October 29, 2025 - The Bank of Canada delivered a modest 25 basis point cut to the overnight rate today, bringing it down to 2.25%. While some market watchers were hoping for a more aggressive 50 basis point reduction, this measured approach signals the central bank's cautious optimism about economic conditions ahead.

Understanding the Overnight Rate: The Foundation of Canadian Interest Rates

The overnight rate is the interest rate at which major financial institutions borrow and lend one-day funds among themselves. Think of it as the "base rate" that influences virtually every other interest rate in Canada—from your mortgage to your credit card.

When the Bank of Canada adjusts this rate, it creates a ripple effect throughout the entire financial system. Banks typically pass these changes directly to consumers, making borrowing either more expensive or more affordable depending on the direction of the change.

Immediate Impact on Variable Mortgages

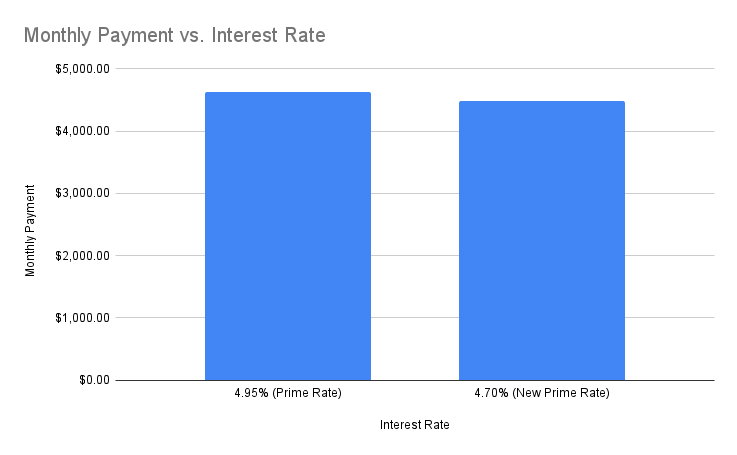

For current variable rate mortgage holders, today's 25 basis point cut translates to immediate relief:

A $500,000 mortgage will see monthly payments decrease by approximately $65-75

A $800,000 mortgage (closer to Toronto's average) will see savings of roughly $105-120 per month

Over a year, this represents $780-1,440 in interest savings depending on your mortgage size

The math is straightforward: Variable rates typically move in lockstep with the overnight rate. If you're carrying a variable mortgage, you should see this reduction reflected in your next payment cycle.

Why 25 Basis Points Instead of 50?

The Bank of Canada's measured approach suggests several factors at play:

Inflation concerns remain - While trending downward, inflation hasn't reached the target 2% consistently

Employment market stability - Job numbers remain relatively strong across major Canadian markets

Housing market caution - Avoiding overstimulation of an already complex real estate environment

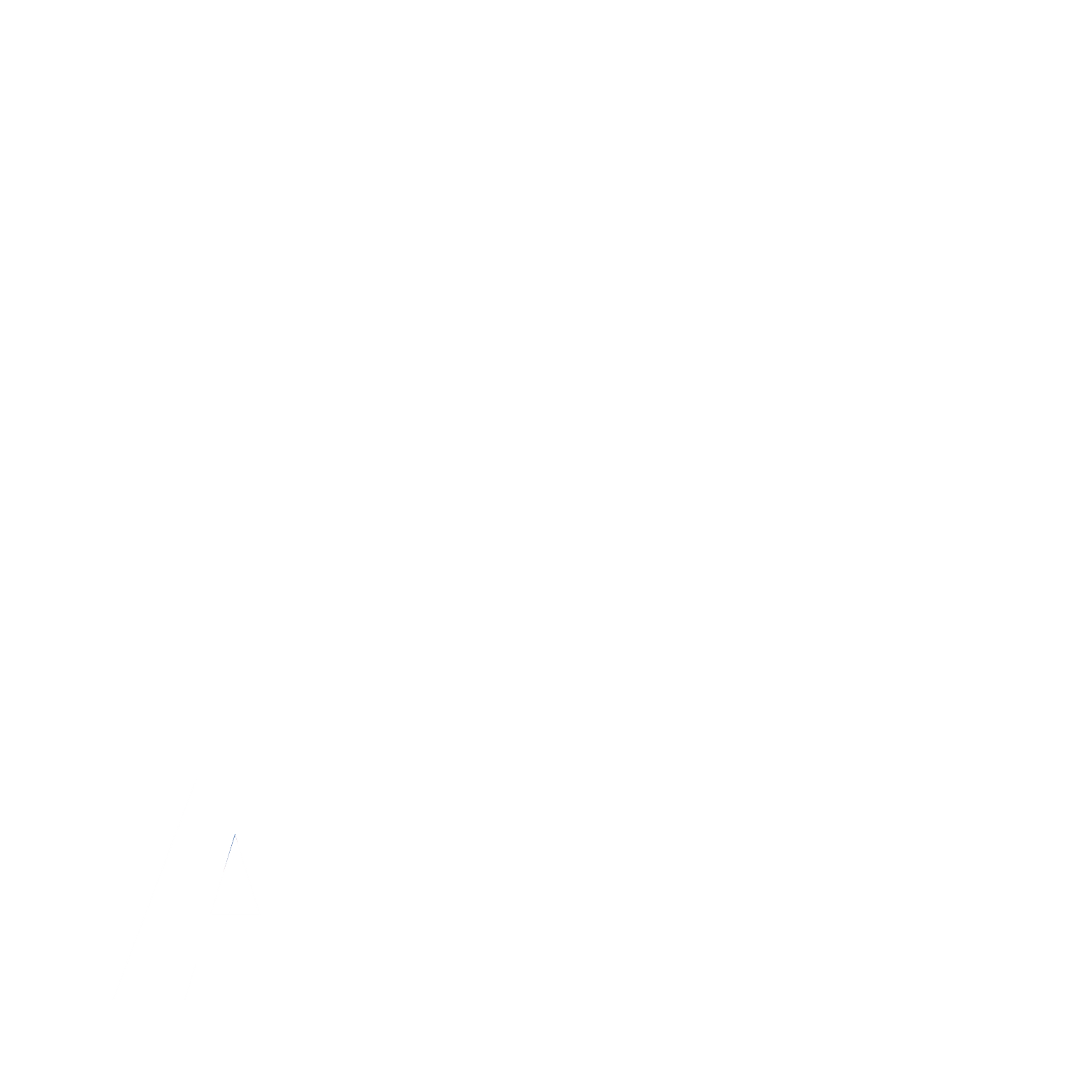

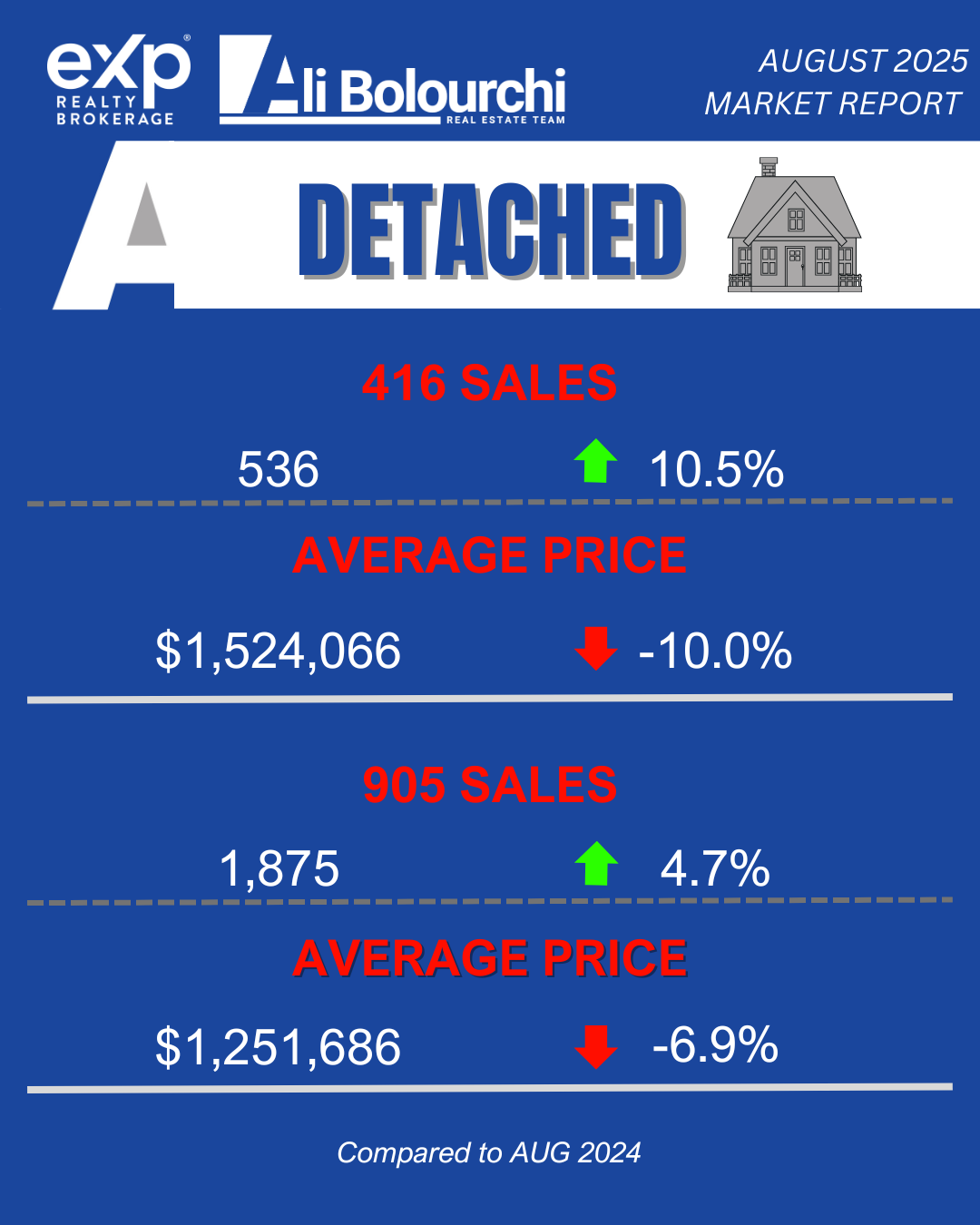

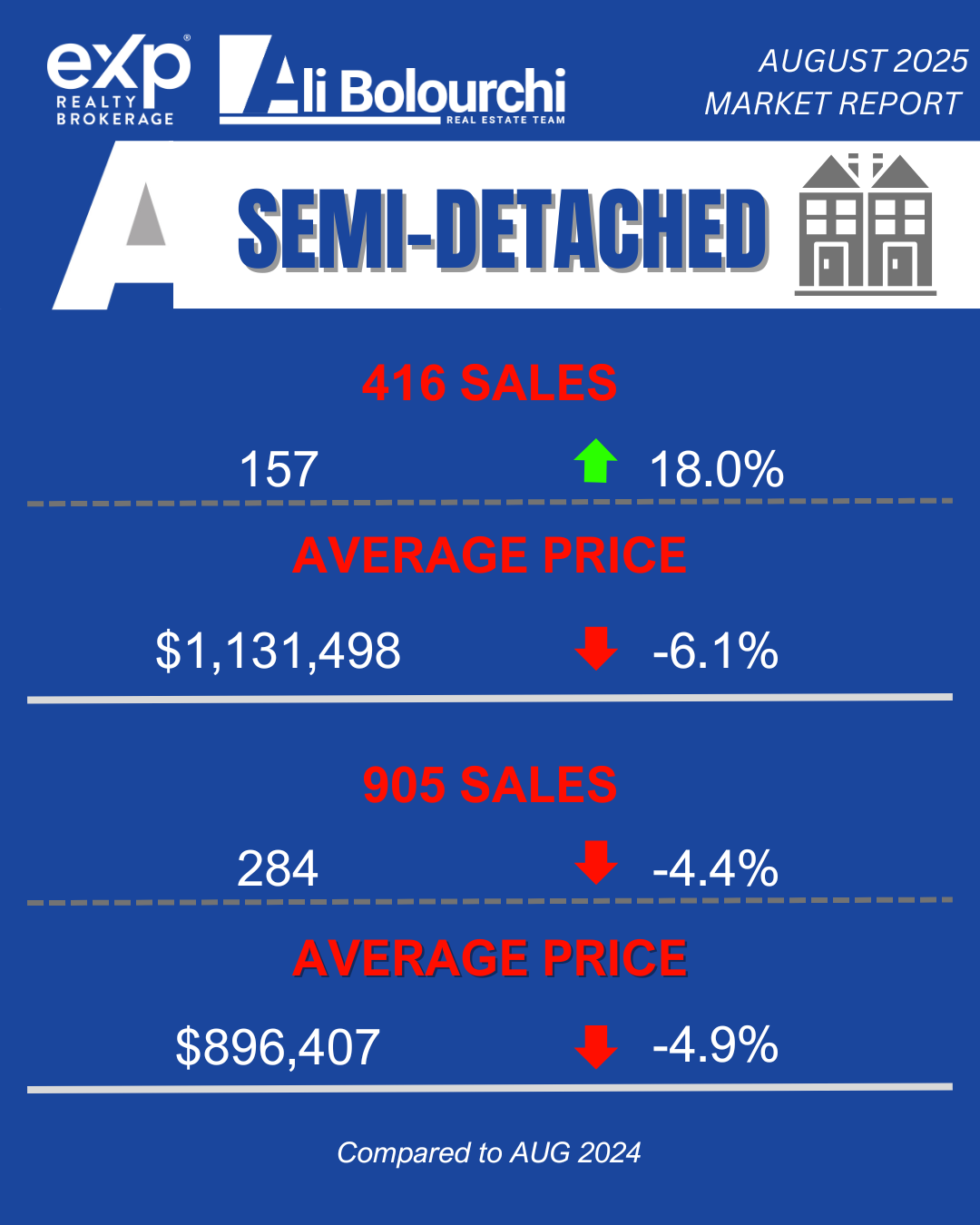

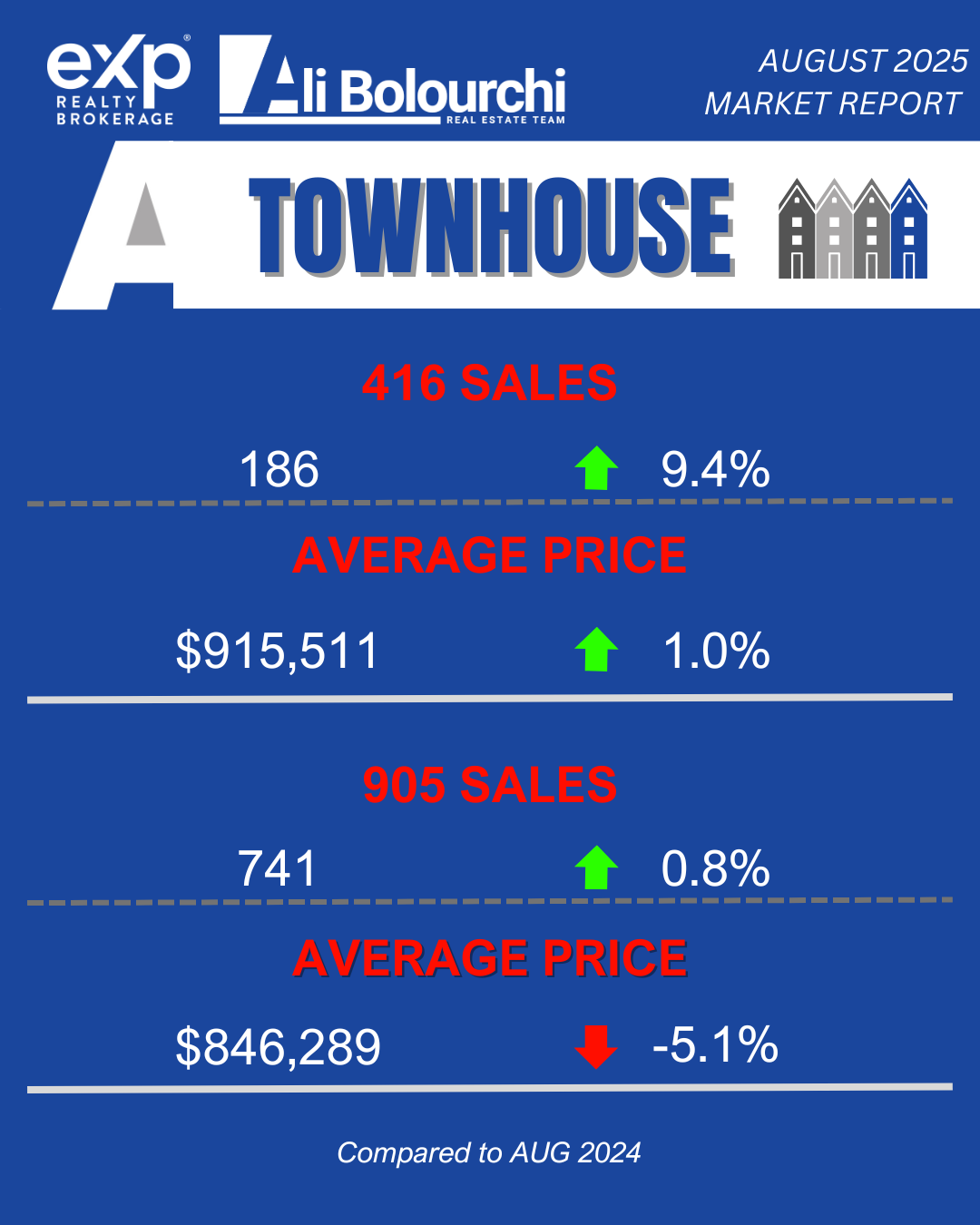

Toronto Area Real Estate: The Nuanced Impact

Immediate Market Response (Next 30-60 Days)

Buyer Psychology Shift

Increased affordability calculations will bring fence-sitters back to the market

Pre-approval amounts will increase by approximately $15,000-25,000 for typical buyers

Renewed confidence in variable rate products among risk-tolerant buyers

Seller Market Dynamics

Properties that have lingered may see renewed interest

Pricing strategies may become more aggressive as seller confidence returns

Multiple offer situations likely to increase in desirable neighborhoods

Geographic Impact Across the GTA

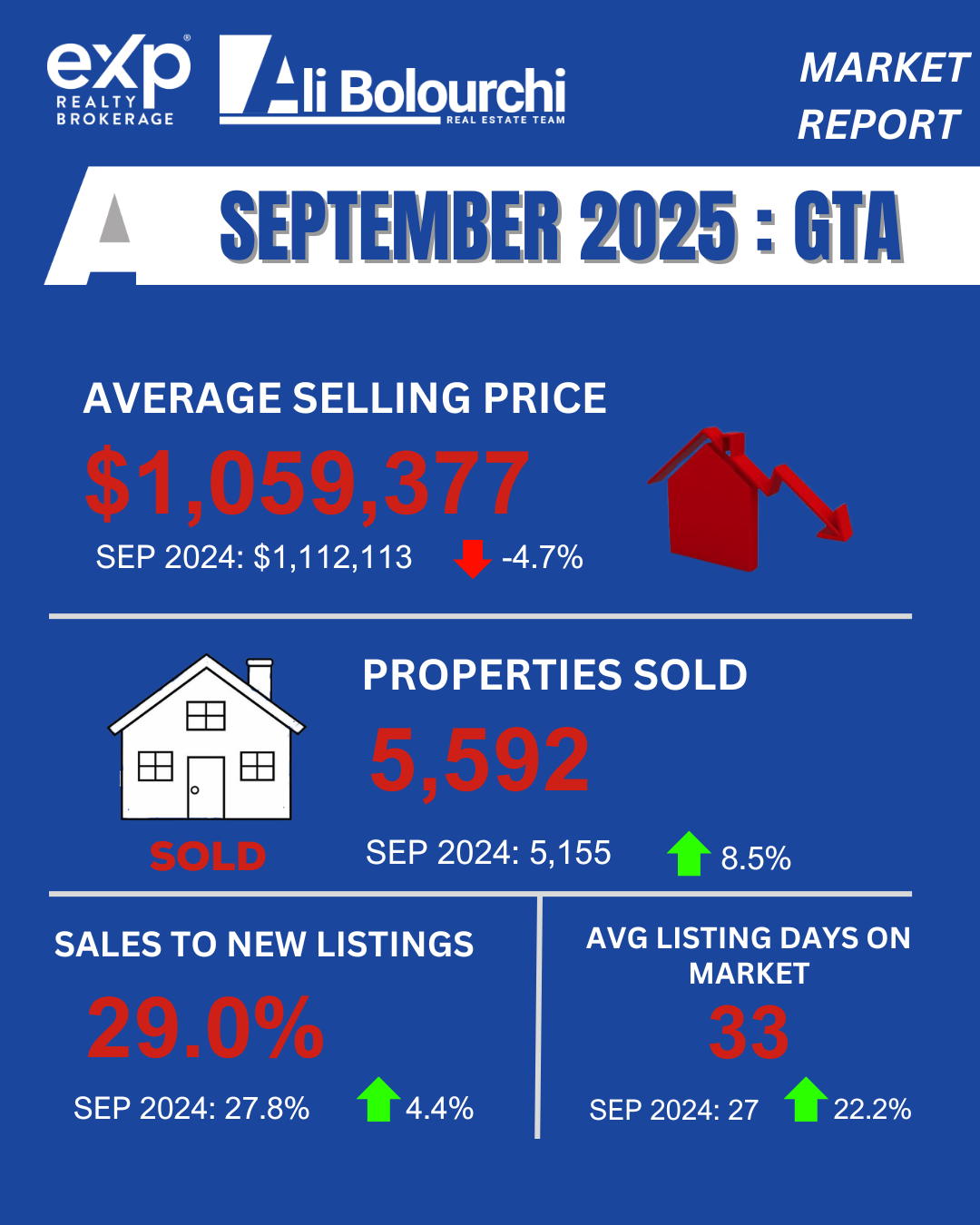

Toronto Core (Downtown, Midtown)

Condo market likely to see the most immediate activity

First-time buyer segment will benefit most from improved affordability

Luxury market ($2M+) may see delayed response as buyers in this segment are less rate-sensitive

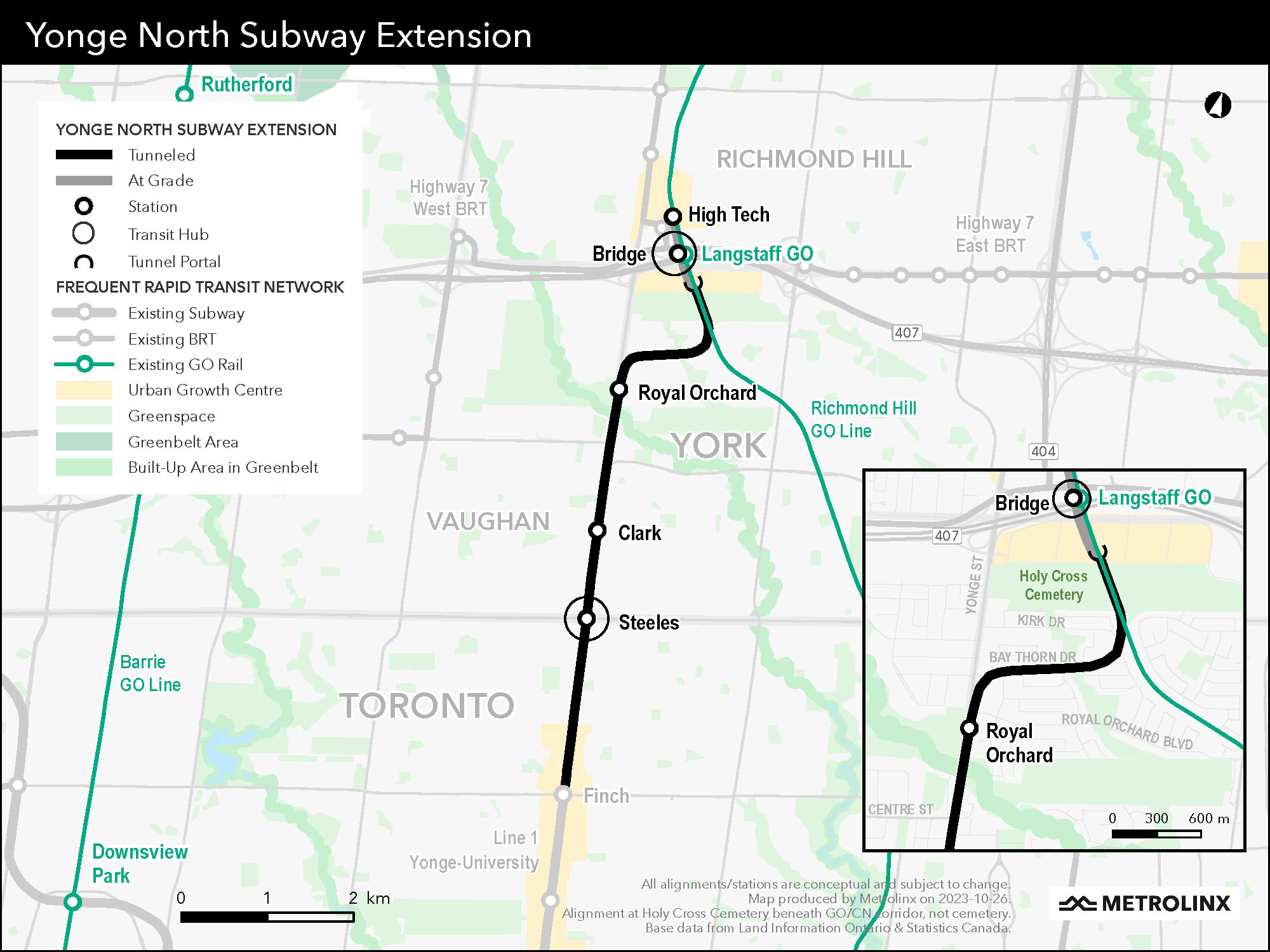

Markham & Richmond Hill

Family-oriented buyers will return to these markets faster

New construction sales likely to accelerate

Competition for detached homes under $1.5M will intensify

Vaughan & Surrounding Areas

Suburban markets positioned for strongest response

Move-up buyers previously priced out may re-enter

Development activity likely to increase in pre-construction phase

The 2026 Outlook: Reading Between the Lines

Today's modest cut, while disappointing to some, may actually signal a more sustainable path forward for Toronto real estate.

Why this matters for your strategy:

Gradual normalization over rapid acceleration - Prevents the boom-bust cycles that create market instability

Sustained buyer activity - Rather than a frenzied rush, expect consistent market activity

Price stability with growth - Moderate appreciation rather than dramatic spikes

Variable vs. Fixed: The Decision Just Got More Complex

With today's cut, the gap between variable and fixed rates has narrowed, but variable products become more attractive for specific buyer profiles:

Consider variable if you:

Plan to pay down principal aggressively

Expect to move within 3-5 years

Can handle payment fluctuations

Believe further cuts are coming

Stick with fixed if you:

Need payment certainty for budgeting

Are stretching to qualify

Plan to stay in the property long-term

Prefer to sleep well regardless of rate movements

Investment Property Implications

For real estate investors, today's cut creates several opportunities:

Cash Flow Improvement

Existing investment properties will generate better monthly returns

Refinancing opportunities for portfolio optimization

Potential to accelerate acquisition timelines

Market Timing Considerations

Increased buyer competition may pressure cap rates

Consider locking in deals before spring market activity peaks

Focus on value-add opportunities that benefit from improved financing costs

What to Watch Next

The Bank of Canada's next scheduled announcement is [next date]. Key indicators to monitor:

Employment data - Particularly in Ontario's major urban centers

Inflation trends - Monthly CPI releases through winter

Housing starts and sales data - Early indicators of market response

Global economic conditions - Particularly US Federal Reserve actions

Strategic Recommendations for Toronto Area Buyers and Sellers

For Buyers:

Act on pre-approvals quickly - Rates could continue declining, but inventory may tighten

Consider variable products - If you fit the risk profile, savings potential exists

Focus on value markets - Markham, Richmond Hill, and Vaughan offer better entry points

For Sellers:

Price strategically - Avoid overreaching in the initial enthusiasm

Prepare for increased activity - Ensure properties are market-ready

Consider timing - Spring market may be more competitive for sellers

For Investors:

Review existing portfolios - Refinancing opportunities may exist

Accelerate due diligence - Good deals will move faster in improved rate environment

Focus on cash flow - Improved financing costs enhance deal viability

The Bottom Line

Today's 25 basis point cut represents a measured step toward monetary easing that should provide modest relief to Toronto area real estate markets without creating unsustainable speculation.

For most market participants, this is positive news—increased affordability, improved cash flow, and renewed market confidence. However, the modest nature of the cut suggests we're in for gradual improvement rather than dramatic market acceleration.

The key is strategic positioning. Whether you're buying your first home, selling to upgrade, or building an investment portfolio, understanding how to leverage this changing rate environment will determine your success in 2026 and beyond.

Ready to discuss how today's rate cut impacts your specific real estate goals? Our team has been navigating Toronto market cycles for over two decades. Contact us for a strategic consultation tailored to your situation.

Contact Ali Bolourchi and The4Sale Team: ☎ 416-886-2000 🌐 GTALuxuryHomes.ca 🏢 The4Sale.com for Investment & Commercial 🏠 Ali.realtor for Residential

This analysis is based on current market conditions and historical trends. Real estate decisions should always be made in consultation with qualified professionals.