When the average home in the Greater Toronto Area (GTA) is priced well over a million dollars, the dream of homeownership can feel like a fairy tale. You’ve crunched the numbers, saved diligently, and still, the down payment looks like climbing Mount Everest. The good news? The path to the closing table no longer has to be a solo journey. The market is evolving, and the Two-Family Mortgage—or strategic property co-ownership—is quickly becoming the smartest financial handshake in Southern Ontario. Forget renting; imagine combining forces with a trusted friend, sibling, or extended family member to conquer unaffordability and start building equity now. This isn't just splitting the bills; it's a strategic, data-driven move that is fundamentally changing who can afford to own in Canada’s hottest market.

The Unspoken Crisis: Why The GTA Needs Co-Ownership

The Real Cost of Waiting: Inventory and Rate Pressure

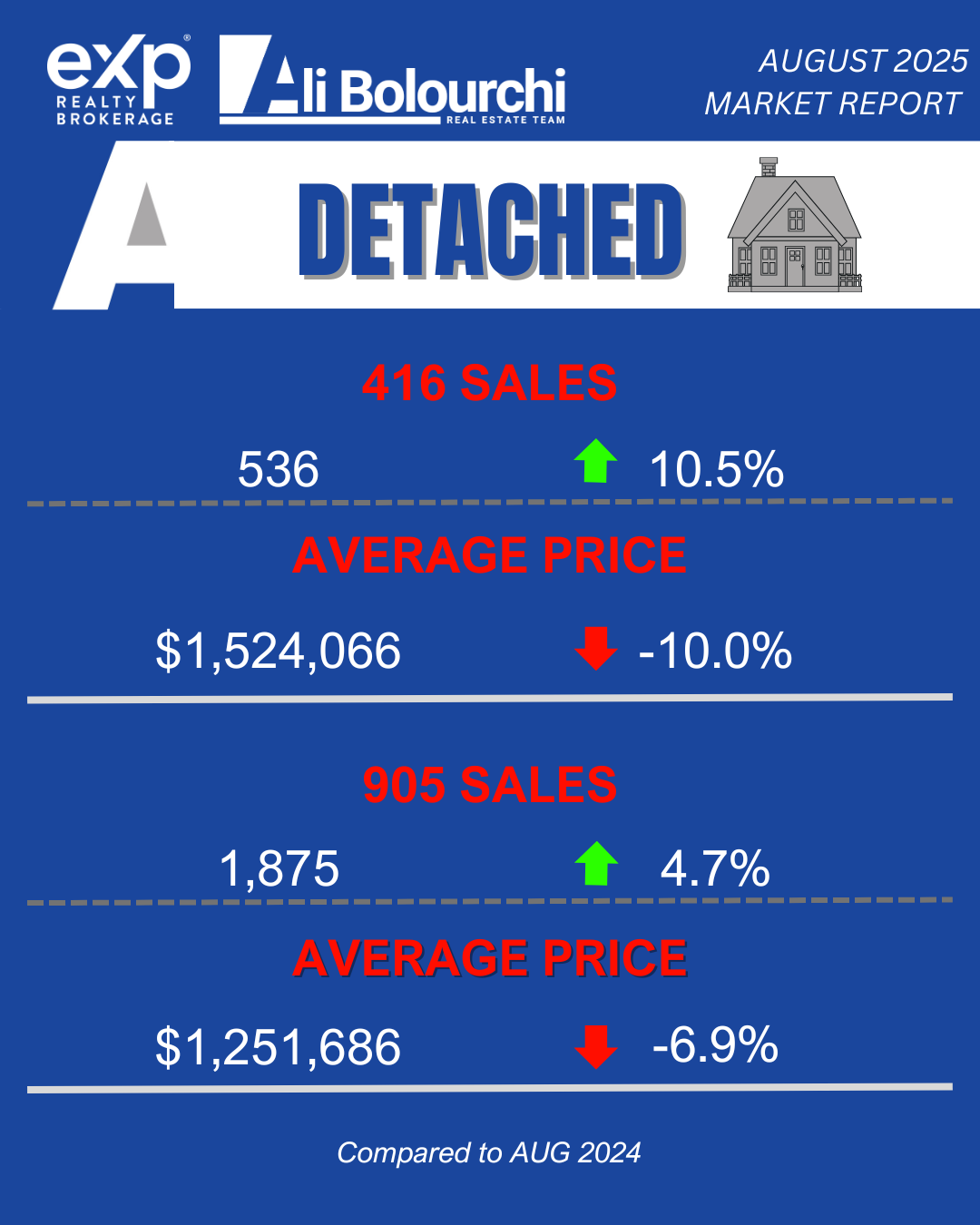

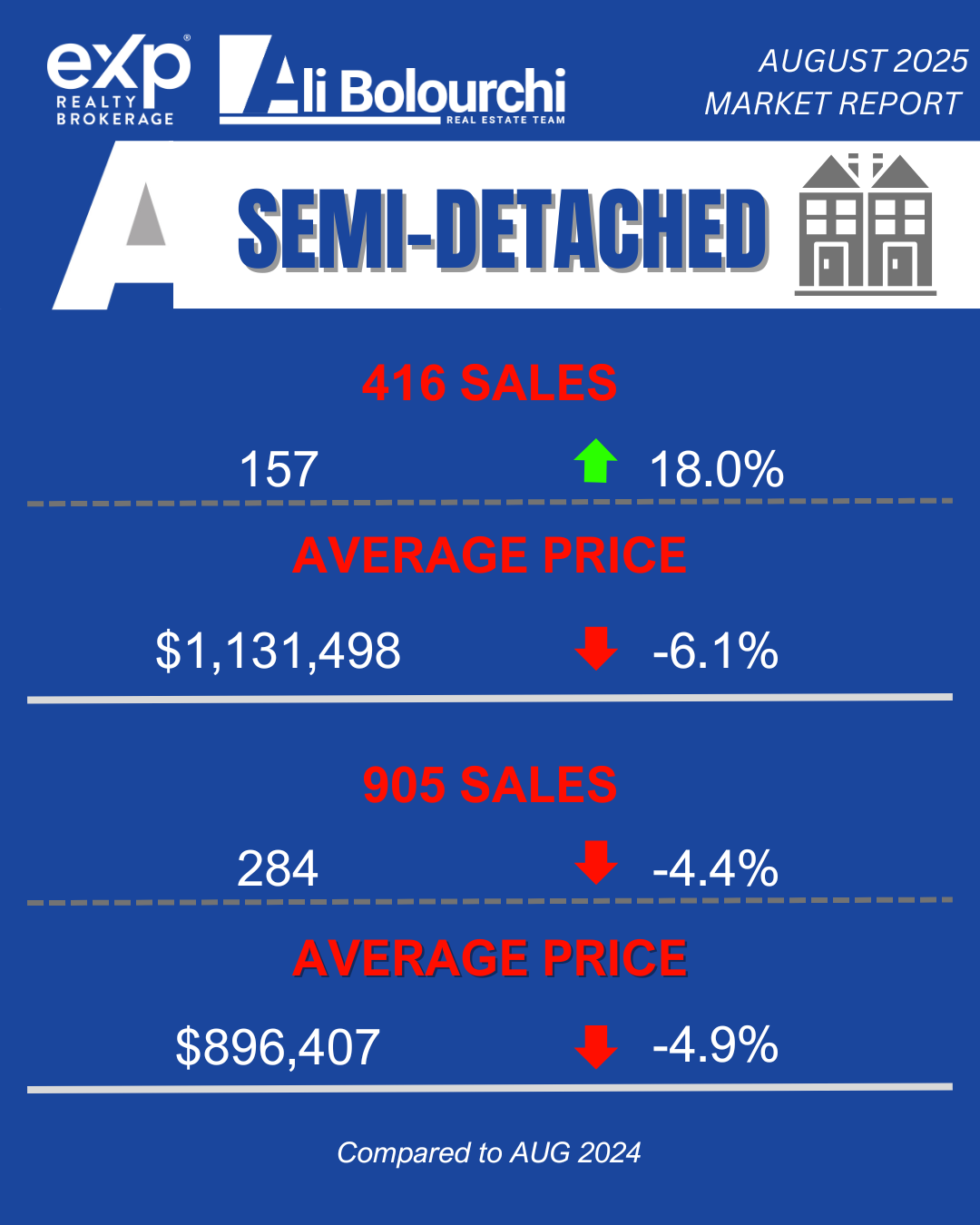

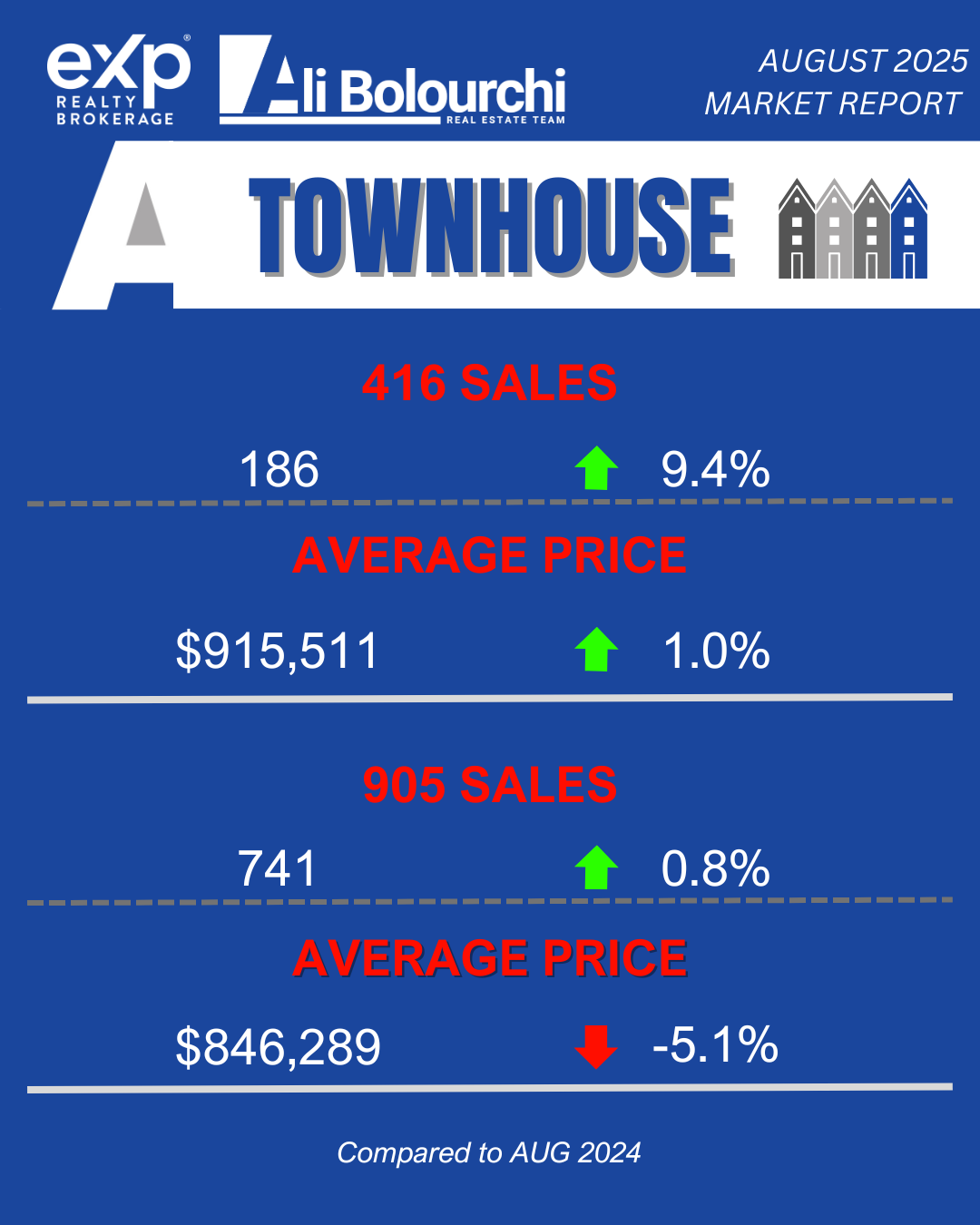

The numbers don't lie. Recent reports from the Toronto Regional Real Estate Board (TRREB) show the average home price in the GTA hovering around $1.02 to $1.07 million. This figure creates an impossible "catch-22" for first-time buyers:

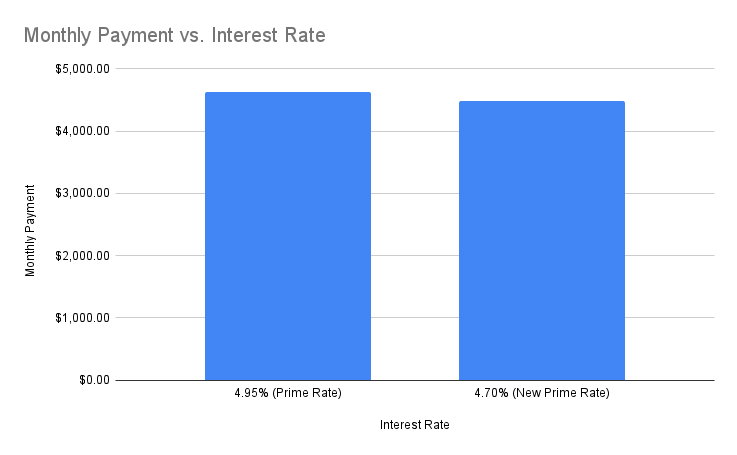

High Rates: Bank of Canada rates have lowered buying power, increasing the monthly carrying cost.

High Prices: Stubbornly low inventory keeps prices elevated, especially for desirable family-sized homes.

If your household income qualifies you for a mortgage of $500,000, but the entry-level home you want is priced at $900,000, the gap is massive. This is where co-ownership becomes the essential bridge from renter to owner. It’s the strategy that allows two or more incomes and savings pools to meet the market where it stands.

📊 GTA Housing vs. First-Time Buyer Income (2020–2024)

Sources: Home price data from Fivewalls and Precondo; income estimates based on historical CRA and CMHC reports.

🔍 Key Insights

🏠 Home prices peaked in 2022, driven by pandemic-era demand and low interest rates.

💼 First-time buyer incomes rose slowly, averaging ~2–3% annual growth.

⚠️ The price-to-income ratio consistently exceeds 12×, far above the recommended 3–5× range for affordability.

This widening gap makes solo ownership nearly impossible without significant financial support, dual incomes, or inheritance. If you'd like, I can help visualize this in a graph or explore affordability scenarios based on mortgage rates and down payments.

How Co-Ownership Works: Two Paths to Ownership

When two or more non-spousal parties buy a property in Ontario, they must choose one of two legal structures. The choice is critical as it dictates financial flexibility and, most importantly, the exit strategy.

Tenants-in-Common (The Investment Strategy)

This structure is common for friends, siblings, or investment partners who contribute unequal amounts of capital.

Definition: Each party owns a specific percentage of the property (e.g., Person A owns 60%, Person B owns 40%).

Key Feature: There is NO Right of Survivorship. If one owner dies, their share goes to their estate, which is then distributed according to their will, not automatically to the surviving co-owner(s).

Target: Ideal for partners with differing financial contributions who need flexibility for estate planning.

Joint Tenancy (The Family/Lifestyle Strategy)

This is the standard for married or common-law couples but can work for close family members.

Definition: All owners are viewed as owning one whole property together with equal rights and responsibilities. Shares must be equal (e.g., 50/50 for two owners).

Key Feature: The Right of Survivorship is mandatory. If one owner dies, their share automatically passes to the surviving owner(s), bypassing the will and avoiding probate.

Target: Best for partners buying with the intent of long-term residence who want the ownership transfer to be seamless upon death.

The Financial Edge: Doubling Your Buying Power

The most immediate benefit of a Two-Family Mortgage is the turbocharge it gives your financial application.

The Down Payment Advantage: Combining Savings

Combining two or three dedicated savings accounts instantly fast-tracks your ability to reach the crucial 20% down payment threshold. By avoiding Canadian Mortgage and Housing Corporation (CMHC) insurance fees, co-owners can save tens of thousands of dollars right off the top, making the property instantly more affordable and improving monthly cash flow.

Qualifying Power: The Two-Income Mortgage

Lenders assess co-ownership mortgages using the combined debt-to-income ratios of all parties on the title. A single buyer with an annual salary of $80,000 might qualify for a $369,000 mortgage. But two co-owners, one earning $80,000 and the other $65,000, combine their incomes to qualify for a much larger mortgage—potentially over $668,000—effectively placing a semi-detached or townhouse firmly within their reach.

The Co-Ownership Agreement: The Critical Legal Shield

The biggest mistake co-owners make is relying on a handshake. No matter how strong the relationship, a detailed, legally-binding Co-Ownership Agreement (COA) is non-negotiable. Think of it as the pre-nup of real estate.

Defining the Exit Strategy

The COA must clearly address what happens when one owner wants to move on. This includes:

Right of First Refusal: The remaining owner(s) get the first chance to buy out the departing partner's share.

Valuation Method: How will the property be appraised to determine the fair market value of the share? (e.g., Agreed-upon appraiser, average of three appraisals, etc.)

Forced Sale Clause: Under what conditions can a partner compel the sale of the entire property if a buy-out is not feasible?

Defining Day-to-Day Operations and Expenses

Clarity prevents conflict. The COA must outline:

Expense Split: How are property taxes, utility bills, mortgage payments, and insurance costs split? (It doesn't always have to be 50/50).

Capital Improvements: Who pays for major renovations like a new roof or furnace, and how do those contributions change the equity split (if structured as Tenants-in-Common)?

Dispute Resolution: A mechanism for mediation or arbitration before resorting to costly legal action.

Conclusion: The Future of Ownership in Southern Ontario

The landscape of GTA real estate demands innovation, and co-ownership is the market's most pragmatic answer. It’s a powerful, tangible tool for building equity and stability that was previously locked away by six-figure price tags. It’s time to get strategic with your closest network.

Actionable Takeaways for Stakeholders:

Buyers (First-Time Home Buyers/Families): Stop waiting for prices to drop. Start talking to a trusted family member or friend about pooling resources. Get a lawyer and a mortgage broker experienced in co-ownership before you start house hunting. Your fastest route to ownership is through partnership.

Sellers (Existing Homeowners): The rise of co-ownership expands your potential buyer pool. Your property, especially larger homes with income suite potential or distinct living spaces, is now appealing to multiple groups purchasing together, which can generate competitive offers and potentially higher sale prices.

Investors/Landlords: Look at co-purchasing larger, multi-unit properties (duplexes/triplexes) with a capital partner under a Tenants-in-Common agreement. This allows you to scale your portfolio faster by accessing high-priced assets that can generate multiple rental streams.

Tenants: Co-ownership is your fastest route out of the rental market. View your trusted roommate or family member as a potential business partner who can help you ditch rent payments and start growing generational wealth.

Ready to Turn Two Incomes into One Home?

Co-ownership is a sophisticated financial strategy that demands expert guidance. You need more than just a real estate agent; you need a team that understands the legal, mortgage, and market mechanics of a shared purchase.

Don't risk your future with a handshake agreement!

Book a Co-Ownership Consultation: Let's sit down with a dedicated mortgage specialist and real estate lawyer referral to structure your Two-Family Mortgage for success. Book Your Strategy Session Here!

Download Our FREE Co-Ownership Checklist: Get the essential 10-point checklist covering legal, financial, and emotional decisions you must make with your co-owner partner before submitting an offer in the GTA.