Buyer's Perspective

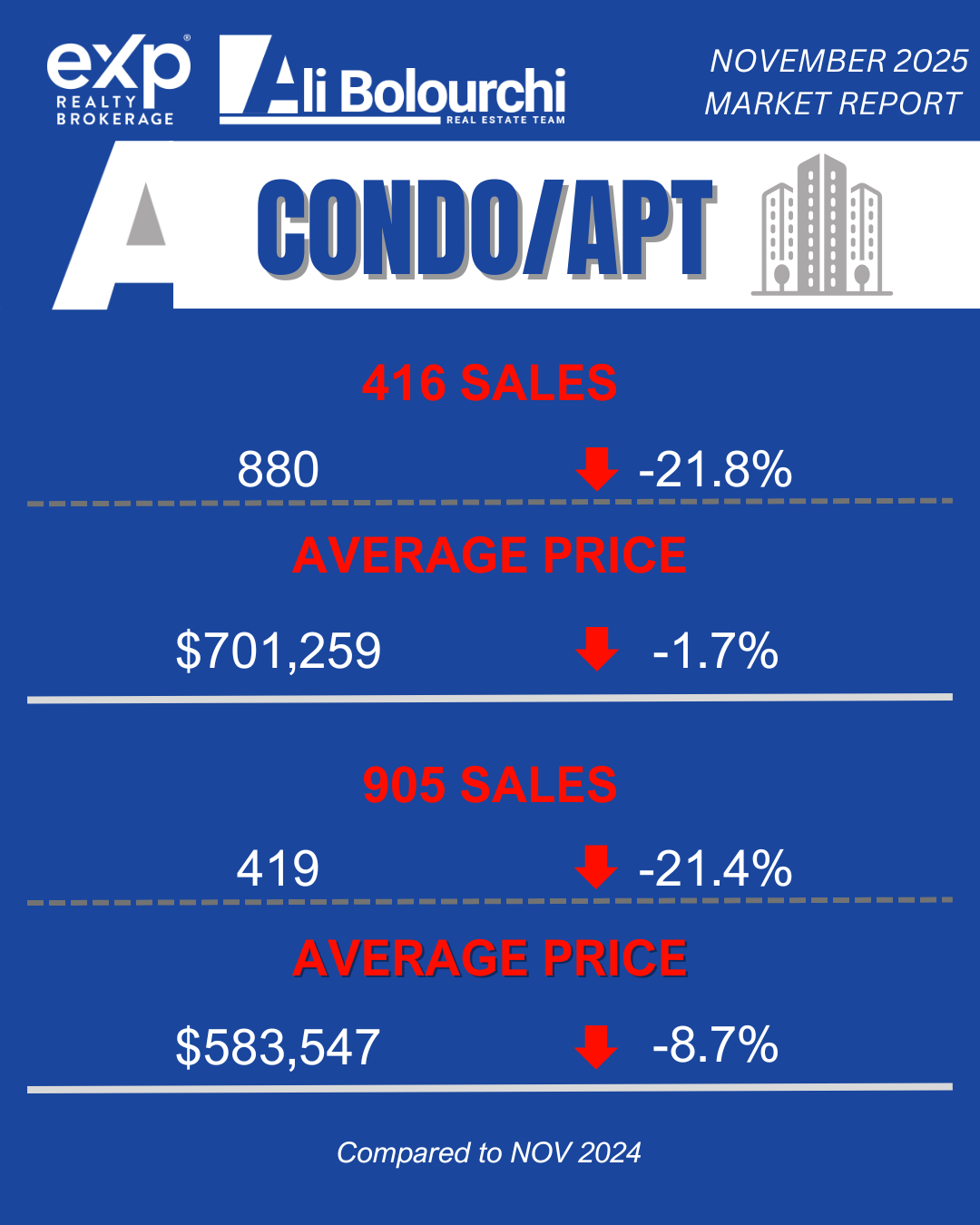

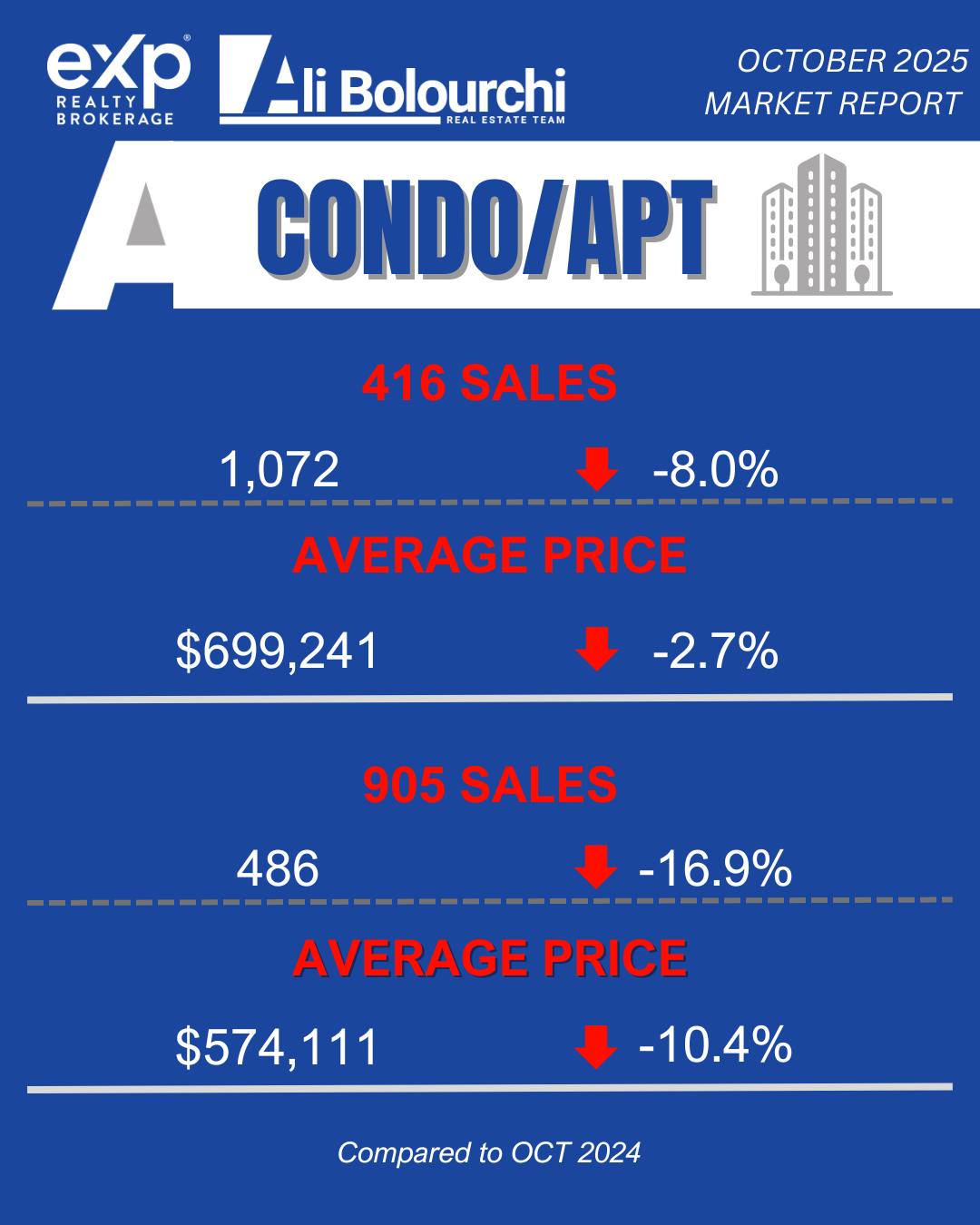

After a significant decline in sales volume in 2023, the Ontario housing market stabilized through 2024, creating a more balanced environment for buyers. For first-time home buyers (FTHBs), condominiums in particular represent a key opportunity to enter the market.

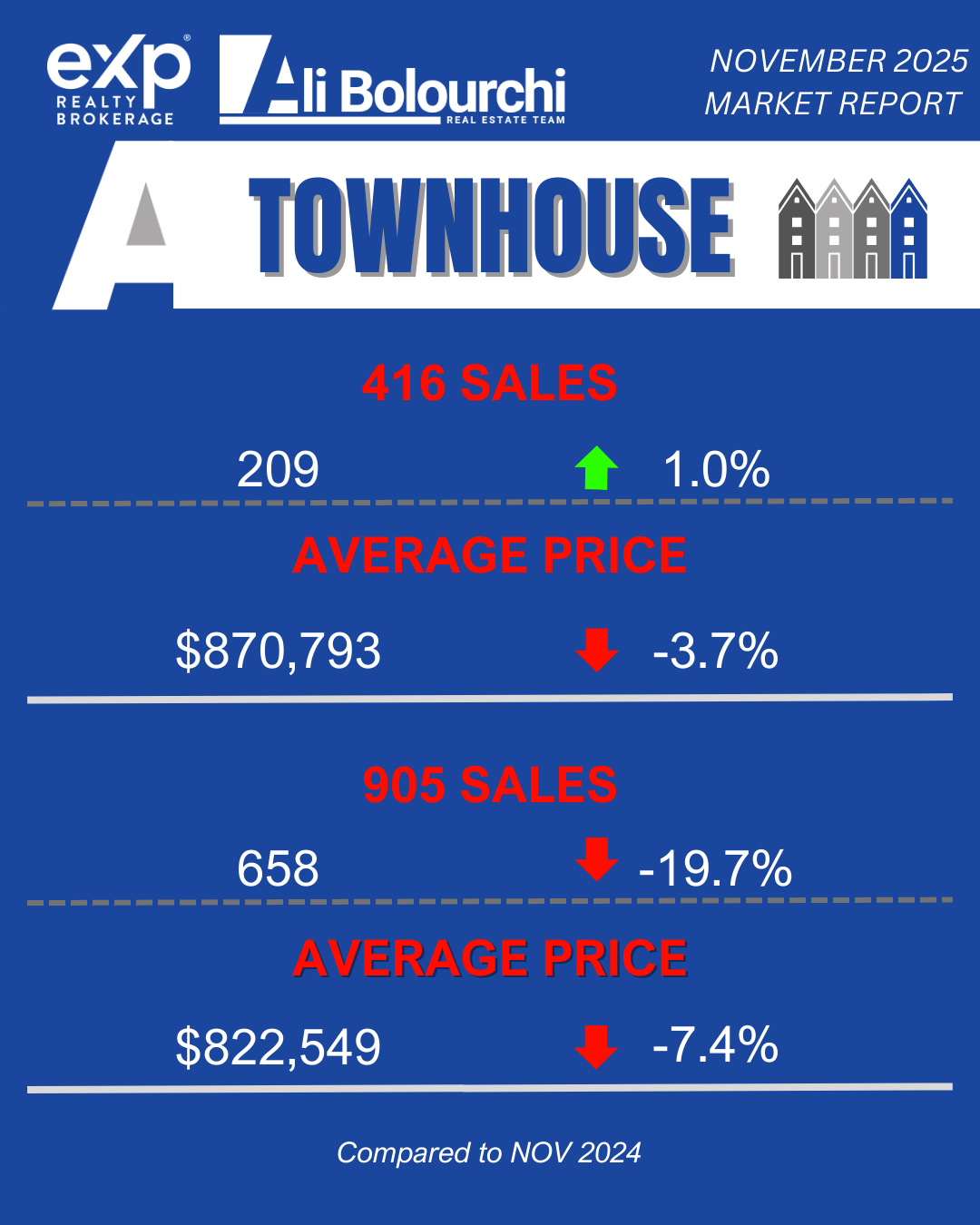

Market data reveals several important trends:

• Condos Are Leading the Recovery: In the 12 months leading up to June 2024, condo sales volumes recovered faster than other property types, showing an 8.3% year-over-year increase.

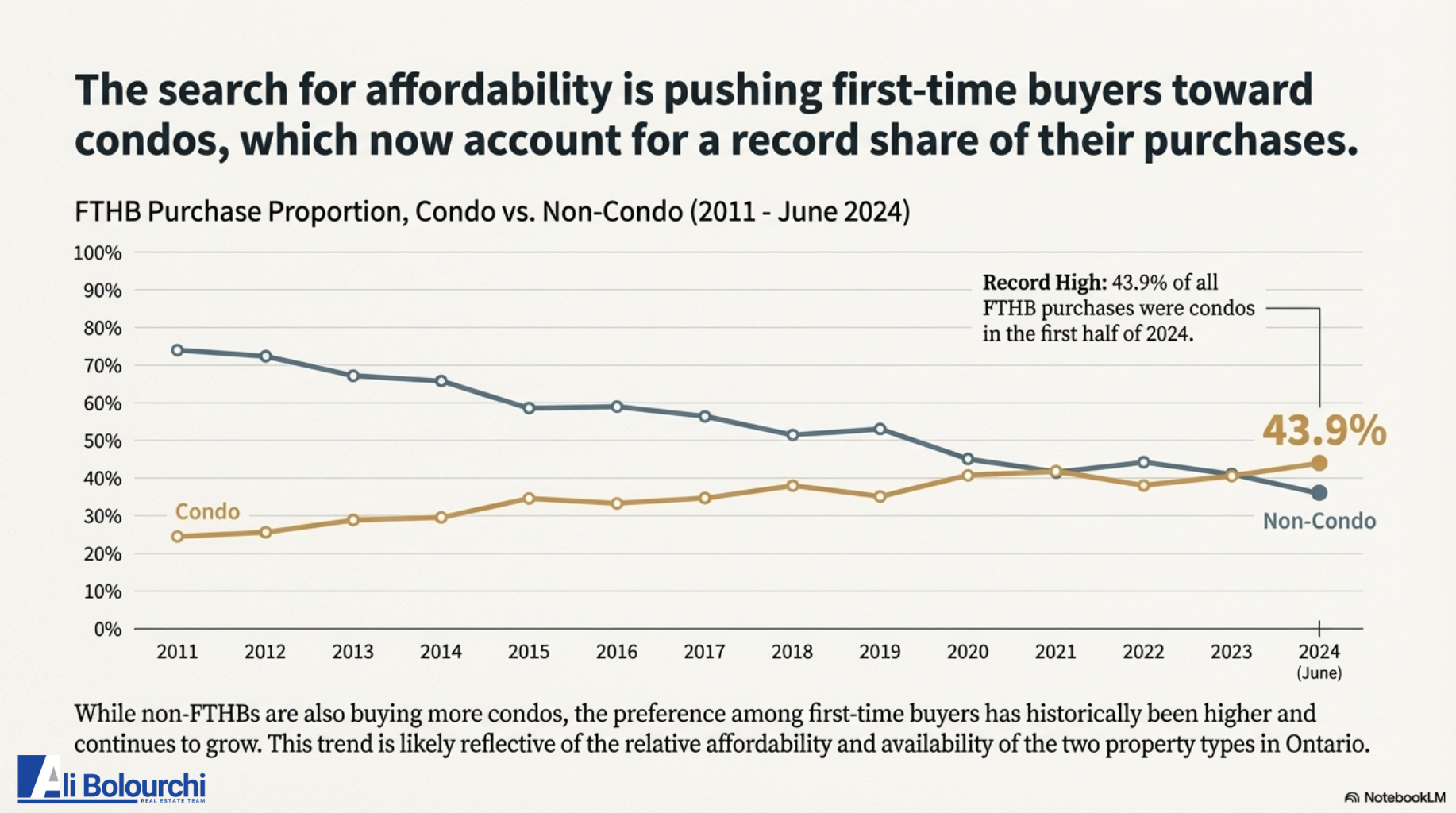

• Condos Are the FTHB Entry Point: In the first half of 2024, condo properties accounted for a significant 43.9% of all purchases made by first-time home buyers.

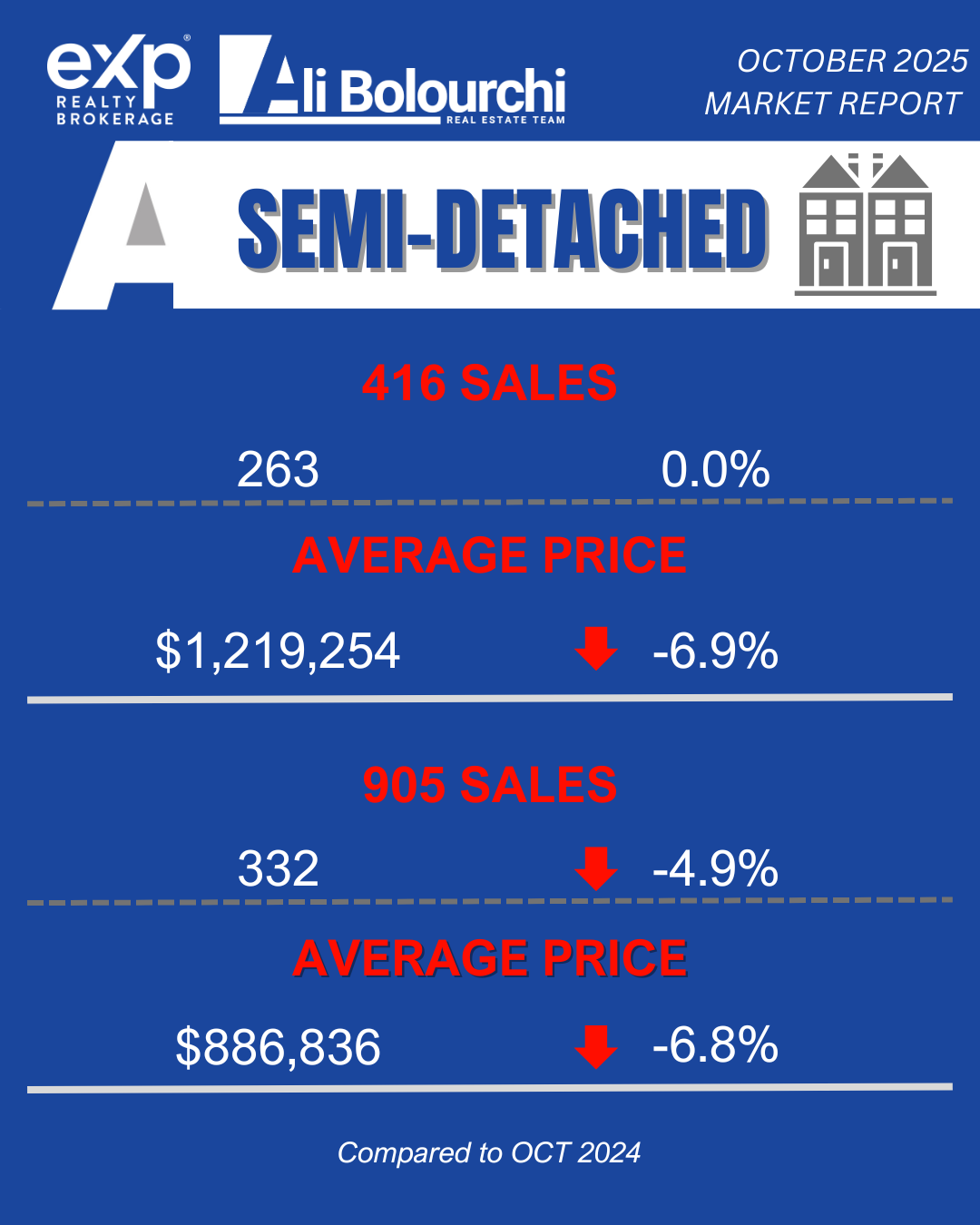

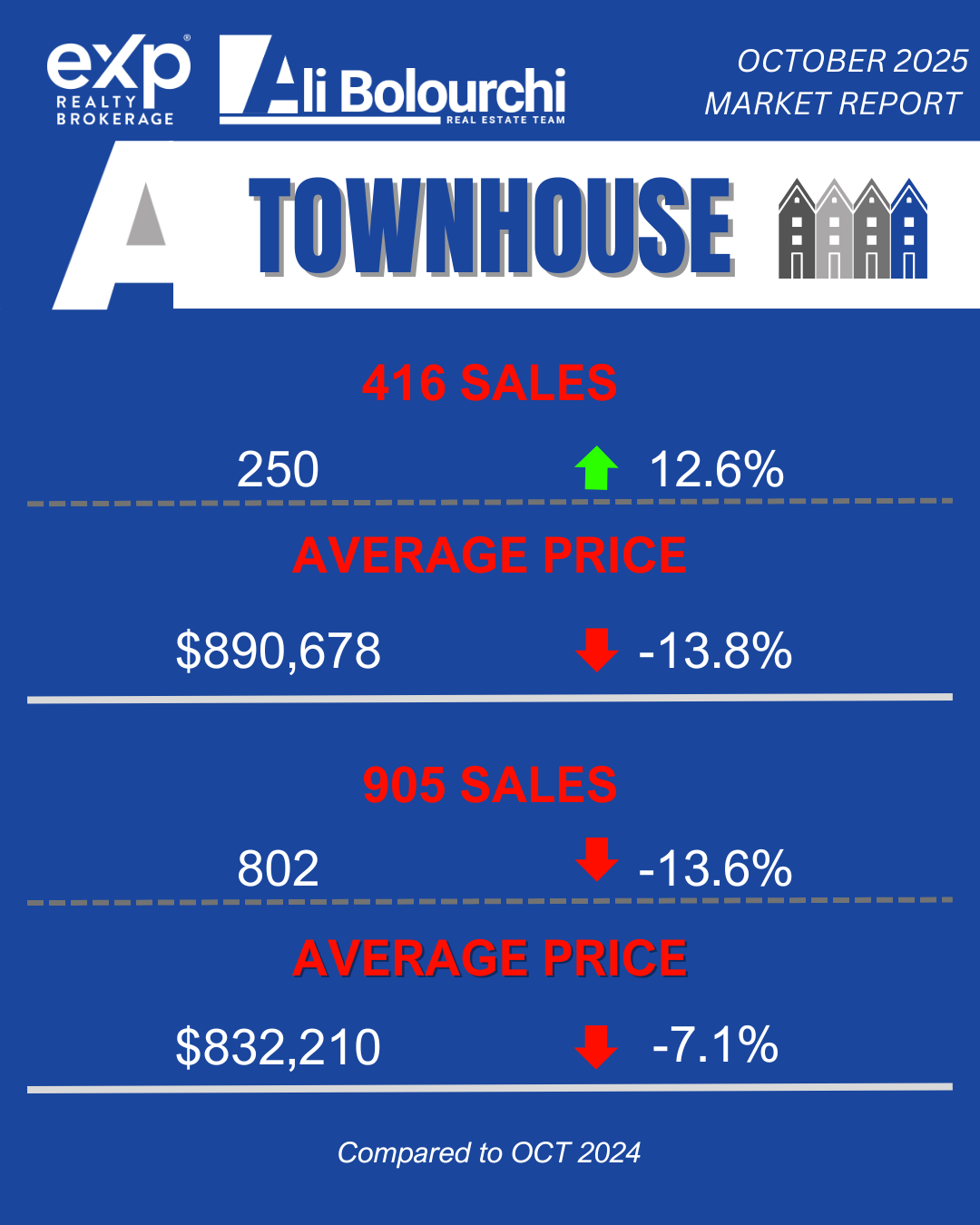

• A Price Opportunity Exists: Condo prices across the GTA have cooled, creating a potential buying advantage. While the City of Toronto saw a modest 5.1% year-over-year decline in the third quarter of 2025, surrounding regions experienced even more dramatic drops. Halton region saw condo prices fall by 12.1% and Peel region by 11.5% in the same period, powerfully reinforcing the case for looking beyond the downtown core.

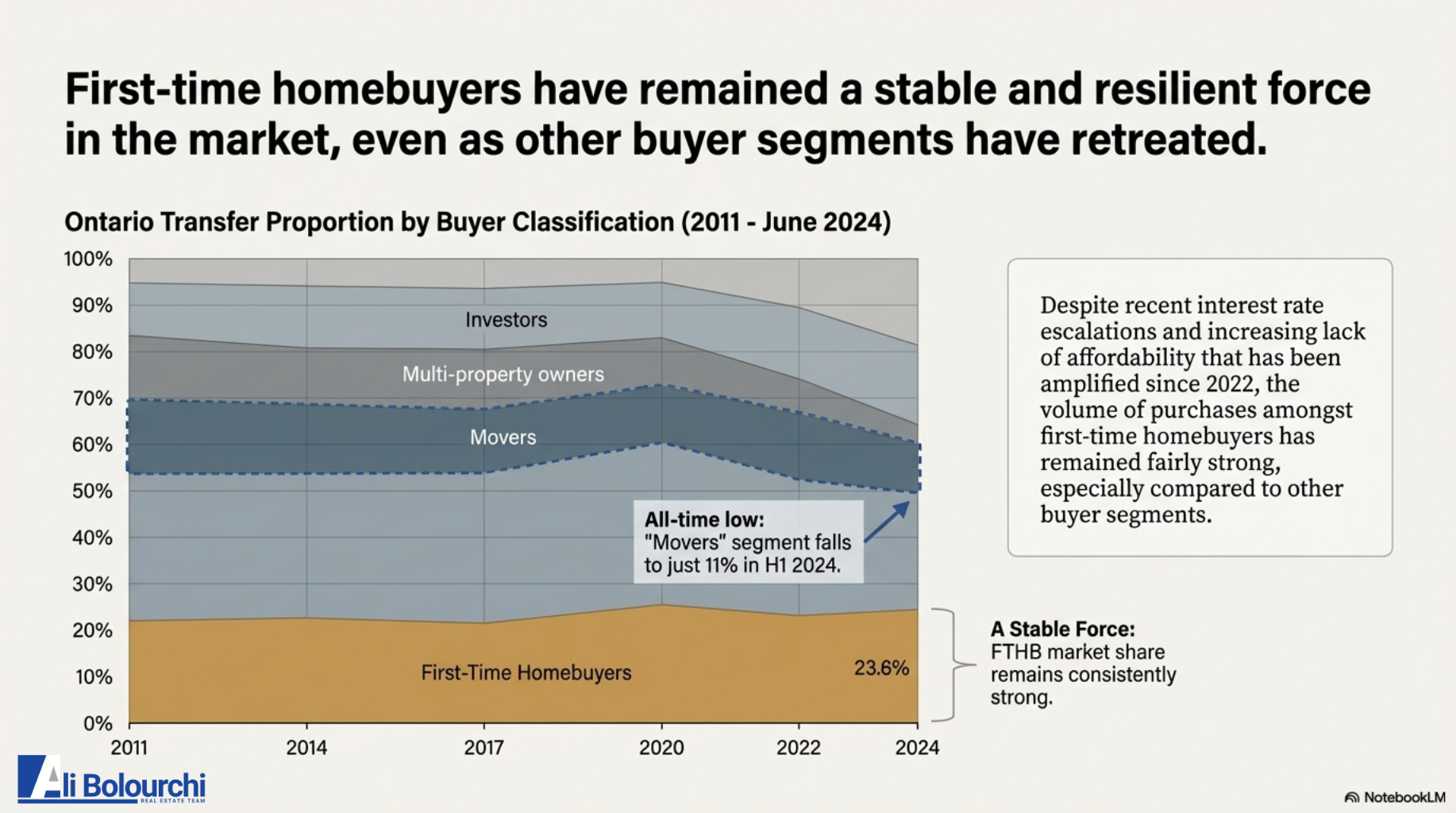

First-time buyers have proven to be a resilient and stable segment of the market, consistently comprising between 20% and 23.6% of all property purchases since 2011. While Toronto remains the top destination for FTHBs, accounting for approximately 20% of activity, its popularity is waning due to affordability challenges. This has led a growing number of buyers to explore surrounding GTA regions like Peel, York, and Durham, as well as emerging communities like Waterloo, in search of better value.

3. The Game-Changer: Unlocking Up to $130,000 in New Home Rebates

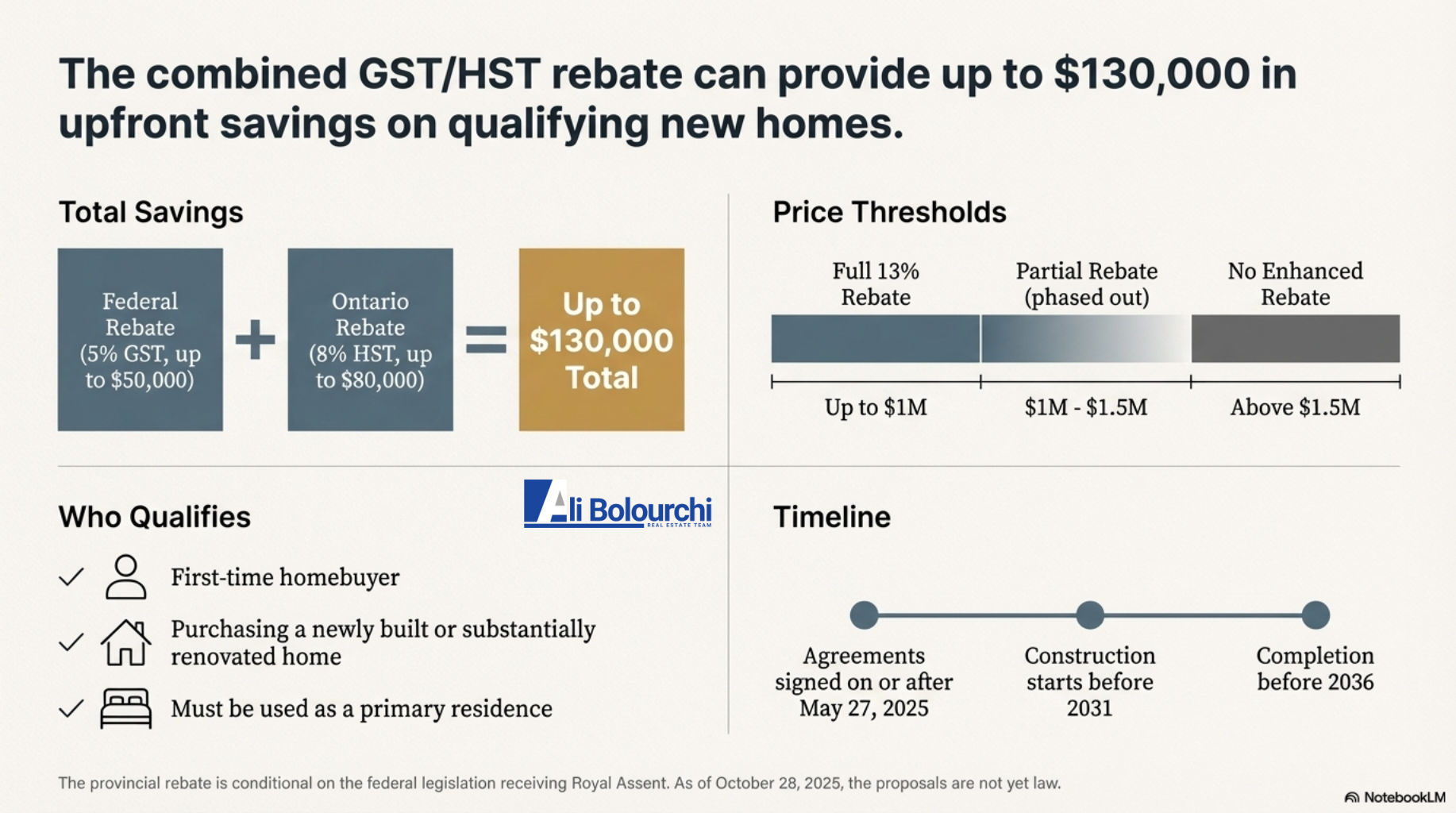

The single biggest financial benefit for first-time buyers in 2026 is a set of new, coordinated Harmonized Sales Tax (HST) rebates from the federal and provincial governments. Aimed at buyers of newly built homes, these programs can dramatically reduce the upfront cost of a purchase.

3.1. The Federal First-Time Home Buyers’ GST Rebate

The Government of Canada has proposed a new rebate that removes the 5% federal portion of the HST—the Goods and Services Tax (GST)—for qualifying first-time home buyers purchasing new homes. This measure provides substantial savings directly at the point of purchase.

3.2. Ontario's Matching HST Rebate

The Ontario government has announced its intention to match the federal initiative by rebating the full 8% provincial portion of the HST on qualifying new homes priced up to $1 million.

Crucially, this provincial rebate is conditional. It will only proceed if the federal government's proposed changes to the GST are formally passed into law.

This new program works by enhancing Ontario's existing HST New Housing Rebate. The previous rebate was worth up to $24,000; the new program, when combined with the old one, ensures the full 8% provincial tax is rebated on qualifying new homes up to the $1 million threshold.

3.3. Putting It All Together: A Hypothetical Example

The combined impact of the federal and provincial rebates is transformative. For a first-time buyer purchasing a new home at the $1 million price point, the entire 13% HST could be eliminated, resulting in a six-figure savings.

Example: Combined Savings on a $1,000,000 New Home

3.4. Are You Eligible? Key Criteria for the Rebates

To qualify for these new HST/GST rebates, you and the home you are purchasing must meet specific criteria.

• Who Qualifies:

◦ You must be a first-time home buyer, defined as not having owned a home you (or your spouse/common-law partner) lived in within the last four calendar years.

◦ You must be at least 18 years old and a Canadian citizen or permanent resident.

• What Homes Qualify:

◦ The property must be a newly built home or a substantially renovated home. Resale properties do not qualify.

◦ The home must be intended for use as your primary place of residence.

• Important Timing:

◦ The rebates apply to purchase agreements entered into on or after May 27, 2025, and before 2031.

4. Your Practical Roadmap to Homeownership in 2026

With this new landscape in mind, here are four actionable steps to begin your journey.

4.1. Step 1: Secure Your Financing

The first and most critical step is to get pre-approved for a mortgage. This will give you a clear understanding of your budget and show sellers and builders that you are a serious buyer. For first-time buyers in urban areas like the GTA, the Big 5 Banks are the dominant lenders, accounting for 70% of all FTHB financing activity in the first half of 2024.

4.2. Step 2: Understand Your Costs and Savings

Beyond your down payment, you will need to budget for closing costs, which include legal fees and land transfer tax. The new HST/GST rebates, offering up to $130,000 in savings, are a massive benefit that can significantly offset these upfront costs. It’s also important to remember that as a first-time buyer in Ontario, you already benefit from the provincial Land Transfer Tax Rebate, which further reduces your closing expenses.

4.3. Step 3: Find an Expert Guide

The 2026 market is defined by new opportunities and complex programs. It is essential to work with a real estate agent and a mortgage broker who specialize in the first-time home buyer market. An expert guide will be deeply familiar with the eligibility rules and application processes for these new rebates, ensuring you can maximize your savings.

4.4. Step 4: Focus Your Search

Use the current market data to your advantage. Condos are the most accessible entry point into the market, and the recent cooling of condo prices presents a strategic opportunity to buy. To get the most for your budget, broaden your search beyond Toronto's core. Regions like Halton and Peel have recently seen double-digit declines in condo prices (down 12.1% and 11.5% year-over-year, respectively), creating significant buying opportunities that are increasingly popular with first-time buyers.

5. Conclusion: Your Window of Opportunity is Open

The current market—defined by stabilizing prices and unprecedented government rebates for new builds—presents a rare and powerful opportunity for determined first-time buyers in 2026. The potential savings of up to $130,000 represents a direct government investment in your homeownership journey, making it more attainable than it has been in years.

Start your research, get pre-approved, and connect with a professional who can help you navigate these game-changing programs. Your dream of owning a home in the GTA is closer than you think.